With a strong financial profile and focus on digital innovation, we investigate how Charm Care is positioned to benefit from Japan’s ageing population in premium urban markets.

Caring for Japan’s old people

Caring for the elderly is deeply rooted in Japanese culture, where ageing is associated with dignity and wisdom, and treated with respect. However, economic and social shifts have made their traditional family-based caregiving model hard to sustain. Fertility rates have fallen well below population replacement levels (now at just 1.3 births per woman), while average life expectancy exceeds 85 years. As more young women enter the workforce and average household sizes shrink, fewer families can provide full-time support for ageing parents or grandparents. Concurrently, those providing care – often spouses or adult children in their 50s or 60s – are themselves ageing. This results in a higher dependency ratio1, which means there will soon be as many elderly dependents as there are family caregivers in Japan.

Formal care, once supplemental, is now central to how Japan must manage its ageing population. The Long-Term Care Insurance (LTCI) Act, introduced in 2000, provides universal funding for elderly care. All Japanese citizens aged 65 and older are eligible for subsidised services, with users typically financing less than 10% privately. Funded by taxes and public insurance premiums, LTCI supports a wide range of care options, from home visits and daycare to full-time residential facilities. Alongside government subsidies, a growing number of families are turning to private insurance to afford higher-quality, premium facilities that offer greater comfort, security and companionship.

Luxury retirement homes for high quality of life

Charm Care is one of the largest operators of long-term care facilities across Japan, all of which are accredited under the country’s LTCI system. Unlike day clinics or home-based care, which offer limited support and rely heavily on family involvement, Charm Care provides full-time residential care that combines medical services, daily living support and social activities under one roof. Its facilities are built for long-term stays (typically five years or more), setting them apart from palliative or short-stay providers, where variable demand often leads to lower, less predictable occupancy.

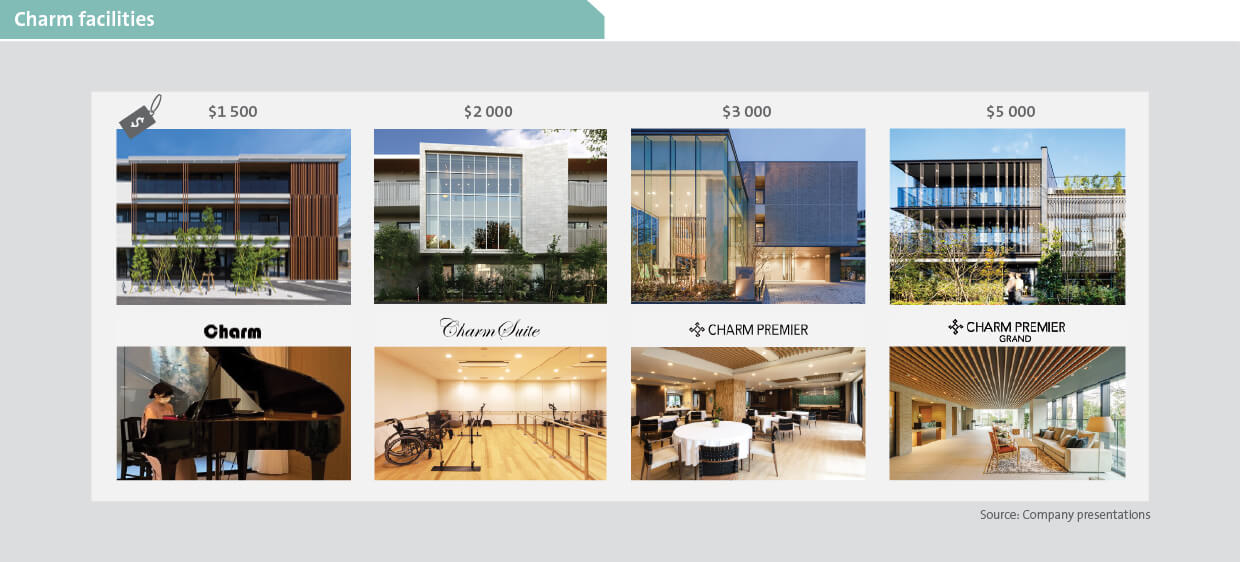

Charm Care offers a tiered range of homes, from its entry-level brand to the premium ‘Charm Premier Grand’ (below left to right), where monthly costs can exceed US$5 000 depending on location and services. Each facility is built to deliver both comfort and care, with private rooms, accessible bathrooms, 24-hour monitoring and on-site medical support. Thoughtfully designed interiors featuring rooftop terraces, fitness facilities and restaurant-style dining create a warm, community-oriented atmosphere. Residents take part in shared meals, recreational activities and tailored wellness programs that encourage physical and social engagement. By merging regulated medical care with hospitality-driven living, Charm Care offers a scalable, high-quality alternative to public or home-based care for Japan’s rapidly ageing urban population.

Building scale in high density urban areas

Charm Care has established a dense footprint with more than 6 000 rooms available across its 90 facilities – half located in the western Kinki region and half in the eastern Tokyo metropolitan area. Focusing on high-demand, transit-accessible areas creates operational synergies across neighbouring sites. Facilities within the same area can share staff pools, training resources and supply logistics. This clustering model is supportive of higher margins and creates barriers to entry for smaller operators.

Charm Care generates revenue from two recurring income streams: long-term care fees reimbursed through LTCI subsidies and monthly usage fees paid by residents. Usage fees cover accommodation, meals and basic services, with optional upgrades like private suites with balcony access, personalised meal plans prepared by on-site chefs and tailored rehabilitation programs beyond the standard care package.

These premium add-ons attract higher-income residents willing to pay for comfort and continuity, supporting both premium pricing and consistently high occupancy above 90%. Most of Charm Care’s costs (ie staffing, rent and utilities) are largely fixed. Once a home reaches high occupancy, the same cost base supports more revenue, allowing a larger share of income to flow through to profits.

Technical innovation and staffing advantage

Japan’s elderly care sector faces persistent staff shortages as demand for care is growing faster than the available workforce. At the same time, long hours, modest pay and the physically demanding nature of the work makes it difficult to attract and retain staff, while strict immigration controls limit the inflow of foreign caregivers. Targeted acquisitions in nurse staffing and age-tech have strengthened Charm Care’s ability to manage labour shortages and integrate technology, creating a more efficient and resilient long-term care platform.

In 2021, the company acquired Good Partners, a nurse staffing agency. This has internalised recruitment, improved training quality and even generated modest revenue from providing staff to other operators. Age-tech company, E-life Design, was another complementary acquisition, supporting the use of digital tools to reduce staff workload and enhance resident care.

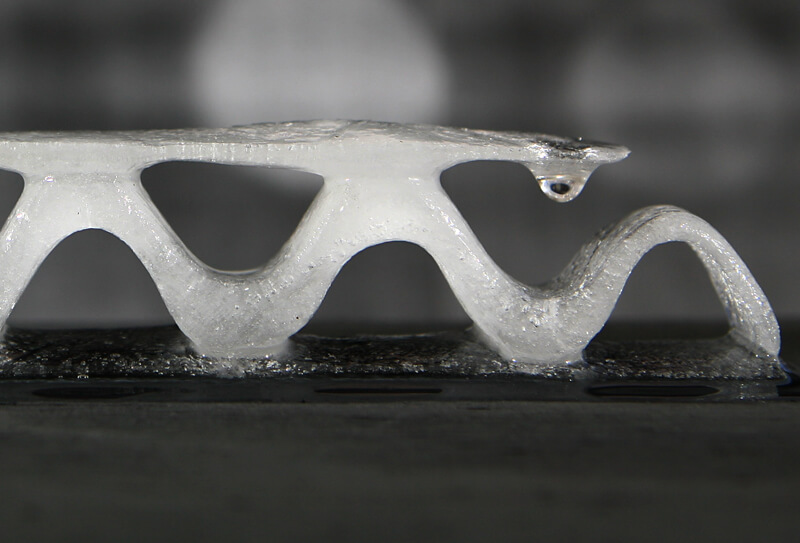

As illustrated below, a typical Charm Care facility embraces technology to support every aspect of daily care. Sleep sensors monitor residents’ movement and posture throughout the night, alerting staff when assistance is needed. Portable ultrasound devices allow caregivers to manage continence with greater precision – reducing reliance on medication and minimising physical strain. AI-driven communication tools keep caregivers connected in real time, for example, service robots that deliver meals and chatbots that can answer simple resident queries. Together, these systems create a safer, more responsive environment for residents, and a smoother, more efficient workflow for staff.

A rare, listed opportunity

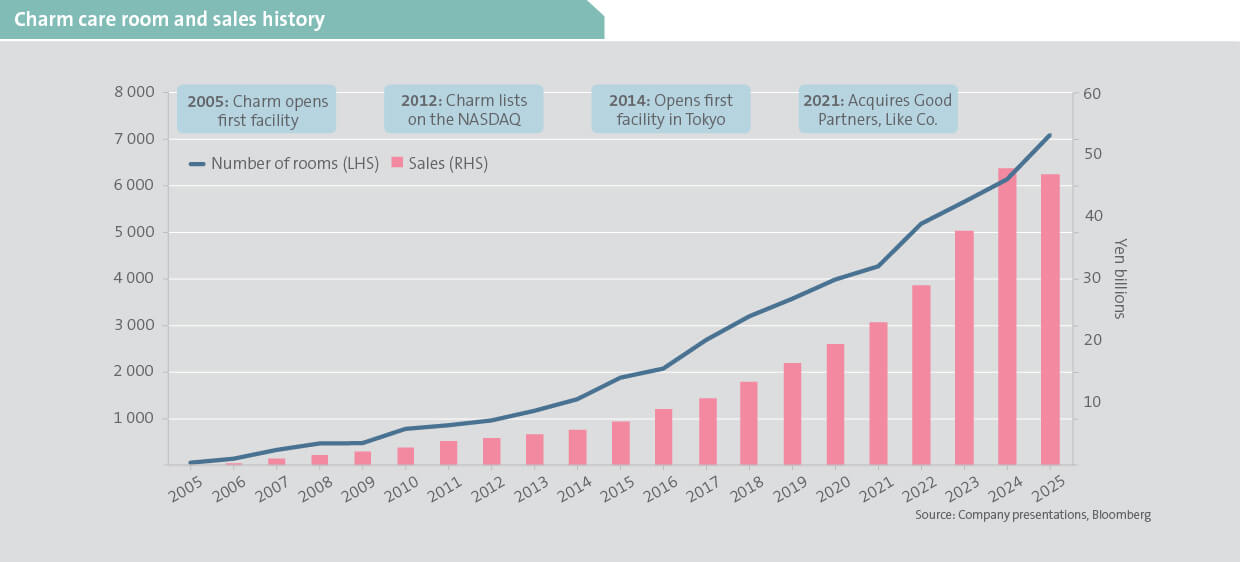

Since opening its first facility in 2005, Charm Care has steadily grown into one of Japan’s leading elderly home operators. As charted below, revenues and room capacity have expanded in lockstep, compounding at over 25% annually over the past 15 years. Profits have grown even faster as the group benefits from high occupancies, strong pricing power and staffing efficiencies.

Looking ahead, Charm Care aims to add 3 000 new rooms by 2030 (a 30% increase in capacity) by continuing to target high-demand urban areas where supply is constrained. Management sets stringent return targets on each facility to ensure disciplined capital allocation and maintain profitability across the portfolio. This rigorous approach allows Charm Care to expand sustainably, while preserving cash generation ability and balance sheet strength.

Although organic growth has been strong, the company also uses strategic acquisitions to strengthen its network – such as the 2022 purchase of Like Partners. This added 16 facilities in underpenetrated areas. By expanding only where returns are strong and demand is clear, the business is poised for profitable and sustainably high growth in the years ahead.

Compound growth from inexorable demographic trends

As Japan’s workforce shrinks and family-based caregiving capacity declines, Charm Care is catering for the rising demand for high-quality, long-term elderly care. In a fragmented market challenged by rising costs and regulation, its scale, complementary acquisitions and disciplined execution reinforce its strong positioning. We hold Charm Care in our global portfolios as a high-quality compounder benefitting from demographic tailwinds in a fast-growing market in Japan.

1The dependency ratio measures how many elderly people (65+) rely on each working-age person (20-64).