Catering to the wellness trend

In 2024, the global sportswear industry generated revenues of around $400 billion, after 8% per annum growth over the last decade. This stems from healthy demand in developed markets, particularly North America (over 45% of the global market), and robust growth from emerging markets, predominantly China. The trend towards athleisure fashion and increased physical activity have been the key drivers. An increased focus on health and wellness, post the COVID pandemic, strongly supports the outlook for the sportswear market into the future.

From small scale to global leader

JD Sports spent its first 20 years consolidating the UK sportswear market, acquiring sportswear stores and opening its own. In 2009, it embarked on its journey beyond the UK by acquiring the French retailer Chausport. It has since continued to grow organically and by acquiring businesses in other European markets – entering the USA in 2018.

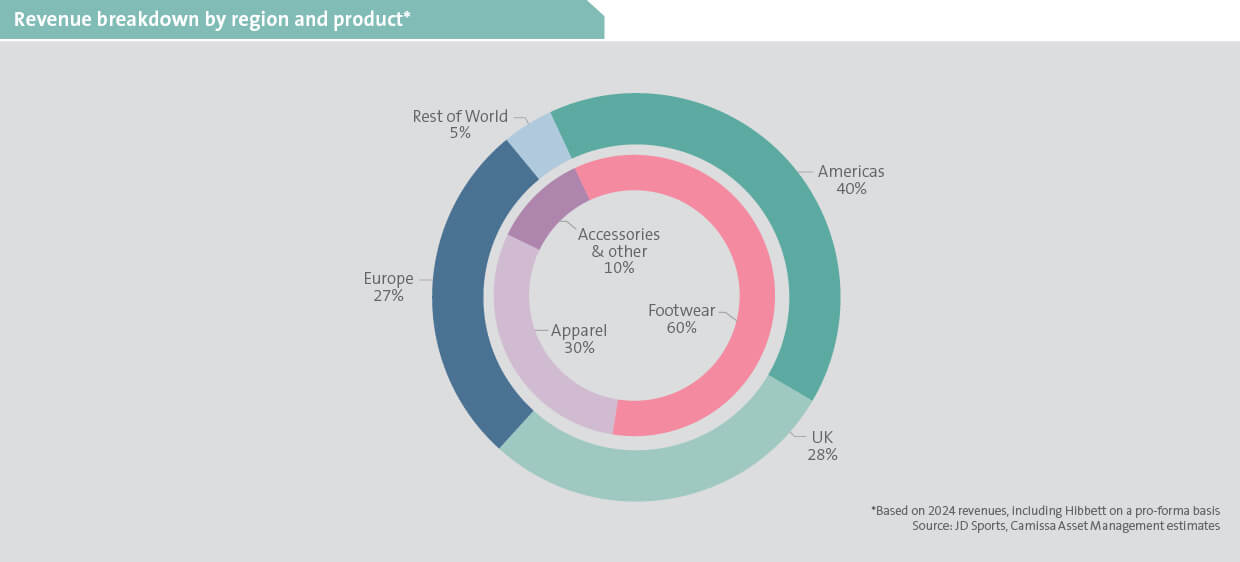

Today, JD Sports is a global business operating out of 4 500 stores, generating around 40% of revenue from North America, 27% from Europe and 28% from its home UK market (shown below). The footwear category dominates its sales, generating close to 60% of revenue for the group, with apparel as the next largest category at 30%.

JD Sports branded stores form the core of the business – accounting for 70% of revenue – and it retains other local brands within the portfolio including DTLR, Shoe Palace and Hibbett in the USA. The business strategy is to continue to open new, more profitable, JD Sports branded stores and to migrate local branded stores to the JD Sports banner.

A winning strategy

JD Sports’ well-invested, modern store base resonates with its core consumers, typically 16 to 24-year-olds. The business has very strong merchandising credentials, with dynamic product-buying teams that ensure the latest and most sought-after products are available in-store. This merchandising prowess ensures that JD Sports sells more of its inventory at full price, avoiding the large seasonal discounting often seen at its competitors. This is good for profitability and preferred by the large brand owners as it helps to maintain their premium brand status.

The scale of JD Sports makes it a key partner for the large global sportswear brands, particularly Nike and Adidas. By our estimates, Nike products account for over 50% of all products sold by the group. These partnerships enable JD Sports to provide valuable input into innovation and new product development based on its intelligence in market trends. The business therefore receives a significant allocation of exclusive products (estimated at 40% of their merchandise at any given time) and sizable allocations to popular product ranges. This access results in increased foot traffic and revenue for its stores.

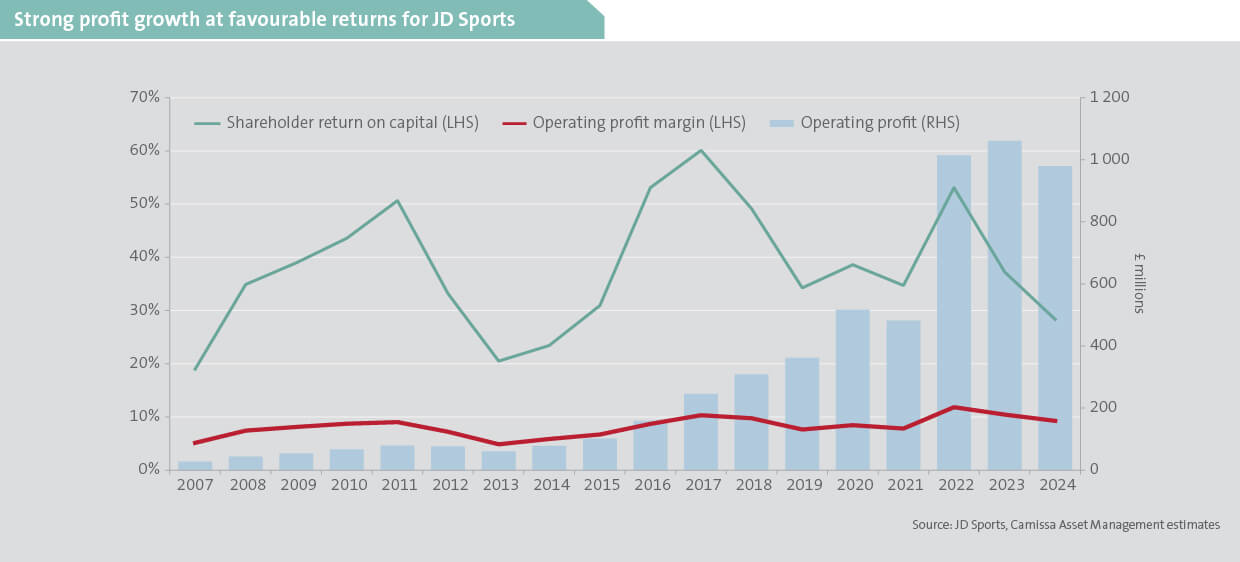

The access to high demand products and the benefits from their material scale have been the key contributors to the success of JD Sports over the years. As evidenced in the chart below, the business has generated strong operating profit growth at improving profit margins, resulting in very favourable returns on capital. Their ability to successfully open or buy stores at attractive returns should continue to produce growing shareholder earnings into the future.

USA is a key growth market

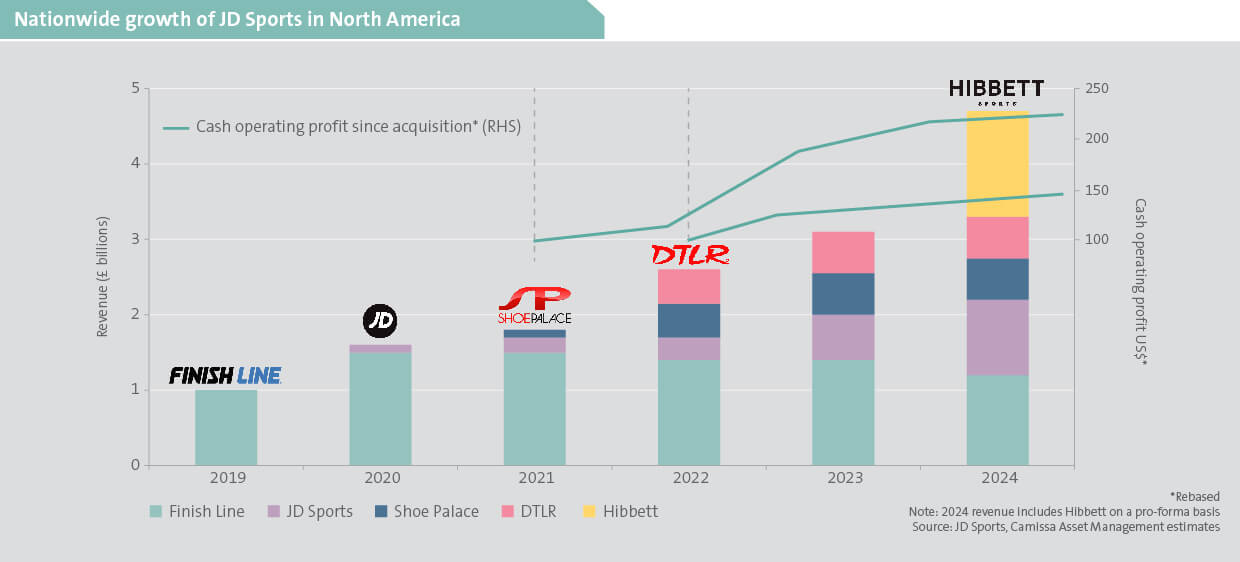

JD Sports first entered the US market through the acquisition of Finish Line in 2018. The US business was further buoyed by the acquisition of Shoe Palace in 2021, DTLR in 2022 and, most recently, Hibbett Sports in 2024 (charted below). These acquisitions have resulted in nationwide coverage, positioning JD Sports as the largest US specialist sportswear retailer.

The group’s strategy prioritises the rolling out of JD Sports stores at appropriate locations across the US, together with the conversion of Finish Line stores to the JD Sports brand over time. With acquired stores, the group strongly grows sales density (revenue per m² of store space) and therefore overall profits by:

• offering a more diversified brand assortment – shifting away from an over-reliance on Nike.

• increasing the apparel component of merchandise within stores, which is at a higher margin than footwear.

• introducing operational excellence that improves overall product assortment, merchandising and in-store experience.

Since taking over DTLR and Shoe Palace three years ago, the group’s strategy has resulted in cash operating profit increasing by 40% and 125% at the two businesses respectively. The recent acquisition of Hibbett expands the store base by 1 000 stores in the US and the group aims to replicate their winning strategy here, further growing profit in the region.

Recent investment to yield further returns

JD Sports’ rapid global expansion has put pressure on its supply chain to keep up. In response, the company is investing heavily in its supply chain infrastructure, focusing on increasing the capacity of its distribution centres (DCs). This initiative has resulted in the construction of a new, fully automated DC in the Netherlands and enhancements to capacity on the West Coast of the US and in Australia. Designed to support the group’s growth ambitions, these investments should lower the group’s cost to serve and increase its speed to market. We expect a significant improvement in group profitability (particularly in Europe) following full implementation of these logistics expansions.

Furthermore, JD Sports has been investing in its digital capabilities. With approximately 20% of revenue currently generated from online sales, improvements and upgrades to its digital infrastructure will further buoy this channel. Investment in its customer loyalty programme aims at better understanding customer needs, supporting a more seamless omnichannel shopping experience.

Well positioned to grow profitably

As a global leader in sportswear retail, with a winning track record for organic and acquisitive growth, JD Sports is poised to capture some of the robust growth prospects of the global sportswear market. Moreover, the group’s cash generative, high-yield business model should continue to provide strong future shareholder returns.