We discuss three South African small-cap packaging companies, namely Bowler Metcalf, Transpaco and MPact. These businesses have excellent management teams, niche product portfolios and enduring track records of generating strong cash flows and returns for shareholders. All three have navigated several challenging years for the South African manufacturing sector, emerging stronger and well-positioned to continue delivering good shareholder returns.

Bowler Metcalf

Bowler Metcalf (Bowler) began operations in 1972 and listed on the JSE in 1987. They grew organically and acquired businesses in the plastic packaging industry over the years. Their focus on niche, customised production (mainly for personal care and pharmaceutical customers) and smaller batch runs allowed the company to enjoy profit margins higher than its more commoditised competitors.

For many years, Bowler was also a large shareholder in the Quality Beverages business, which operated and grew the successful “Jive” soft drink brand in the Western Cape. Bowler supplied plastic bottles to this business and was therefore one of the early vertically integrated soft drink bottlers in the country. After the merger of Quality Beverages with Durban-based, Shoreline, to form SoftBev in 2014 – Bowler sold this beverages investment in 2018. A portion of the resulting R400 million-plus windfall was returned to shareholders and the business retained a large sum for investment in the plastics division.

Plastics unwrapped

Plastic packaging is produced by heating different recycled or virgin polymers such as polyethylene terephthalate (PET) or high-density polyethylene (HDPE) to a molten form and then shaping the molten plastic using various moulding techniques (left chart below):

• Blow moulding creates hollow shapes with thin walls (ie beverage bottles and home and personal care containers). Compressed gas blows the molten polymer against the sides of the mould, where it cools before being released. Bowler mainly produces blow moulded packaging products.

• Injection moulding inserts molten polymer into a mould cavity, where it cools and confirms to the shape of the mould. This is commonly used for thicker, more rigid plastic products such as crates, wheelie bins and bottle closures.

• Extrusion is a process used to form continuous, uniform plastic shapes. Molten polymers are extruded into a roll of plastic that can then be pushed through a mould to form pipes or gutters, or stretched to produce a thin film used to make plastic bags.

The South African plastic packaging manufacturing industry has struggled in recent years, with very high polymer prices impacting profitability. Shipping constraints and port congestions have negatively impacted the availability of key raw materials, adding further stress to supply chains. In addition, loadshedding has been devastating for the energy intensive process of heating and moulding plastic. Sudden process interruptions are particularly negative as cooled plastic needs to be removed from moulds, which consumes substantial time and incurs additional costs. Loadshedding has also impacted customers’ ability to manufacture consistently, making demand planning for packaging products unpredictable.

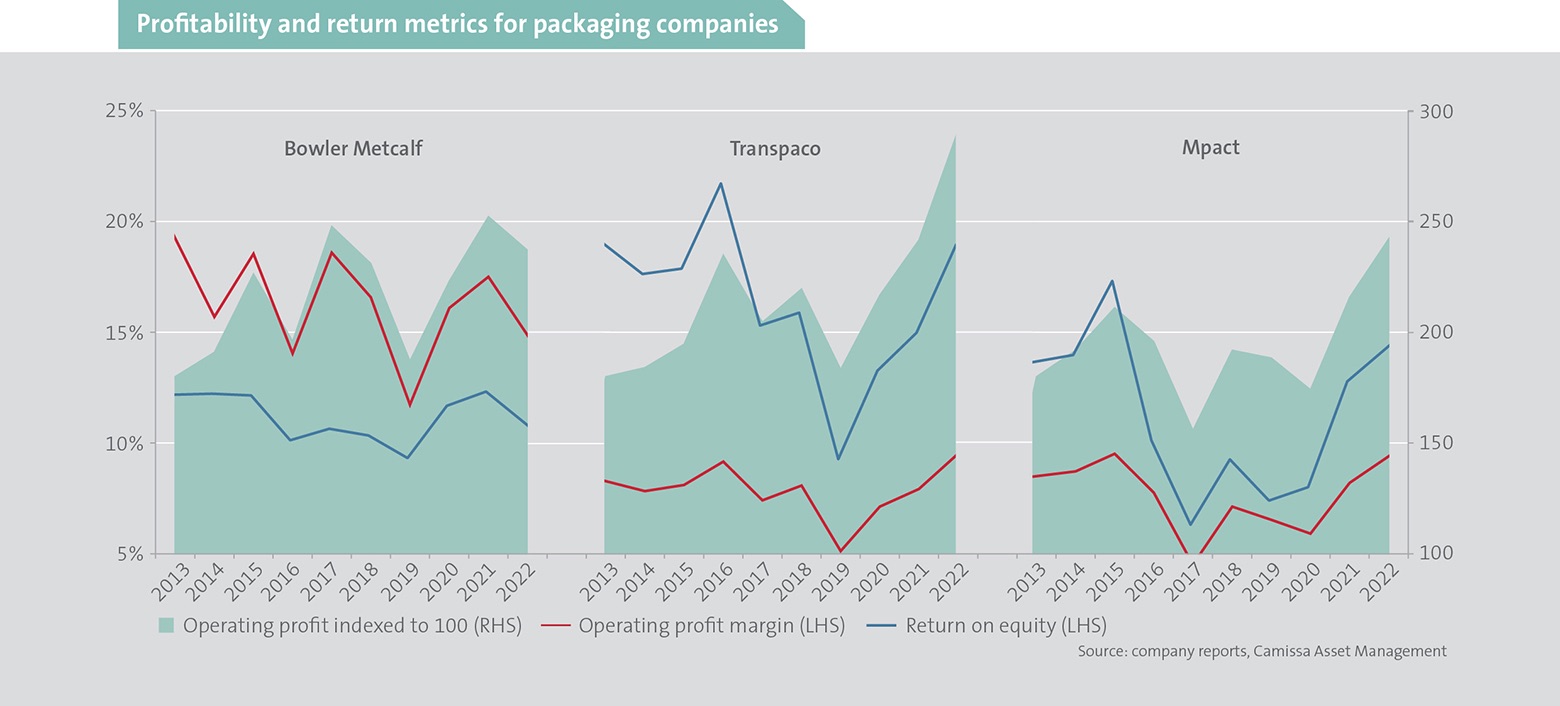

As charted below, challenges faced by the plastic packaging industry are evident in the reduction in Bowler’s profit margins. The business has responded by reconfiguring its operating model to accommodate unstable electricity supply and installing solar and other back-up power sources where needed. Positively, following several years of disruptions, Bowler is again growing and is investing in new capacity to service suppliers to the informal market in South Africa where high growth is evident.

Transpaco

Transpaco has been listed on the JSE for 36 years and has also grown organically and through acquisition. Today, it houses several businesses that manufacture and distribute plastic and paper packing products, predominantly in South Africa.

The majority (53% of revenue) of plastic products are produced via extrusion. Products are manufactured across the following divisions:

• East Rand Plastics was acquired in 2015 and is the market leader in the production of black refuse bags under the ‘Garbie’ brand and other house brands for various retailers.

• Specialised Films produce various grades of plastic film used predominantly for pallet wraps.

• Flexibles is the largest producer of retailer shopping bags in South Africa and also produces a range of school stationery.

The paper division contributes 47% to revenues and consists of:

• Cores and Tubes that was acquired from Nampak in 2010 and manufacturers tubular cardboard cores, dividers and various products used in the wine, paper and other industries.

• Britepack produces high quality printed folded cartons and inserts mainly used in the pharmaceutical industry.

• Packaging supplies and distributes a full range of stationery, servicing a broad range of the local economy. This is a lower margin business, yet it has a very low capital requirement, which allows it to generate a good return on capital.

Transpaco is a very well-run business. CEO (and significant shareholder) Phil Abelheim has stood at the helm since 1977, establishing himself as a good operator and a shrewd capital allocator. There is a strong focus on key operational metrics including cash generation and return on capital, which has resulted in Transpaco delivering very good profit growth (middle chart above), with return on equity (ROE) trending back to 20% and regular dividend payments to shareholders.

MPact

MPact was unbundled from Mondi and separately listed on the JSE in July 2011. It is a vertically integrated recycled containerboard (paper division) and plastic packaging manufacturer. The integration of recycling, paper manufacturing and paper packaging production is a key competitive advantage in capturing the whole margin across the value chain – ensuring consistent supply at the best price. Mpact’s contribution to the circular economy in South Africa highlights that what is good for the environment can also be good for business.

The paper division generates 65% of business revenue and consists of three segments (previous right chart above):

• Recycling – Mpact is the largest recycler in the country and collected 716 tonnes of recyclables in 2022 (83% paper, 6% plastic and 11% other). MPact collects paper surplus for its raw material needs and sells the rest to external customers.

• Paper making – Out of its three mills in Felixton (KZN), Springs (Gauteng) and Mkhondo (Mpumalanga), the business produces a range of paper and board from recycled and virgin (tree) fibre. Paper is made by adding water, chemicals and heat to create a pulp before being dried and turned into rolls of paper. Mpact uses around 25% of its paper products internally for conversion into packaging products and sells the rest outside of the group.

• Converting – Paper and board is converted into a range of corrugated and other paper packaging products. Mpact has a particularly high share of the boxes used in the agricultural market.

The plastics division constitutes 35% of revenue and consists of three main businesses:

• Bins and Crates, where MPact produces injection moulded packaging that includes wheelie bins and bins for the agricultural market, plastic pallets and crates used by retailers and beverage companies.

• Fast Moving Consumer Goods produces injection and blow moulded rigid plastic packaging such as bottles, jars and containers for food, beverage and home and personal care companies.

• PET Preforms and Closures manufactures plastic bottle tops and PET pre-forms for bottles and jars.

Since unbundling in 2011, Mpact has consistently invested in its asset base to provide capacity for growth and to improve underlying operating efficiency. It has recently embarked on a significant capital expansion plan, investing in:

• low-cost capacity in the bins and crates division;

• increased paper capacity at its flagship Felixton mill; and

• a project to produce specialised virgin paper out of its Mkhondo mill to meet the packaging deficit expected from the increase in fruit export volumes.

These investments in niche growth markets will depress cash flow in the short term but should yield good returns thereafter. As indicated in the far-right chart above, Mpact has delivered good growth and profitability over the past decade, with return on equity currently at a healthy 15% pa.

Wrapped up for future returns

The three businesses discussed have long track records of delivering excellent returns to shareholders. Their solid management teams have successfully navigated the most difficult of operating conditions in the past four years. Current share prices do not adequately reflect the quality of their business models and the future cash flows we expect them to deliver. We therefore hold all three companies in our client portfolios.