Small in revenue, big on performance

With a group revenue of R22 billion, Truworths ranks as the smallest of its locally-listed competitors. Yet, in terms of profitability, it places among the top apparel retailers globally. With almost 800 stores in South Africa, the business strategy focuses on delivering quality, aspirational fashion tailored to a youthful, style-conscious, middle-income customer base. Through a suite of strong brands, Truworths aims to meet a diverse range of apparel needs – from casualwear to workwear, eveningwear and footwear. Its singular-customer focus minimises the risk of over-segmenting the market, giving buying and marketing teams greater clarity and direction.

Master merchandisers

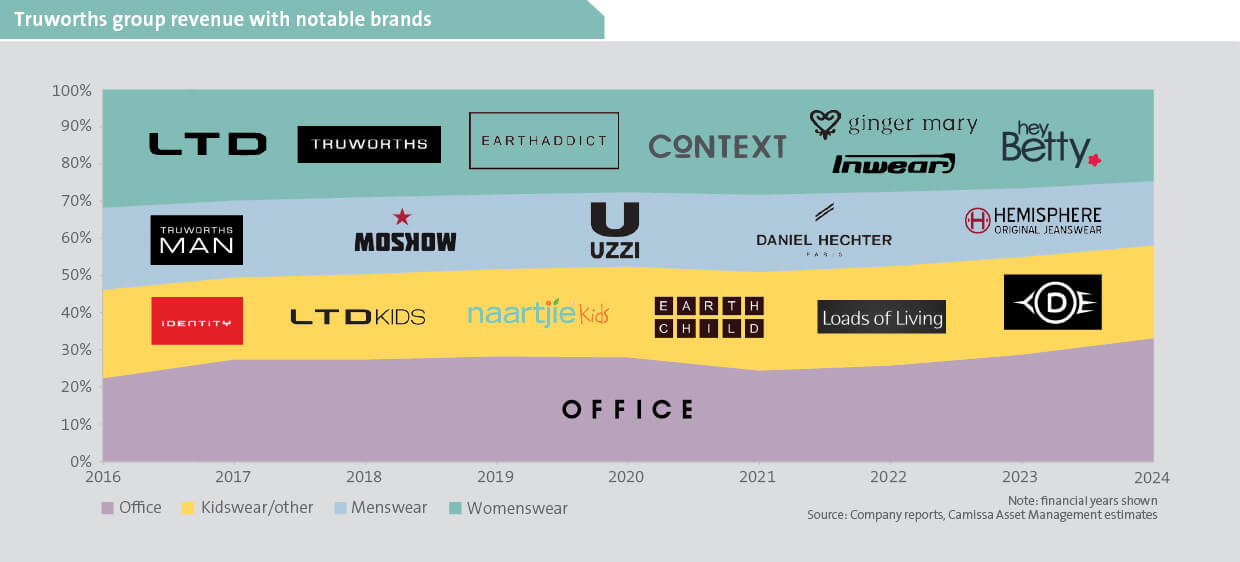

Merchandising and brand-building have long-defined Truworths’ strength. Over decades, they have successfully established a portfolio of exclusive, internally-developed brands. ‘Truworths’ and ‘Truworths Man’ remain core labels, supported by in-house brands such as Ginger Mary, Identity, Hey Betty, LTD and Inwear (charted below). While each brand has a distinct style, price point and customer appeal, they share the quality and design oversight that Truworths is renowned for. A cohesive merchandising strategy centred on quality, fashion and premium fabrics leads to very low levels of purchased items that are returned by customers due to quality concerns.

Truworths applies a consistent buying and planning methodology for every season, drawing on a wide range of sources for insights into trends. These include international runway collections, trade fairs, influencers, social media and street trends – both global and local. New internal brands have been regularly developed to meet evolving lifestyle needs.

Moreover, Truworths demonstrates exemplary stock management, with inventory typically turning over more than four times a year – well ahead of the industry average of 2.8 times. High stock turnover brings about reduced markdowns, better product freshness, increased store footfall and generally higher sales from a given store footprint – boosting profitability. Core to this is their philosophy of ‘buying wide, not deep’: offering a broad selection of styles in limited quantities to create a stronger perception of exclusivity and encourage frequent store visits.

Through strategic local sourcing (45% from South Africa – mainly via exclusive suppliers), Truworths merchandisers can react quickly to sales trends and avoid overstocking on trailing items. Its agile supply chain allows style adjustments as late as four weeks prior to delivery, ensuring alignment with the latest fashion trends.

The emporium experience

Truworths has enjoyed notable success with large-format, specialist emporium stores that have dedicated store formats for each line, including menswear, ladieswear, designer ladieswear and kidswear. Each emporium showcases a portfolio of in-house brands within one store, designed to promote cross-brand shopping. Stores are typically centrally located within malls and have up to five entrances. This store format allows for the flexibility to re-allocate space away from underperforming brands to those more in demand, thereby improving sales density. Additionally, a common trading space contains costs as staffing is shared and rentals are lower than if individual brands were in smaller standalone stores.

Kings of credit

Truworths positions itself as an aspirational brand, offering high-quality products at premium prices. Unique to the business model is the high level of integration of retail credit, where approximately 70% of sales are conducted on credit, compared to the competitor average of around 17%.

Many consumers, particularly in the younger middle-income segment, have limited access to traditional bank credit (ie overdraft facilities and credit cards) and rely on store accounts to make purchases. For some, Truworths is their first experience with credit, helping them buy goods and build a credit history.

Retail credit differs from traditional money lending in that the retailer earns revenue from interest on credit together with profit margins on products sold. Since money lending is not Truworths’ primary business, by approving more customers for credit (including those with riskier profiles), they stand to sell more products. Even if some customers default, the profit from the increased sales generallly offsets the losses from bad debt if credit-granting is managed responsibly.

Truworths’ 2.9-million-member credit book usually breaks even, highlighting that the retail credit aspect of the business functions as a tool to increase sales rather than make a profit. With a gross profit margin in its retail business of around 55% (well above the 42% sector average), Truworths can tolerate higher bad debt risk, while maintaining robust overall profitability. The scale and stability of this gross margin are fundamental to their ability to grant credit at such volume.

Tough domestic backdrop

South Africa’s retail environment has been sluggish for most of the last decade, with the increased cost of living, weak economic growth and stagnant wages contributing to suppressed industry sales volumes. On a comparable basis1, unit sales are down an estimated 26% across the sector, since 2014.

Truworths has not been spared by these conditions. It has lost market share in both men’s and women’s apparel in recent years. Yet, through gross margin resilience, relatively high product inflation, cost containment and the fading fortunes of weaker rivals, Truworths has managed to navigate the challenges reasonably well. While we expect the consumer to experience some relief from above-inflation wage growth, lower interest rates and lower inflation, discretionary retailers will still be navigating a constrained consumer environment for the foreseeable future.

A good day in Office

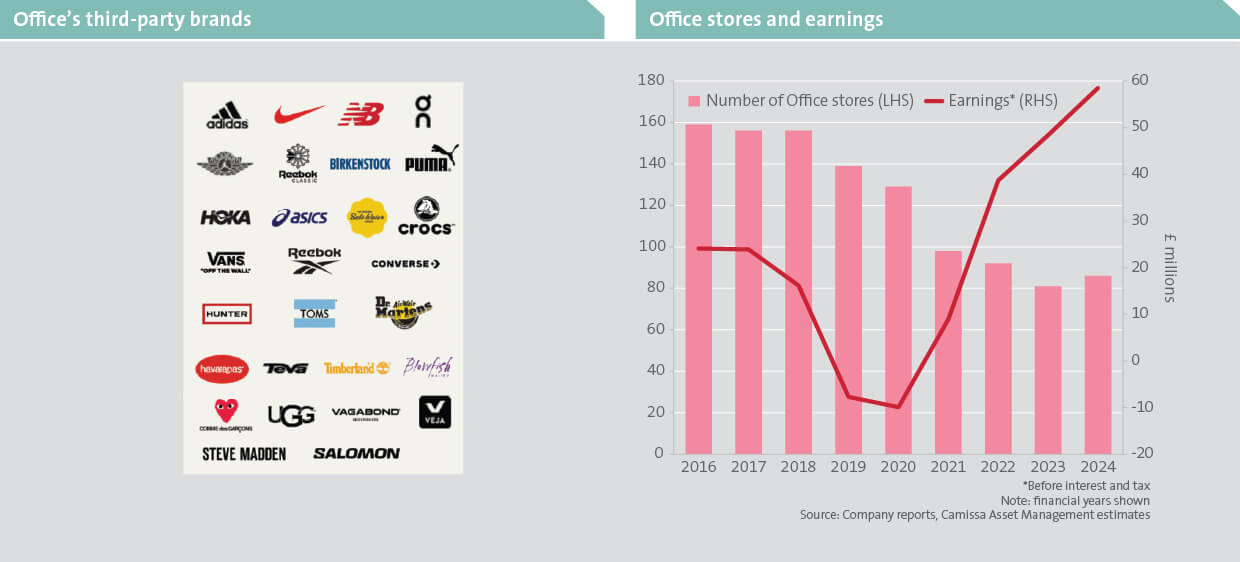

Acquired by Truworths in 2015, Office is a UK-based footwear retailer primarily targeting the fashion-savvy ‘London girl’. As illustrated below (left), Office’s range predominantly comprises third-party brands like Nike, Adidas and New Balance, based on strategic relationships cultivated over time. Office differentiates itself through exclusive sneaker brand collaborations and limited-edition product releases, working closely with key brand partners to develop these ranges.

Despite the challenging UK retail market, Office has performed well, growing earnings by a remarkable 11%2 per annum since 2016. As with Truworths domestically, Office’s merchandisers have demonstrated solid stock management skills – reading the market well and strategically reducing exposure to current off-trend brands (eg Nike) and catering more to trendier options (eg HOKA and ON). This has played a critical role in their ability to outperform competitors.

Management has taken a proactive approach to reshaping Office’s store portfolio, closing over 40% of underperforming stores (below right). This strategic consolidation, alongside the successful expansion of its online channel (now accounting for 46% of total sales, up from 24% in 2016), has enabled Office to more than double its earnings3 over the past seven years to achieve a margin more than twice that of competitors. We remain sanguine on Office’s future, based on its proven agile stock management and optimised store estate.

Succession – a work in progress

Longtime CEO Michael Mark, who has led Truworths since 1991, is widely credited for its success. His succession, however, remains a concern especially following a failed external handover attempt in 2015. Mark remains at the helm for now, with two internal candidates being mentored for the role. The potential successors are seasoned insiders who understand Truworths’ DNA, providing a measure of confidence in continuity of company strategy and its execution when Mark eventually retires.

Disciplined capital allocation

Truworths is among the most capital-efficient apparel retailers globally, with current returns on equity and returns on invested capital of 36%4 pa and 25% pa respectively. Despite a recent decline, the metrics remain high. Backed by strong cash generation, Truworths has consistently returned surplus capital to shareholders – distributing R13.5 billion through dividends and share buybacks over the last five years – a standout figure in the industry despite its smaller relative size. At the same time, it has reinvested meaningfully in its operations, including R1 billion in a modern distribution centre in the Western Cape.

While the domestic outlook remains tough, Truworths’ demonstrated ability to manage capital, credit and merchandise with precision through economic cycles, sets it apart. We believe the market underestimates its long-term potential and, therefore, we continue to hold it in our funds.

1Excluding the unit sales gained from opening new stores.

2Based on a compound annual growth rate, in pound terms.

3 On a ‘before interest and tax’ (EBIT) basis.

4Truworths’ global benchmark was 20%, calculated as the average ROE of leading international apparel retailers.