Through its history of scientific and technological breakthroughs since the 1800s, DuPont is now best known for its Kevlar bulletproof vests that are more than capable of protecting the wearer against the gunpowder produced by its founder in 1804. We investigate DuPont’s 200-year business journey, shaped by reinvention through a plethora of acquisitions and disposals, while remaining rooted in innovation.

Significant transformation

DuPont embarked on its most significant transformative phase in 2017, announcing a merger with Dow Chemicals. Both companies had similar market values at the time and the ‘merger of equals’ created a diversified industrial and chemicals business with a $120 billion market capitalisation – DowDuPont. The intention was to amalgamate Dow Chemicals’ crop protection business with DuPont’s seed business to create a massive-scale, specialist agriculture-focused business. This was later renamed Corteva Agriscience and subsequently demerged into a separate company that listed on the New York Stock Exchange in May 2019.

The chart below timelines DuPont’s recent mergers, acquisitions and disposals, including the demerger of Dow Chemicals and Corteva on 1 July 2019. Thereafter, DuPont transferred its commodity chemicals businesses to Dow, divested its agricultural chemicals and seed businesses to Corteva and sold its nutrition and bioscience products business to International Flavours and Fragrances (IFF). The portfolio transformation was largely concluded with the cash sale of its mobility and materials business to Celanese Corporation for $11 billion in November 2022.

During this time, an intended acquisition of Rogers Corporation (specialist manufacturer of materials such as elastomers, high frequency circuit materials and components for applications in the communications and transportation markets) was terminated after Du Pont failed to obtain Chinese regulatory approval for the $5.2 billion transaction. Given that China is Rogers Corporation’s biggest sales market, this was a significant blow. DuPont then announced a substantial share buy-back program as a means of returning value to shareholders.

The combined market value of the Dow, DuPont and Corteva businesses since May 2019 is evident in the left chart below – ending in line with the initial market value. There has, however, been substantial underperformance of DuPont relative to its sister companies, Dow and Corteva, since the demerger in June 2019 (right chart below). DuPont has devalued by more than 50% over the period, which is in stark contrast to Corteva, that has more than doubled in market value over the same period.

Dow Chemicals remained largely flat, with a 4% loss in value, outperforming Du Pont by almost 50%. DuPont’s earnings and market value were severely impacted by the pandemic and concomitant global lockdowns in 2020 and 2021. The legacy mobility and materials division suffered disproportionately, with steep revenue declines as global car manufacturing ground to a halt. The negative earnings impact on DuPont resulted in a substantial loss in market value and is the main cause of the underperformance. Extensive recovery in the mobility and material division’s profitability in 2021 – albeit to lower levels than the pre-pandemic era – enabled DuPont to sell the business at a substantial premium to our assessment of its intrinsic value.

Finding value through greater agility and clear focus

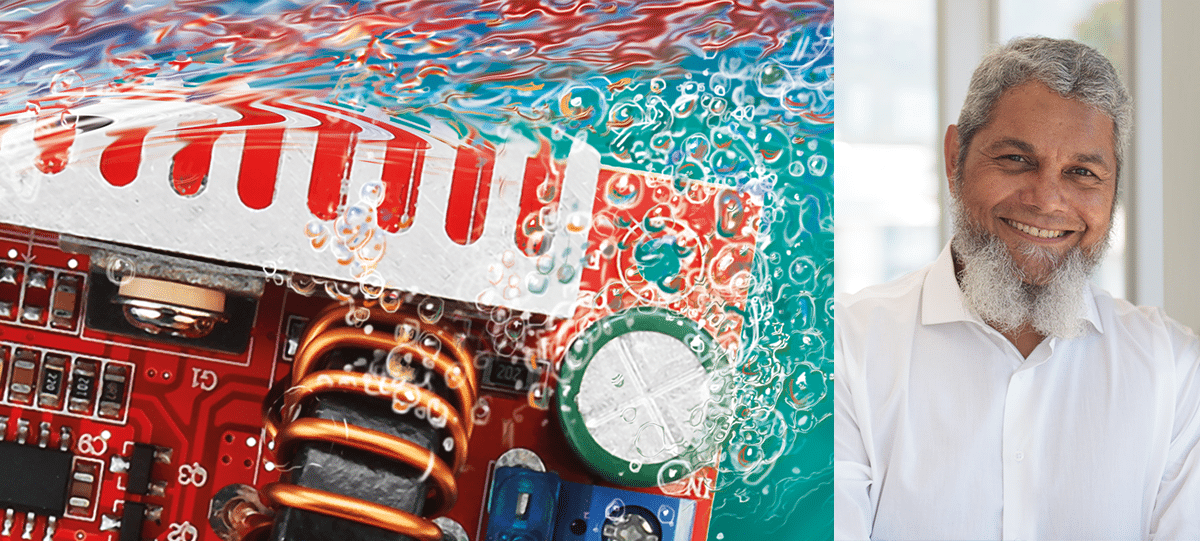

DuPont is currently focused on two key segments: ‘Electronics and Industrial’ and ‘Water and Protection’. Within this, there are five underlying divisions (tabled below) that include a range of businesses, such as producers of smart semiconductors and advanced safety systems for electric vehicles, and water desalination and purification businesses. DuPont believes that these divisions are uniquely positioned to show strong organic growth as demand for their products and services are expected to accelerate with climate change mitigation efforts gathering pace worldwide.

The business has a long history of involvement in sustainability practices and social responsibility, implementing several initiatives to reduce its environmental impact and contribute to the wellbeing of communities around the world. These initiatives include: the divestment of businesses that produce harmful chemicals like PFAS1 (also known as forever chemicals), an increasing use of renewable energy sources, the development of sustainable products and technologies and the implementation of programs that support local communities.

1 Per- and Polyfluorinated substances are a group of chemicals used to make coatings and products that are heat, oil, stain, grease and water resistant.

Key drivers for organic growth

Electronics focuses on the pursuit of new technologies and performance materials. DuPont is considered a technology leader in this field, producing semiconductors, conductive polymers and other materials used in electronic devices.

Industrial Technologies provides specialised materials for protective use in harsh and environmentally demanding environments. Du Pont’s thermal management materials offer superior temperature stability compared to competitor products and are widely used in the healthcare and aerospace industries.

Water is a sustainability-driven segment that develops solutions aimed at addressing water scarcity. The water business supplies many critical components and systems needed for the technologies employed in generating clean water (eg reverse osmosis, ion exchange and ultrafiltration). DuPont operates two world class manufacturing facilities – one in Minnesota in the US and the other in Jubail, Saudi Arabia. The Jubail plant manufactures membranes and components for reverse osmosis desalination plants in the Middle East, Africa and Asia. This division also works closely with large manufacturing plants, like semiconductor producers in China and the rest of Asia, to reuse wastewater – typically achieving over 90% reusability. The cost savings and substantially reduced environmental impact is immense, making the water solutions business an automatic choice for many industrial customers in Asia and the Middle East.

The Protection business spans both shelter solutions, with products like Styrofoam™ used in construction, and highly engineered materials used in protective wear garments and accessories that are critical to the protection of life, like Kevlar™.

Through their Next Generation Automotive business, Du Pont produces a range of materials used in vehicle and aircraft manufacturing, such as those used to coat and protect against corrosion and wear (eg in tyres). Additionally, this segment develops new technologies related to transportation, for example: for electric vehicle batteries, improving fuel efficiency and driver safety and comfort (eg autonomous driving and safety systems).

Poised for growth

After a frenetic four-year period of corporate activity that included a global pandemic, DuPont has emerged with a strong, cash-flush balance sheet. It has renewed focus on its core businesses that have enduring competitive advantages and are exposed to fast-growing end markets such as water scarcity solutions and next generation mobility.

The electronics and industrial portfolio of businesses have demonstrable pricing power that proved their worth during the pandemic, with continued volume growth, while competitors saw large volume declines. The modern-day DuPont is an entirely different business to the one started by Eleuthère over two centuries ago and its products and services are in considerably greater demand today than the gunpowder produced back in 1801.