Solid structure built on strong brand base

SPAR’s unique business model has roots in the Netherlands. Its name is a Dutch acronym translating to “through united cooperation everyone profits equally” – a value upheld in the way it does business today.

The SPAR Group acquired the rights to use the brand in Southern Africa from Netherlands-based SPAR International – the global custodians of the SPAR brand. The group now owns the rights to use the brand in nine countries, the most notable being South Africa, Ireland, Switzerland and Poland (charted below). The core Southern African division operates six grocery distribution centres (DCs), one Build-it DC (building materials) and one pharmaceutical DC.

Among the major food retailers operating in South Africa, SPAR distinguishes itself by functioning (almost exclusively) as a wholesaler and distributor to independent stores operating under its brand, as opposed to trading as an integrated retailer that owns and operates its own stores. Its voluntary trading system allows independent retailers the flexibility to source better deals from other wholesalers and to stock products not supplied by SPAR. The proportion of products purchased by retailers from SPAR historically averages around 80% in the key grocery division.

The magic in the model

SPAR’s business model of independent store ownership offers strong financial incentives to store owners who directly participate in their operational success. This is a strong motivator given that the financial upside is uncapped, unlike for corporate-owned grocery store managers. Owners have the freedom to tailor operations, customise their store’s appearance, offer high levels of service and adapt stock to local needs. A store in an affluent area might, for example, offer a range of unique imported products. Additionally, SPAR stores can operate without union complexities, supporting simpler staff structures.

A strong brand name and centralised buying power allows SPAR’s independent retailers to be competitively positioned against larger integrated retailers. The model promotes profitability for SPAR and its member stores through fair wholesale pricing, shared marketing costs and operational efficiency. As retailers cover the costs of store openings and refurbishments, SPAR benefits from a capital-light model, whereby scale increases with minimal capital investment beyond maintaining DCs and truck fleets.

This model has proven to be consistently successful, exhibiting strong historic comparative store sales growth, stable profit margins, an impressive 30% return on capital and above-average cash conversion. The key negative is that store expansion is generally slower compared to corporate-run retailers, as store growth depends on retail operator availability and financial resources. In addition, financially weaker store owners are severely impacted in periods of economic downturn or when local market conditions change adversely, leading to potential store closures and bad debts for SPAR. SPAR will often elect to buy struggling but viable stores, turn them around and then resell them.

Unfortunate acquisitions abroad

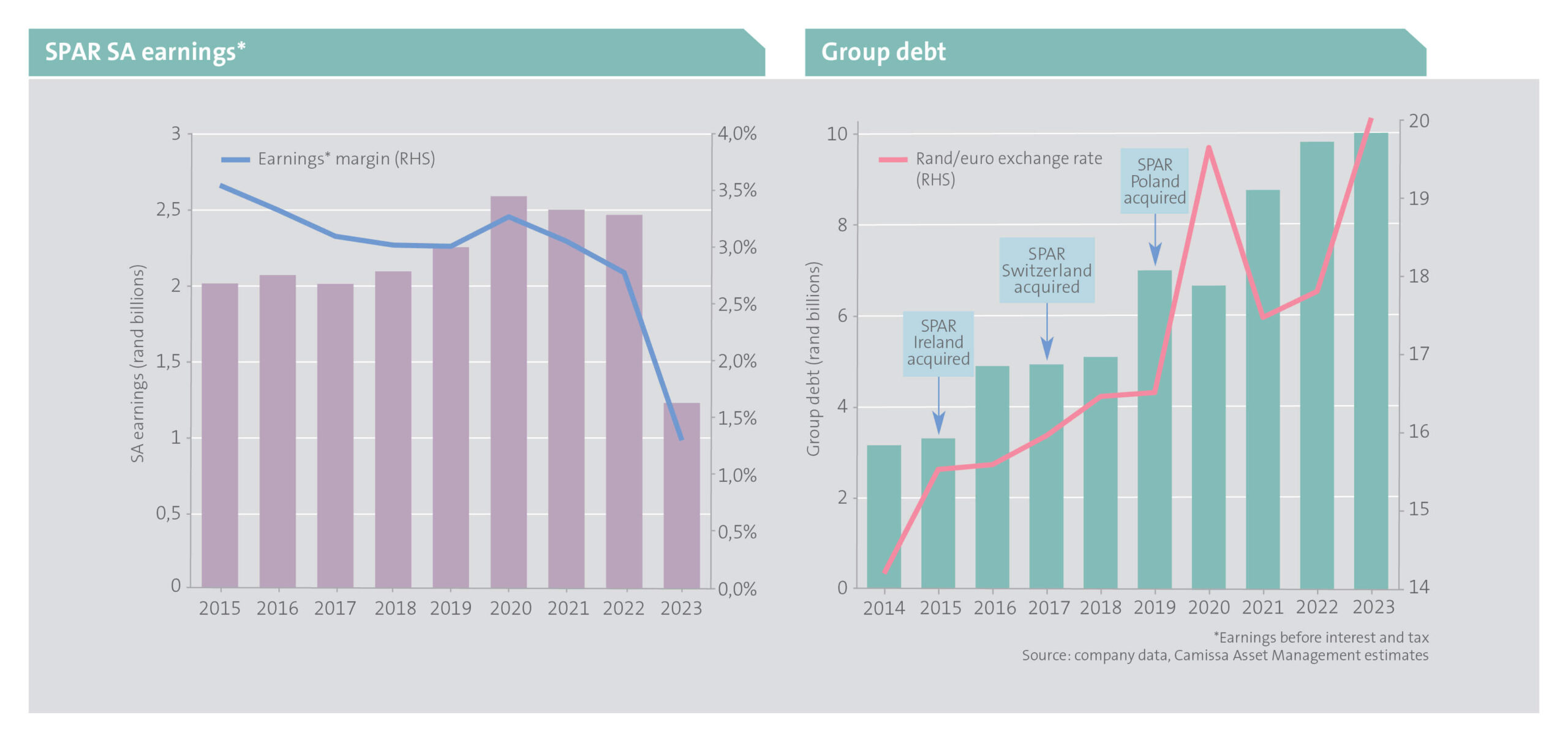

Buoyed by local success, the SPAR Group ventured offshore in 2014, capitalising on low European debt costs to acquire operations in Ireland and later Switzerland. The Irish business has performed well, nearly tripling profits in eight years, to deliver a return above its cost of capital.

The Swiss operations, however, have fared poorly. Due to the high cost of living and price of groceries, many Swiss residents resort to cross-border trips to shop in neighbouring countries, where prices are lower. The result has been anaemic sales growth, declining profitability and minimal cash flow to service the debt that financed the purchase.

The 2019 Polish acquisition has been the group’s most problematic to date. Purchased for just one euro, the group took over the existing debt and invested heavily in the ailing business. SPAR Poland has had low retailer loyalty and operates a sub-scale DC – generating significant losses and high interest costs from its mounting debt burden. With fewer than 200 stores and under 2% market share, management overestimated their ability to turn the business around and grow it. With an unclear path to profitability, the SPAR Group plans to sell the Polish business in late 2024.

The strain from the high debt balances of the Swiss and Polish operations have been exacerbated by the higher interest rates in Europe. Additionally, the offshore debt has ballooned (in rand terms) as the rand has sharply weakened and the debt has recourse to SPAR Group’s South African cash flows.

The perfect storm

In 2023, amid the foreign currency debt strain and heavy losses in Poland, the SPAR Group undertook a major IT overhaul in South Africa, their most profitable region. This involved the replacement of an archaic 30-year-old AS400 IT system, used to run several SPAR DCs, with SAP1. Deemed crucial as the old system was reaching the end of its life and lacked technological support – posing significant risk to the business – the new SAP system was implemented at SPAR’s largest DC in KZN.

While some disruption was expected, the change of IT platforms resulted in colossal challenges for SPAR at its KZN DC. Among many integration implementation problems, difficulties with the transferal of master data caused cost prices to be incorrect and a loss of visibility of stock levels and locations. Fulfilling orders to retailers was extremely challenging as a result, compounded by staff being inadequately trained to deal with such a scenario. SPAR South Africa had to resort to encouraging their KZN retailers to source products from other suppliers, leading to a drop in loyalty. Some bigger SPAR retailer groups opened accounts at rival wholesalers, business that SPAR is still fighting to win back.

The timing of this was disastrous. The sharp drop in earnings from their core South African business (below left), combined with growing foreign currency debt in rand terms (below right), and massive losses in Poland, led to the group breaching their debt covenants. To preserve cash, the company was forced to suspend its dividend.

While operational issues have somewhat stabilised, SPAR South Africa does not yet have a clear line of sight into unit cost prices – hindering sensible pricing decisions. They are now installing a different IT warehousing system to manage stock levels, orders, picking and sorting. This is essentially an updated version of the old AS400 system, which should allow for easier data migration and user adoption.

1An enterprise retail planning system by a German software provider.

Stiff local competition

Market leader, the Shoprite Group, has shown remarkable self-reinforcing momentum over the last five years, buoyed by strong merchandising, the effective use of customer data (enabled via SAP) and immense bargaining power over suppliers. They have consistently gained market share in a challenging trading environment. The Checkers brand has thrived, with the success of Checkers Sixty60 and the launch of smaller store formats like Checkers Foods. These initiatives challenge SPAR’s convenience proposition. Yet, a perpetually weak Pick n Pay has been a source of market share gains for SPAR and other grocery retailers. As Pick n Pay reduces its store footprint and grapples with deep-rooted operational challenges, we expect them to continue losing market share.

Addressing SPAR’s challenges

The SPAR Group is taking decisive steps to repair their weakened balance sheet. Disposing of their Polish operations should stem annual losses (R500 million in 2023) although the associated R2 billion debt will remain. They can raise cash by selling non-core properties or conducting a sale and leaseback on their local DCs and truck fleet, potentially releasing up to R2.4 billion. The underperforming Swiss business is also under strategic review, which could further reduce group debt if sold.

SPAR’s new management is also taking steps to improve performance in their core South African grocery division. They are focusing on changing unwarranted consumer perceptions of high pricing. New product ranges, including the premium Signature Collection and value-focused SaveMore range, have been launched together with a revised customer rewards platform. Additionally, new store concepts such as a standalone pet offering and a discount store are being evaluated.

Despite the intense competition and operational difficulties at warehouse level, SPAR South Africa’s like-for-like store sales growth has remained strong, keeping up with the formidable Woolworths Foods when indexed to 2019. This is testament to the tenacity of independent retailers, good store locations and the relevance of the SPAR format.

Improvement ahead

We are encouraged by the recent strengthening of SPAR’s board, that has addressed governance issues such as conflicts of interest and previously ignored whistleblower complaints, while making good headway in repairing relations with aggrieved store owners. With capable new leaders now in key positions, we are optimistic that SPAR should navigate the current challenges and refocus on core strategic strengths, thereby restoring balance sheet health and profitability.

Our clients have materially benefitted from the recent share price rebound.