We delve into the elements that are considered for rating South Africa’s creditworthiness as an issuer of bonds. We then consider three broad possible scenarios for the country’s economic future and highlight the importance of maintaining a long-term perspective when valuing government debt.

Sovereign risk assessment factors

Bond yields – the annual return to an investor if the bond is held to maturity – reflect, among other things such as inflation risk, expectations for the possibility of the borrower defaulting on the loan. As markets are inherently forward looking, current market yields may price in credit risk that is different to yields implied by current, historically determined, official credit ratings from ratings agencies.

At the very high levels prevailing prior to the elections, bond yields were pricing in a material worsening in the country’s credit ratings and thus in the outlook for the possibility of its default.

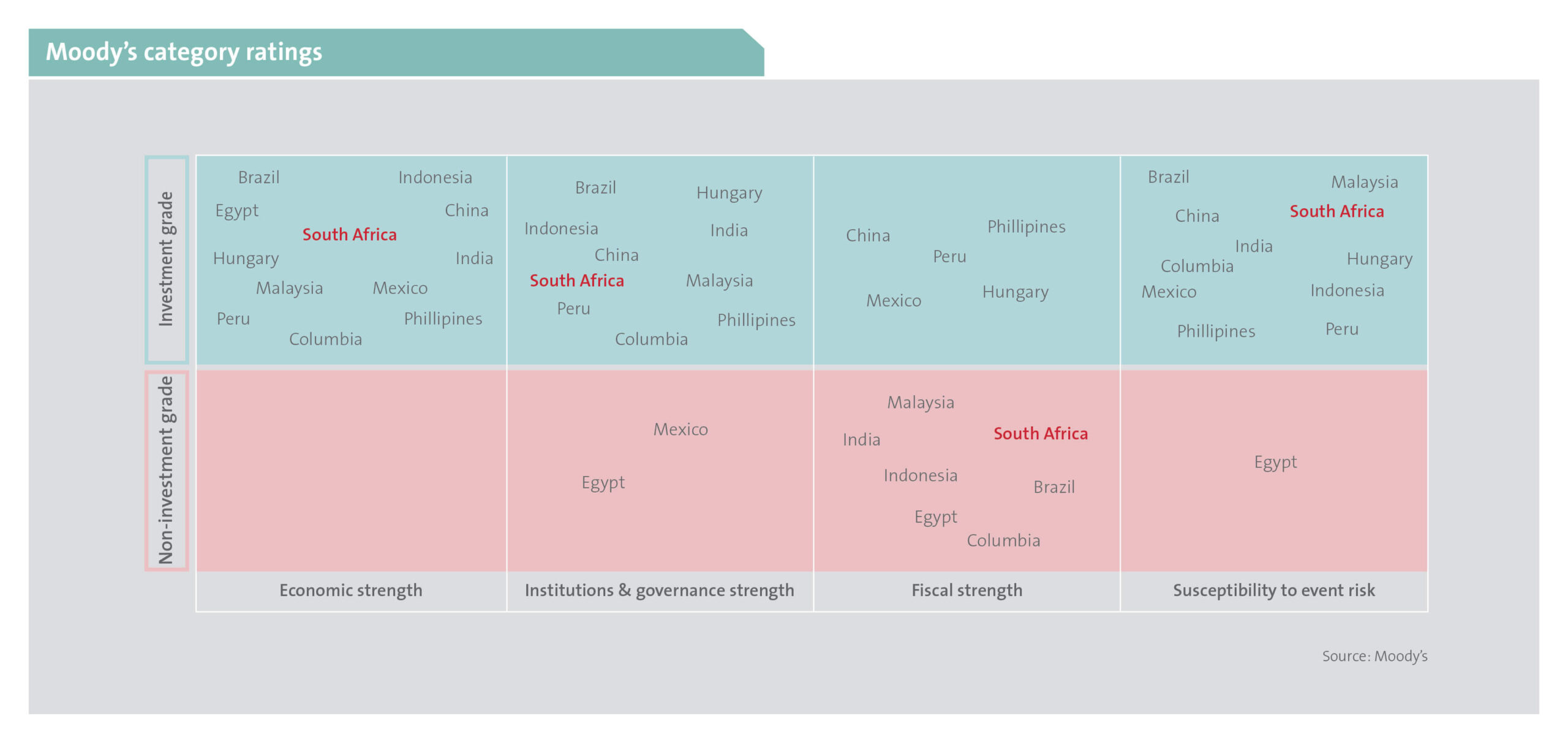

Moody’s is a highly regarded global credit rating agency known for its in-depth research and robust methodologies and we use their framework in what follows. Moody’s focuses on four categories when evaluating a country’s credit profile. These are rated individually and then aggregated to determine the final assessment of a country’s overall credit profile. The categories are:

• Economic strength: This is a key facet of a country’s credit evaluation, measurable through an analysis of prospective growth, size of economy and sources of revenue. South Africa’s economic strength assessment comprises a mix of positive and negative factors. While South Africa’s real GDP growth rate is low, its credit rating benefits from the sizeable level of GDP, relatively high GDP per capita and positive economic diversification. Currently, these strengths result in an assigned investment grade category rating.

• The strength of institutions and governance: This is the next important rating factor and, in particular, the stability of the country’s legal and regulatory framework is a vital consideration. Historically, global experience has shown a clear relationship between institutional weakness and sovereign defaults. According to Moody’s, South Africa has high-quality core institutions, resulting in a positive investment grade rating for this category.

Moody’s appears to somewhat emphasize policy effectiveness over the quality of institutions, with the former negatively weighing on this category’s assessment. For South Africa specifically, the effectiveness of fiscal policy – managed by The National Treasury – is regarded as a weaker area, while the operation of monetary policy – the responsibility of the South African Reserve Bank – is highly rated.

• Fiscal strength: This factor attempts to measure a country’s ability to sustain its debt burden – a significant area of weakness for South Africa resulting in a category rating that is below investment grade. The impact of this is meaningfully negative on the country’s overall sovereign rating and is effectively the sole factor dragging us below investment grade. According to Moody’s, important measures of fiscal strength include ratios for debt affordability and debt burden. In both measures, South Africa rates poorly.

Moody’s does, however, acknowledge the ratio of government financial assets to GDP as a positive factor, mitigating the above negatives somewhat. It is understood that countries with high levels of financial assets can buffer large shocks through asset liquidation if needed. Such assets would include cash deposits, contingency reserve funds and foreign currency reserves.

• Susceptibility to event risk: The final factor aims to measure a country’s resilience to shocks that might impact fiscal a country’s resilience to shocks that might impact fiscal stability, particularly risks that influence the economy and its institutions. An example would be factoring in the effect of stress on the banking sector. Here, Moody’s rates South Africa as investment grade with notable strengths, highlighting the deep and diversified financial sector, low foreign currency denominated debt levels, flexible exchange rate and the ease at which the government can raise funding.

The chart below compares South Africa’s category ratings to a select group of other emerging market countries. Our current rating factor assessments, albeit determined in the past, are generally in line with this peer group of countries and are in some cases, better.

What may lie ahead

A general illustrative description of three contrasting economic futures for South Africa, and thus its possibility of defaulting on its borrowings, may be as follows:

A low road scenario, where the economic and governance situation for South Africa worsens, may see a deterioration in its key strengths, for instance: unexpected weakening in institutions, declining economic strength or higher vulnerability to event risks. Such an outcome will result in rating downgrades.

A positive high road scenario may incorporate a quickening in the growth rate of the country’s economy and consequent improvements in the fiscal position, particularly in reducing debt burden and better debt affordability. Tax revenues will be higher, lowering the fiscal deficit and the debt balance will be a smaller percentage of the larger economy. This scenario should prompt a credit rating upgrade.

In the case where the current economic trajectory is similar to the recent past, whereby existing credit strengths and weaknesses endure, this might be regarded as a middle road scenario. Economic growth would remain weak, fiscal consolidation may occur only gradually and to a muted extent, and South Africa’s credit rating may remain unchanged at two notches below investment grade.

Accurately calibrating the probabilities for these scenarios is difficult. Given the economic challenges South Africa is facing and its extensive structural weaknesses, our view is that the middle road is most likely, followed by the low road, with the high road scenario being far less probable. However, the probability of the high road has risen post the formation of the new government after this year’s elections and given the early economic reform momentum shown by the presidential ministry.

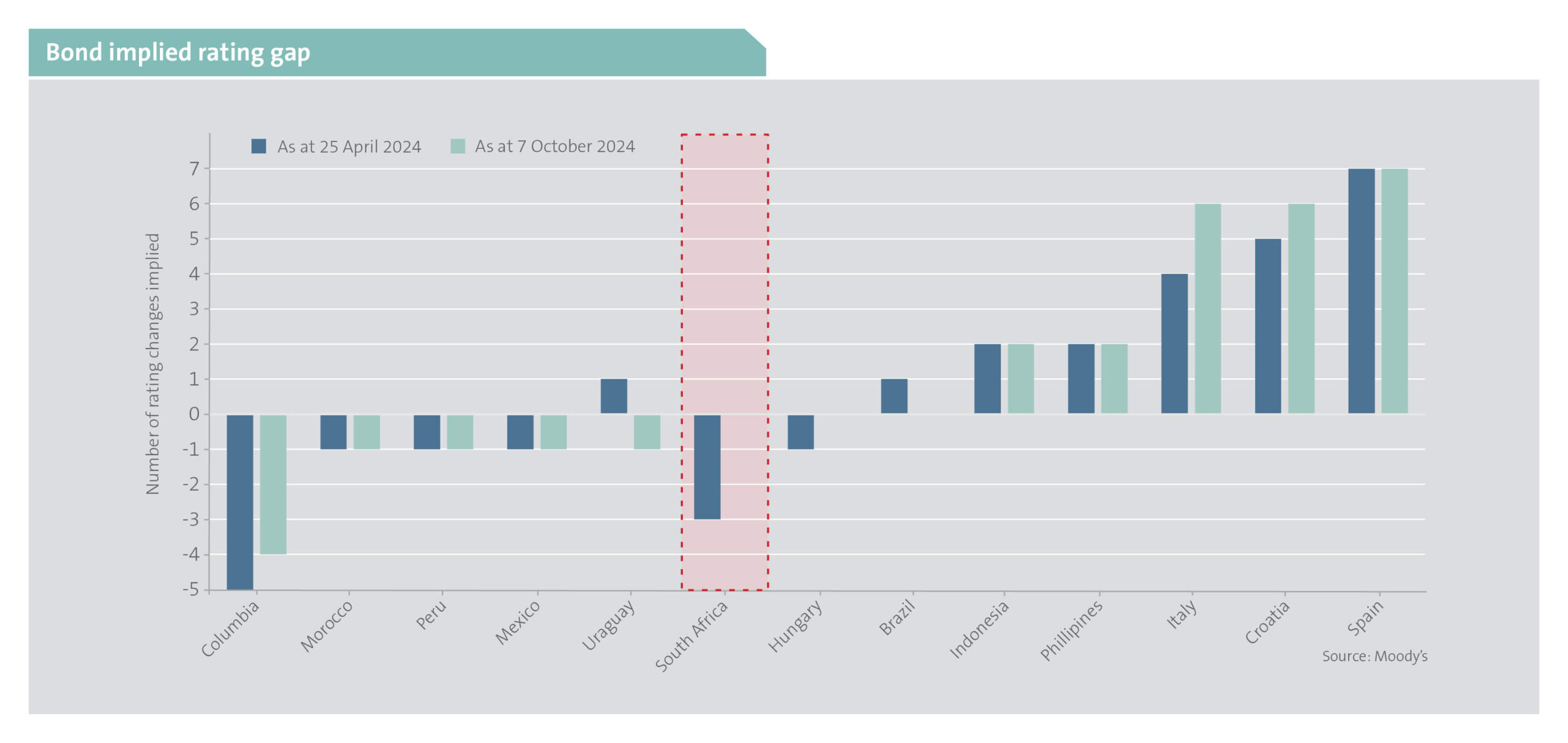

What the market was telling us

The Moody’s analytics tool uses market signals to determine the credit rating implied by the bond market. The output indicates what the market expectation is for South Africa’s future credit rating. The chart below, indicates a comparison of other emerging market and southern European countries, showing the market-implied rating changes at present and before the South African general elections. Current yields suggest investors are anticipating South Africa’s credit rating to remain constant. Notably, prior to the elections, market pricing indicated that the country’s rating would deteriorate by a further three notches. At that time, we argued that elevated bond yields already priced in a low road scenario and were going to pay a 13% per annum yield for the next 20 years, even if the three notch downgrades were to happen.

Clearly there was a possibility of default and of the deterioration of inflation management, which we do not intend downplaying.

Our view was that these risks were far lower than the market feared and we still believe in a greater probability of a middle road scenario somehow unfolding. In this event, bond yields were way too weak and one could not only bank 13% per annum for 20 years, but also a substantial capital gain as rates fell to reflect a better outlook, albeit still weak. Additionally, in the event of any quicker than expected improvement in the fiscal position, which we viewed as an unlikely high road, the main drag on South Africa’s credit profile would be reduced and bond yields could move considerably lower.

Substantial gains to date and more to come

This substantial and highly asymmetric return profile is rarely offered to investors and has already proved extremely lucrative for our clients. Developments in the country since the elections have been materially more positive than even the most optimistic forecasts from earlier in the year. We have a stable government of national unity, populist parties have been marginalised, reform momentum has strengthened and load-shedding has not occurred since March.

No doubt the future will present problems and setbacks. The country’s substantial structural problems, such as its vast unskilled and unemployed population, failing public services and organised criminal activity, loom large. However, as Moody’s highlights in its country assessment, there are many structural positives too. We believe real yields are still too high, although substantially less so than earlier in the year, and our client portfolios are positioned accordingly.