Taking shape

The enormous rise in the e-commerce market share of consumer expenditure has driven strong box industry volume growth. This, combined with consumer preference for more sustainable packaging and accompanying regulatory support, has meant that box volumes have expanded at 2% per annum over the past 15 years. This momentum is set to continue over the medium term, supporting a good growth outlook for this form of packaging.

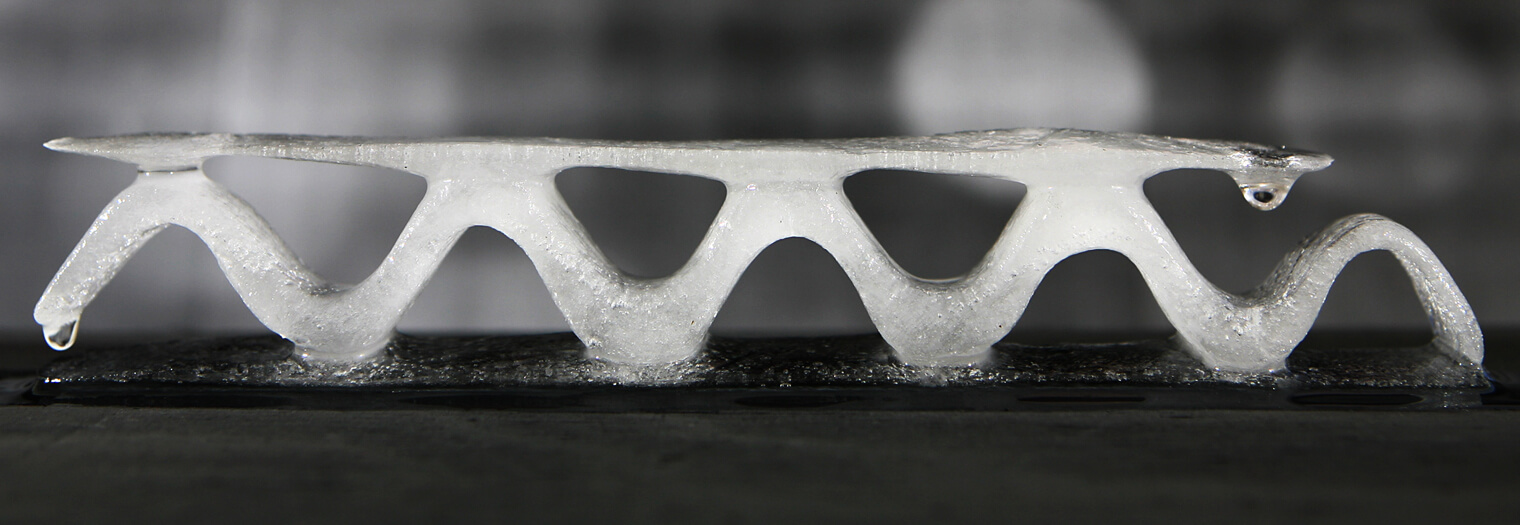

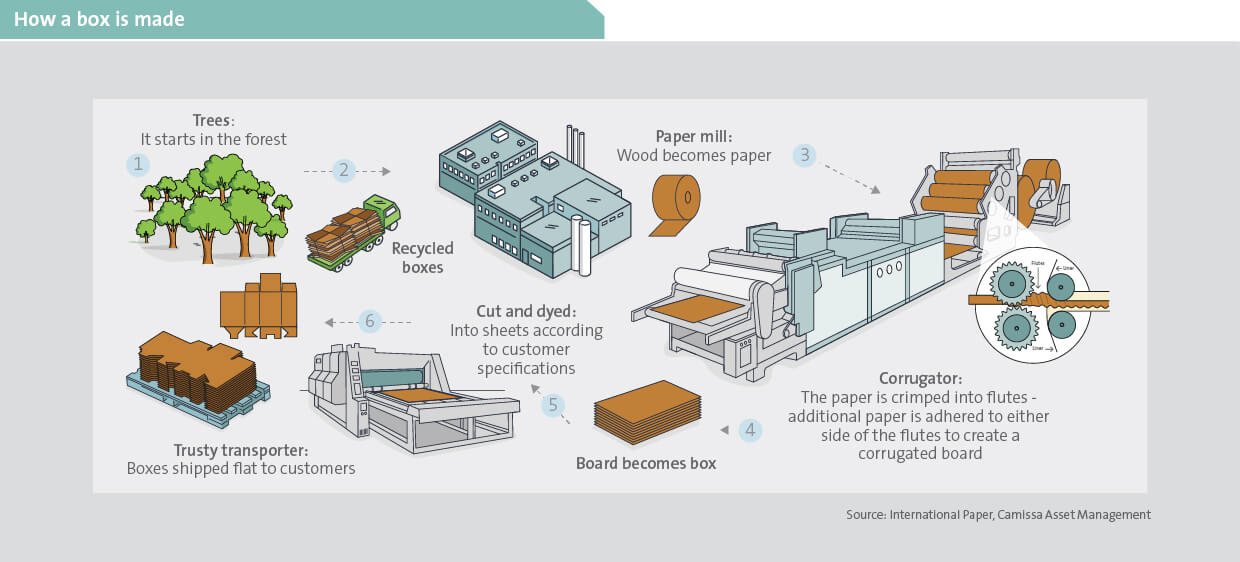

While cardboard boxes are tailored to diverse customer needs, they all follow a similar manufacturing process. As illustrated below, cardboard is made by combining a layer of paper-based fluting between two sheets of recycled paper or virgin fibre-based paper, called containerboard. The fluting provides strength, rigidity and insulation to the board. Virgin fibre-based board is stronger, making it ideal for higher value goods, food-grade products and high-quality printing.

The manufacturer cuts the printed board to size according to client specifications and delivers it flat-packed to customers for assembly. Box manufacturers are generally situated close to their customers to minimise transport costs. The larger global box manufacturers are also vertically integrated into the paper-making process, ensuring sufficient supply and quality control of the paper needed for their corrugated board manufacturing operations.

From humble beginnings to global leader

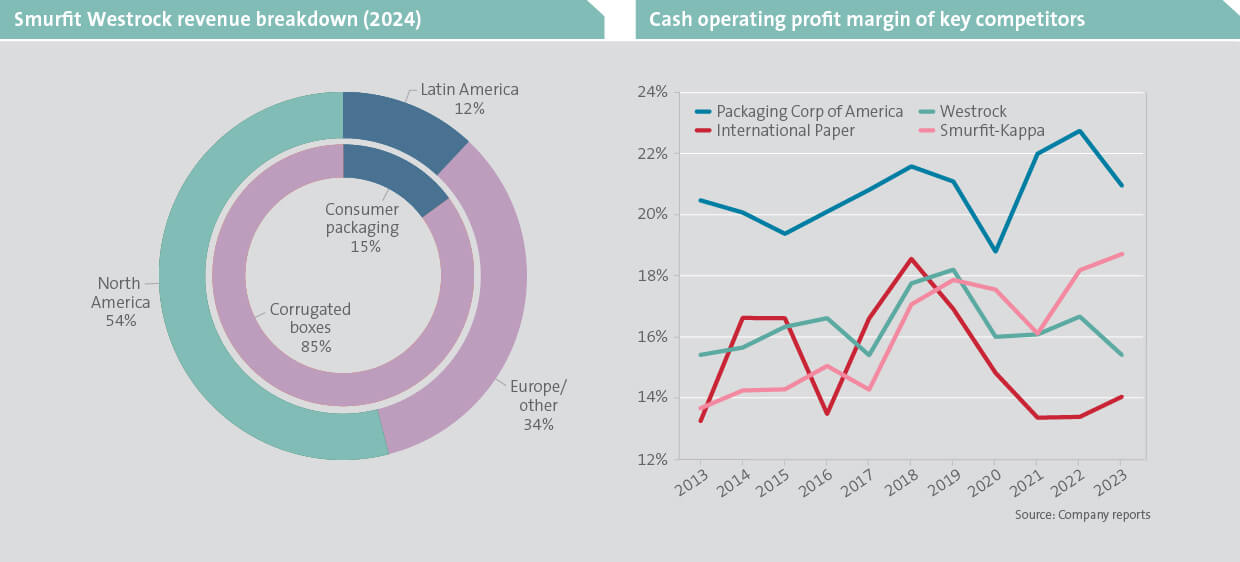

Smurfit Westrock started out as a small box-making business in Dublin in 1934, founded by John Jefferson Smurfit. Through several mergers – notably with Stone Container Corporation in 1998 (USA) and Kappa in 2005 (Europe) – the business morphed into a large, predominantly European-focused packaging leader called Smurfit-Kappa. The most recent merger with US-based Westrock in 2024 has made Smurfit Westrock one of the largest global packaging companies, now generating 54% of revenues from North America, 34% from Europe and 12% from Latin America (charted below left). The majority of revenue (85%) is derived from the sale of corrugated box solutions, with the remaining 15% generated from selling other forms of consumer packaging products. The Smurfit family remains actively involved, with CEO Tony Smurfit leading the business that was founded by his grandfather.

Proven performance

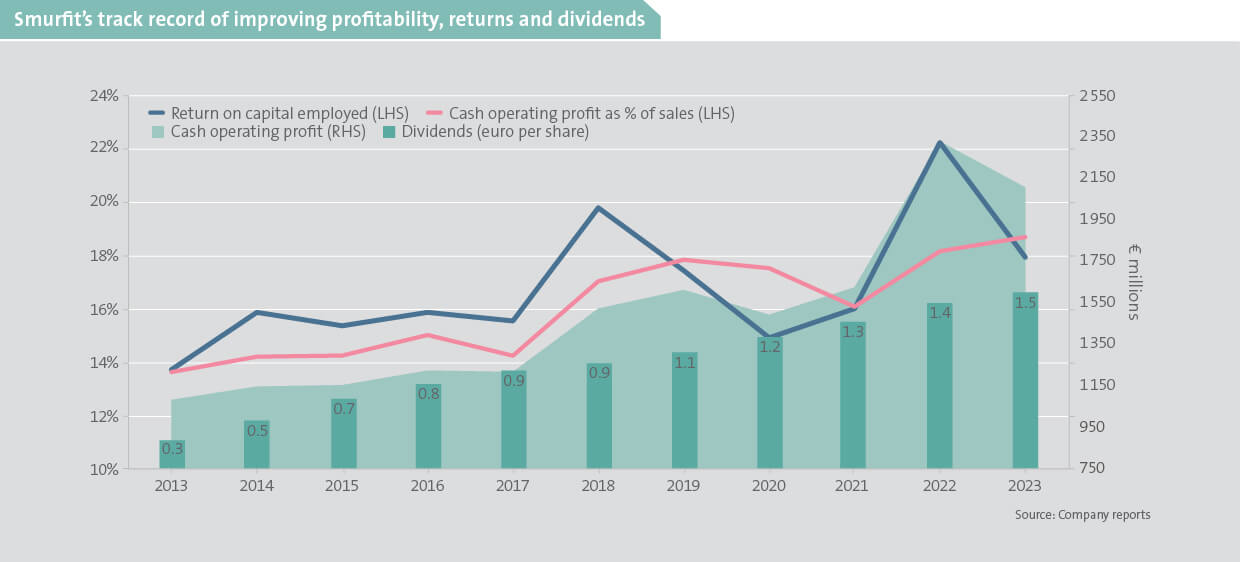

The Smurfit-Kappa management team has delivered strong results over many years due to:

- a decentralised business model, where a small central head office function has supported regional management, with full autonomy over production and pricing decisions.

- a strong culture of innovation, combined with a client-centric approach, delivers differentiated solutions that support market share growth in a competitive environment. A greater focus on the small and medium-sized enterprise market has resulted in strong growth and better margins.

- a vertically integrated business model – where the company produces its own containerboard – sees it capture the full margin of paper making and box production.

- large internal investment programs, with a strong focus on return on capital, leading to a low-cost, efficient production footprint and industry-leading returns.

This strategy has produced high profitability, robust returns on invested capital and strong cash generation, enabling a gradual increase in dividends distributed to shareholders – shown below.

Opportunity from the Westrock merger

The Smurfit-Kappa and Westrock merger closed in July 2024, with the Smurfit-Kappa executives remaining at the helm of the larger group. The key architects of their European success have been tasked with implementing the group’s best practices within Westrock. This should enhance Westrock’s performance, which has lagged its potential in the US market for several years. Despite the scale advantages of being a very large, national player in the US, Westrock’s profitability and return metrics have significantly lagged Smurfit-Kappa and smaller US competitor, Packaging Corp of America (PCA) – see previous chart above right.

We believe there is an opportunity to materially raise the profitability of Westrock toward the levels of PCA and Smurfit’s European business. Specific areas of focus include:

- US$400 million deal synergies have been identified and will be delivered by the close of 2025.

- implementing a decentralised business model. Previously, Westrock operated a centralised structure focused primarily on maintaining full production at its paper mills. Consequently, paper prices for the box businesses were effectively subsidised, and the company entered many very low-margin contracts with customers. Smurfit has identified contracts generating around US$10 billion in revenue that currently yield no profit. Assuming a reasonable box margin, these could contribute an additional US$1-1.2 billion in profits over time.

- improved innovation using some of Smurfit’s novel European products that are not yet available in the US, for example, shelf-ready packaging.

- investing in high-return capital projects. We believe a strategic review of Westrock’s manufacturing base is likely to yield several opportunities for a multi-year investment program, like that which Smurfit embarked on in Europe in 2015. This will likely include mill consolidation and closures, and other efficiency and expansion related capital expenditure. This should improve profitability and shareholder returns.

US box market is transitioning through a brutal cycle

The US and European box markets have recorded volume growth of around 2% per annum over the past 15 years. This is supported by rising consumer demand, the expansion of e-commerce and a shift toward paper-based packaging – fueled by growing environmental impact concerns.

The consumer boom in discretionary goods following the COVID crisis in 2021 resulted in significant volume growth over those two years. However, as the world normalised and spending shifted back toward services, demand for durable goods and the associated packaging declined sharply and has remained at these lower levels. Oversupply in box-making paper has depressed paper prices, which in turn has pressured box prices. This challenging environment has resulted in a severely negative cycle for the industry.

The US packaging market is very concentrated, where the top four box producers are vertically integrated and contribute around 75% of total market volumes. Historically, we have seen rational paper and box price inflation over the years, with the careful alignment of capacity (supply) to market demand, to reset pricing to levels where returns on capital are again strong. This concentrated market structure strengthens the US market’s attractiveness by helping to broadly sustain industry margins through the cycle.

Several key industry players (including International Paper – the largest global pulp and paper producer) have indicated extensive mill closure plans this year, with 10% of total mill capacity expected to be lost in 2025. This will tighten the supply side of the US market and mean a better pricing outlook despite subdued demand.

Set to take the lead

Smurfit Westrock has navigated the softer demand environment well, with their strong innovation pipeline and vertically integrated and decentralised business model. We are confident that it can emulate the success of its European business in the US and see strong multi-year earnings growth ahead as the Westrock business is repositioned to its European standards. We believe this potential is not yet reflected in the share price and therefore hold Smurfit Westrock shares in global

client funds.