Prussian engineer and soldier, Werner von Siemens – who founded Siemens Energy in 1847 – discovered the dynamo-electric principle. This revolutionised the development of electric motors, generators and the modern electric grid, and the company became a global leader in energy products. To this day, the unit of electrical conductance (symbol: S) is called the siemens.

Gas turbines: advanced technology to harness heat

Gas turbine systems burn fossil fuels to produce superheated, high-speed exhaust gases that power a rotary mechanical device (turbine), which is connected to a generator to produce electrical power. The temperature extremes necessitate sophisticated technology. Turbine systems are an indispensable source of electricity generation due to uniquely useful features such as:

• high energy efficiency – the latest combined cycle gas technology. Excess heat from gas turbines is used to drive smaller steam turbines, offering a high level of energy extraction efficiency from fossil fuels (thermal efficiency of up to 64%). This can be improved further (up to 85%) when residual heat is used to warm buildings.

• feedstock flexibility – gas turbines use natural gas or various liquid fuels. Siemens Energy recently pioneered the use of very high blends of hydrogen (up to 100%) in gas turbines – a technical breakthrough, as hydrogen has a higher burning temperature than other components of natural gas. Due to the large volumes of hydrogen needed to continuously run a gas turbine, the adoption of hydrogen powered turbines will take time.

• operational flexibility – gas turbines offer excellent flexibility. They can be quickly ramped up or scaled down, which is essential for supplementing intermittent renewable energy supply.

• up to 50% lower carbon dioxide emissions – from combined cycle gas plants compared to a coal-fired power generator.

• relatively quick, reliable turnkey installation of large power generation capacity – Siemens Energy currently manufactures the world’s most powerful gas turbine, the E9000, which can be quickly deployed to produce 411 MW of power, capable of powering 300 000 homes. The mega South African coal-fired power station plant, Kusile, has a capacity of 800 MW for each of its six generating units.

Manufacturers of gas turbines make most of their profits from the predictable, high-margin after-sales services (two thirds of revenue) that occur over the long life of the turbine. On-site servicing involves minimally invasive techniques using borescope equipment and major overhauls, where large parts of the turbine are removed and potentially replaced. Valuable on-site customer interactions from servicing often produce profitable up-selling and retrofitting related business opportunities.

Improved outlook for gas turbines

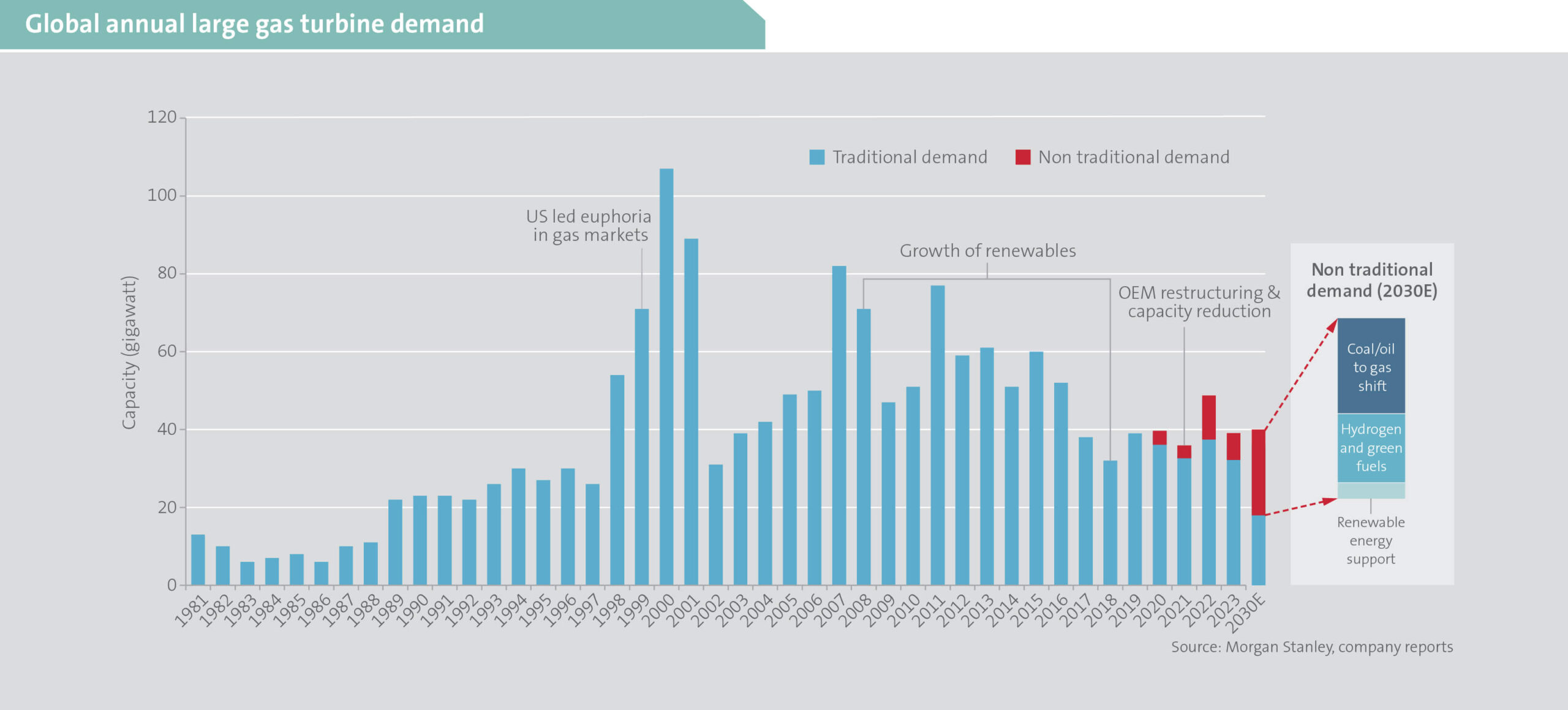

The onset of the electrical black- and brownouts1 experienced by the US in the 1990s, necessitated a material increase in generation capacity. Huge capital flows and capacity additions followed, and the euphoria led to exceptionally high demand for turbines from the US. In the three years to 2001, more gas turbines were bought than in the 15 years prior – followed by a market slump in 2003 (illustrated below).

The market has subsequently recovered, driven by increased electricity demand from eastern Europe and Asia, particularly India and China. New gas turbine demand began to falter again from 2017 as the plunging cost of solar and wind power caused a redirection of capital spend towards renewables and displaced gas turbine demand. Manufacturers that had substantially invested to produce larger, more efficient gas turbines, faced acute overcapacity and undertook a period of painful restructuring, consolidation and downsizing.

In a now smaller and highly consolidated industry, the outlook has improved due to China’s ongoing coal-to-gas transition and increased demand for renewable energy supplementary power. Furthermore, the significant increase in power efficiency and emission reduction of more modern turbine systems, is strongly incentivising continuous retrofitments of older plants. This increased demand, coupled with decreased capacity in this highly concentrated market, leads to a greater likelihood of higher margins in the medium term.

1Temporary drops in voltage.

Grid technology demand will be strong

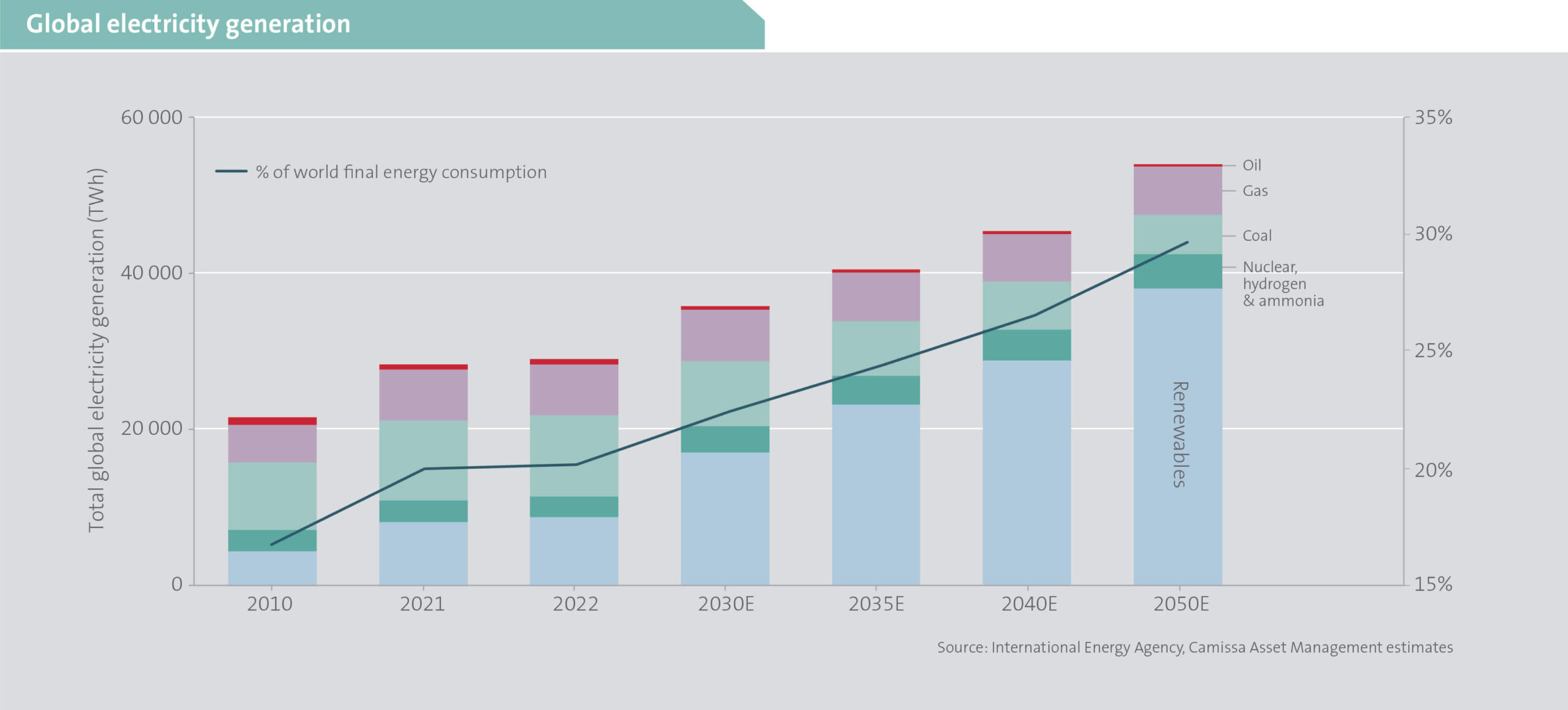

Global electricity usage growth is expected to accelerate as electricity’s share within growing energy consumption increases (charted below). Electricity generation is shifting towards fragmented, often geographically remote, and intermittent renewable sources. Demand is shifting towards battery charging and data processing in the medium term, with hydrogen production forecast for the long term. The significant increase in demand and resultant complexities requires substantial upfront near-term investment2 in global power grids to cater adequately for:

• the increased need to step up electricity voltage to enable efficient long-distance transmission and for increased high direct current (HVDC) transmission capacity.

• the greater need for stability at distribution level (delivery of lower voltage electricity to consumers).

• the sizable backlog of general system maintenance needed due to chronic underinvestment in large parts of the US and Europe where power grids are old (>60 years) relative to newer grids in Asia.

The grid technology division of Siemens Energy is well placed to supply the required infrastructure. They manufacture the required transformers and HVDC management systems for electricity transmission, switching gear to control electricity flow for local distribution and breakers needed to protect against overloads.

Given the significant grid investments in China in the last two decades, Chinese manufacturers of grid technologies have strengthened meaningfully, dominating the China market and competing formidably in the rest of Asia. They are, however, disadvantaged in developed markets, where the critical infrastructure status of grid investments amid geopolitical tensions and the need for in-country servicing capacity, favours local players.

Amid robust demand, Siemens Energy’s medium-term order book has surged, allowing the company to be selective on projects and price them well. It is therefore likely that returns will be higher than normal for a period.

2BRE estimates that the level of global capital expenditure in power grids will need to rise threefold by 2030 and could be significantly higher if net zero goals are to be met. Growth is expected to be particularly strong in Europe and North America.

Turbulence for wind turbines

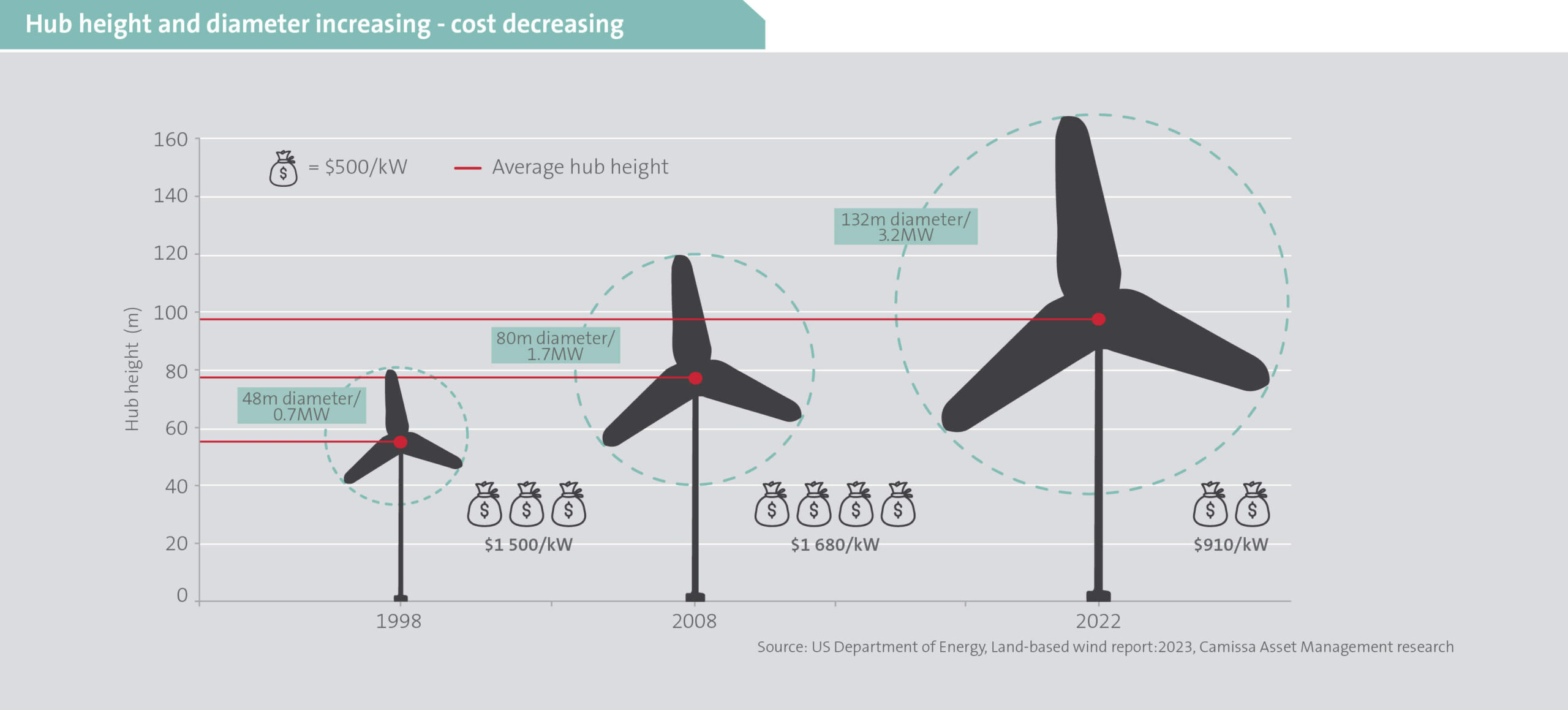

Illustrated below, the last 15 years have seen huge technological advancement in wind power generation amid fierce competition between wind turbine manufacturers to produce more efficient turbines. Onshore turbines are now on average 88% more powerful than in 2008, with 24% increased height and 64% increased rotor diameter. Greater heights allow for the capturing of richer wind energy and larger rotor diameters achieve larger sweep areas and therefore more energy extraction.

These are critical improvements as wind farm locations develop beyond the most wind-rich catchment areas. Over the same period, the cost of wind turbines has decreased, providing a meaningful boost to the viability of onshore wind power – now cheaper than legacy power generation in many markets.

These developments have, however, resulted in chronically low economic returns for manufacturers who, in recent years, have been challenged by continuously high development costs. Increased input cost pressures from strained global supply chains and higher commodity prices have forced manufacturers to disproportionately absorb the impact of sharp input cost price inflation. This has been compounded by poorly constructed supply contracts with customers.

Siemens Energy’s wind business has been particularly hard hit. It has also experienced disappointing and costly technical problems with its latest onshore wind platform, arguably resulting from aggressive product development in too short a space of time. Yet, industry pricing has recently improved and the outlook for demand is robust, particularly in the more technically demanding offshore wind sector where Siemens Energy has historically been a leader. It has a 70% market share of the installed offshore fleet with an even higher deep-sea market share. The immediate focus for management is to stabilise the onshore segment of the business and stem the significant losses it is currently incurring.

Siemens Energy is well placed for a greener energy future

Material shifts in the global energy market due to increased electricity demand, greater renewable energy generation and higher voltage requirements necessitates: an enduring gas power base load demand that is bigger than previously expected; urgent and substantial power grid investments particularly in Europe and the US; and substantial ongoing investment in modern wind power generation equipment.

Given this high demand and the limited market capacity, Siemens Energy is currently able to price well in its gas services and grid technology segments and should enjoy a period of higher-than-normal returns. Additionally, there is substantial positive optionality should Siemens Energy be able to turn around its deeply loss-making wind business.