With a history spanning the last century, Santam (the South African National Trust and Assurance Company) has weathered many storms and remains South Africa’s leading short-term insurance business. Its massive success stems from strategic adaptability and remarkable operational execution in evolving its client-centered service offering that caters for individuals, business owners and institutions. We unpack Santam’s history, the business and its strong market position today.

Early origins

Santam was founded in 1918 in the aftermath of World War I and the Spanish flu pandemic. Within months, they had established a subsidiary focusing specifically on life insurance, namely Sanlam (the South African Life Assurance Company). Santam remained the largest shareholder in Sanlam until 1953 when Sanlam converted to a mutual insurer. Subsequently, Sanlam became Santam’s largest shareholder.

Santam’s early focus was on insuring risks related to agriculture and it later expanded into offering various forms of personal (ie motor and home), business and liability insurance. The company revolutionised the insurance industry in the 1970s by launching the first all-risks policy (Multiplex) that enabled South Africans to consolidate the insurance of all their assets under a single policy. The yellow umbrella brand icon, reinforcing their positioning, was incorporated into Santam’s logo in 1981.

Growing and adapting their position

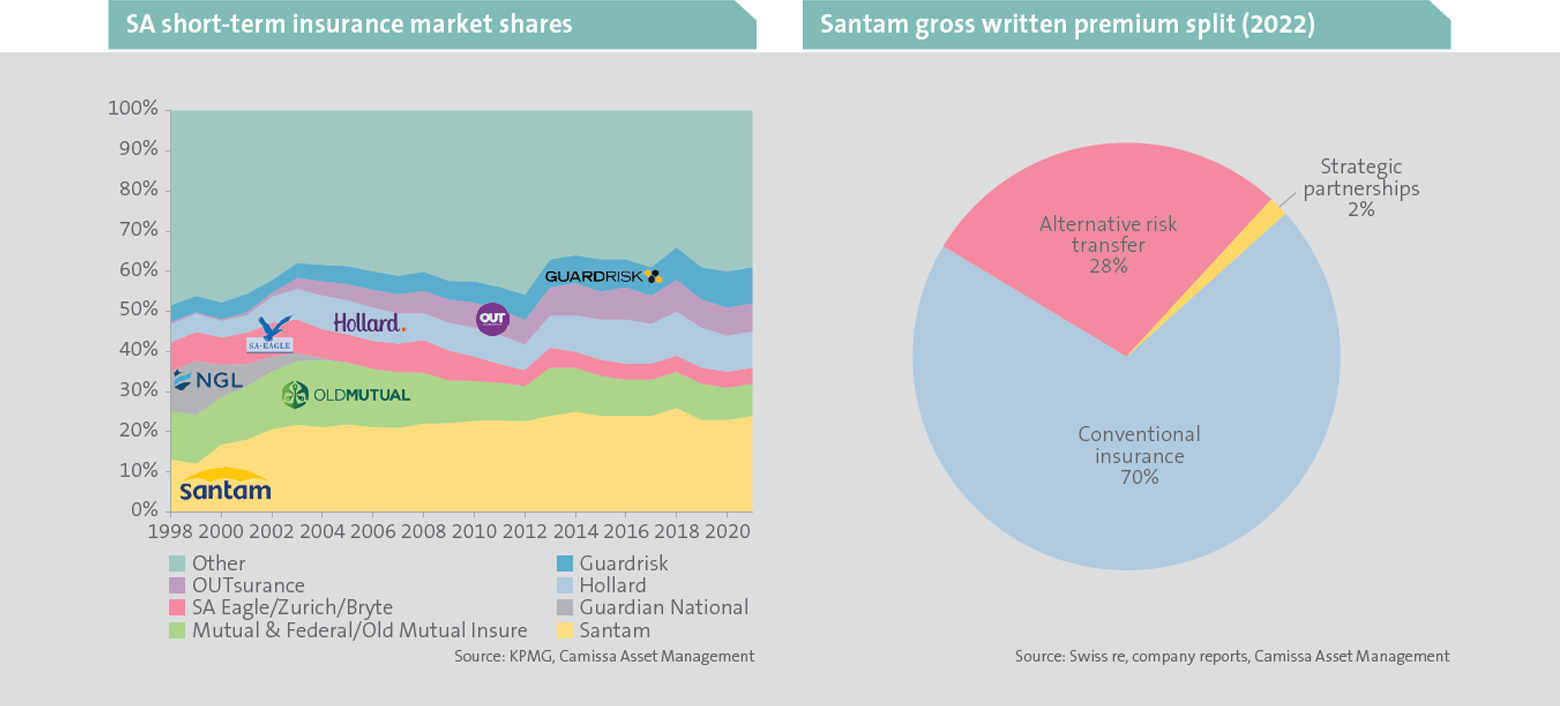

Santam’s 1999 acquisition of Guardian National (the third largest insurer at the time) for R1.6 billion, was a huge success. It was transformational for Santam as it secured a 25% market share of the local insurance industry (below left), thereby achieving material economies of scale and reducing market competition. It significantly increased the company’s presence in the commercial insurance market. The complimentary combined market offerings of the two companies created immediate benefits from risk diversification and capital optimisation, and longer-term cross-sell opportunities.

In 2003, Santam (in conjunction with Sanlam) established insurance businesses outside of South Africa (particularly in other developing countries). They later also established Santam Re and Santam Specialist, offering business insurance.

In the late 2000s, direct1 insurance competitors emerged and began rapidly gaining market share from intermediated2 insurers such as Santam. To counteract this threat, MiWay – a direct insurer separately branded from Santam – was launched in 2008 by Santam, Sanlam and PSG. MiWay was acquired in full by Santam in 2012 and has been a remarkable success, capturing a large portion of the move to direct insurance without disrupting Santam’s relationships with its intermediated distribution channel.

1Online and call center-based personal lines insurers that deal directly with customers, rather than via intermediaries such as brokers.

2Insurance sold and serviced via intermediaries such as insurance brokers. Client interactions are primarily face-to-face, with more of a personal touch than can be offered by a call center.

Substantial competitive advantages

Santam’s competitive advantages stem from its decades of experience, broad geographical footprint, massive scale, brand strength, business diversity, specialist skills and capabilities, and distribution networks. Currently, it offers short-term insurance solutions under three divisions (right chart above):

• Conventional insurance comprising Santam Commercial Conventional insurance comprising Santam Commercial MiWay, Santam Re (wholesale reinsurance) and Santam Specialist for business (eg crops, liability, engineering);

• Alternative risk transfer offerings are tailored solutions for business clients to enable them to insure their own operational risks. These comprise a separate legal entity (cell) operating under Santam’s insurance licence; and

• Strategic partnerships outside of South Africa in countries including Malaysia and India.

Personal lines – large and very competitive

Personal lines insurance (mostly motor and household insurance for individuals) comprises 50% of total industry premiums. This market has seen direct insurers rapidly gain substantial market share, with their penetration seeming to now stabilise at around 40%. Direct insurers include Outsurance, Miway, Telesure (with brands such as DialDirect and 1st for Women) and King Price.

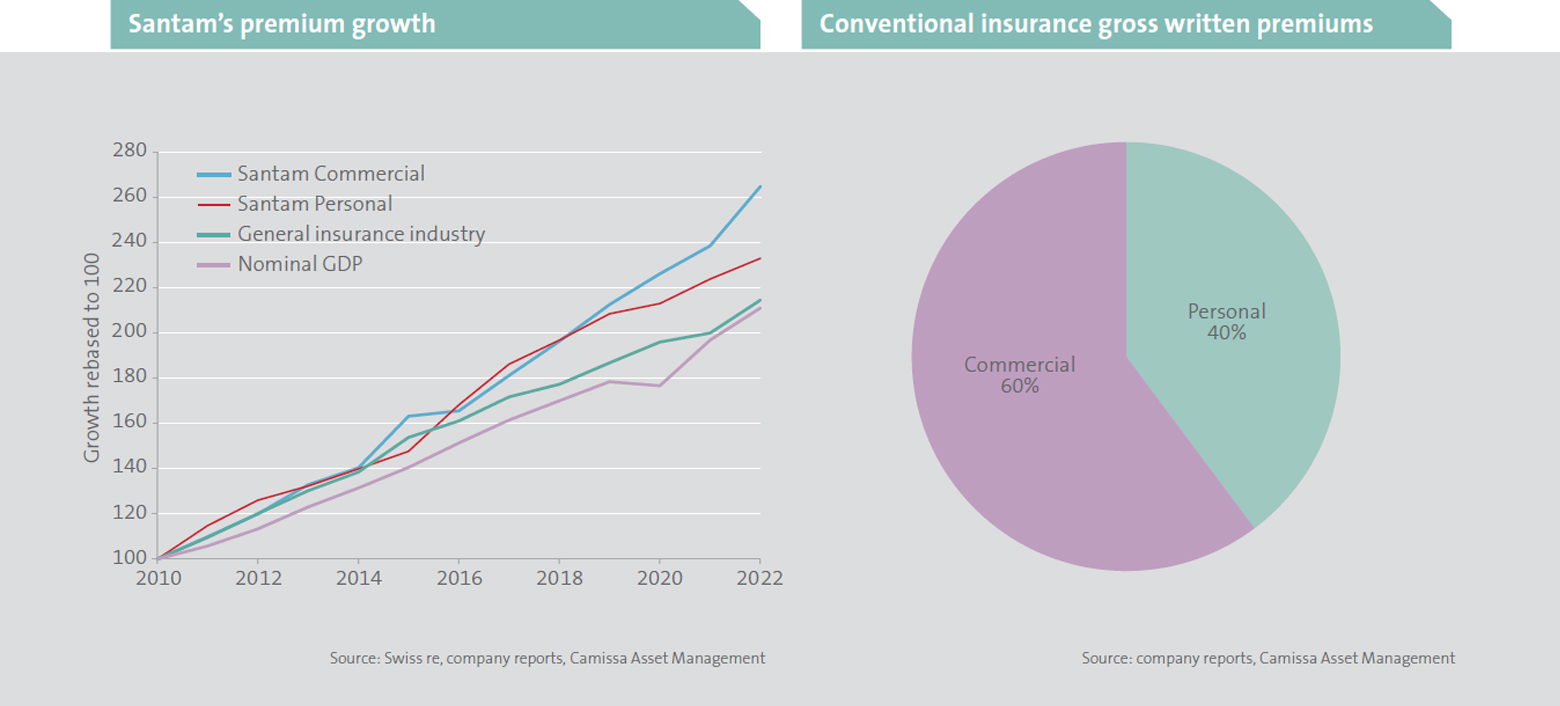

Santam Personal (41% of Santam’s gross written premium3) has exhibited sector-leading growth that accelerated post 2016 – largely aided by strong growth in MiWay (left chart below). Although the growth rate has eased due to the tough economy, Santam still sees significant growth potential for MiWay. This should be boosted by the launch of its fully digital offering that will compete with new digital competitors such as Pineapple and Naked.

3The total premium written by an insurer before deductions for reinsurance and commissions.

Commercial lines – the growth driver

Commercial lines insurance (below right) contributes approximately 30% of the industry’s premiums. Santam Commercial has exhibited above-industry growth and holds the largest market share. This leading position stems from Santam’s deep experience and expertise in specialist risk insurance across a far broader range than competitors.

The commercial market has three segments, with a specific distribution model for each:

• Small corporate – a mix of direct and broker-led with many new entrants. Discovery and Outsurance are growing well in this segment and competition is high.

• Medium corporate – broker-led, where Santam is the largest player with fewer competitors.

• Large corporate – broker-led, where Santam dominates and has more than 3 000 established broker relationships. Growth opportunities in this segment will come from:

o asset growth and related protection needs as these businesses grow and the value of their assets increase in real terms.

o new risks that are emerging, for example cyber-crime, terrorism and climate change.

Cell captive solutions

Cell captive insurance, whereby a business entity self-insures its assets by setting up its own insurance subsidiary administered by an insurer and written on that insurer’s licence, is expected to grow in the coming years. An increasing number of companies are seeking to manage their risks more effectively and reduce their insurance costs. Santam’s alternative risk transfer business is a relatively small profit contributor (8% of total profits) now but is expected to grow fairly rapidly.

Dominance in a difficult market

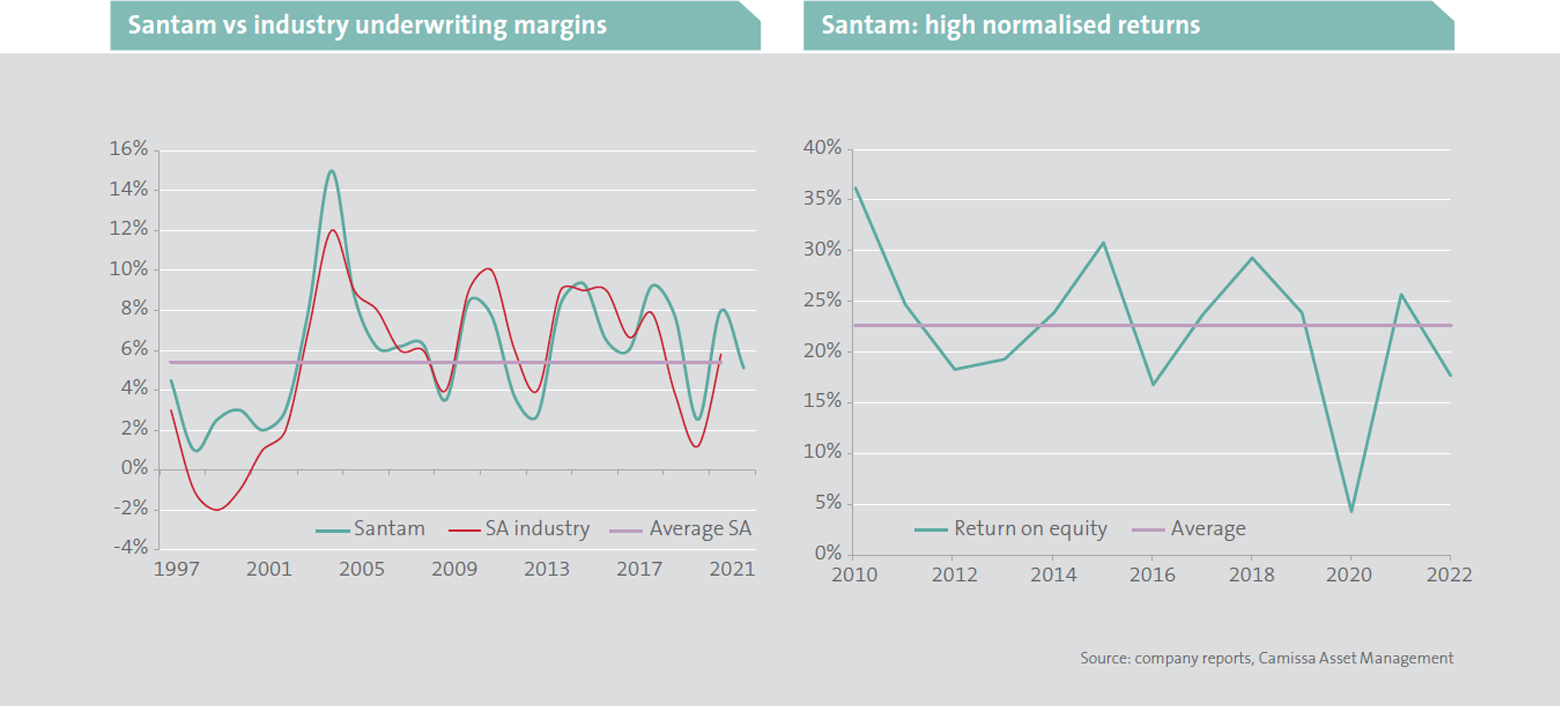

Santam’s margins and return on capital have been excellent over the long term (charted below). Their robust long-term underwriting margin signature results primarily from outstanding risk selection and pricing. They have also effectively managed their capital requirements by diversifying their portfolio of risks and applying internal risk capital models that result in higher returns on equity than competitors.

As a market leader with a history of financial stability and solid risk management, Santam has immense scale, operates with efficiency and deploys leading underwriting skills that enable it to achieve high margins and provide a compelling competitive edge. This will serve shareholders well in the years to come.