Origins of cement

Cement is undeniably a key material in the building industry, having been used over the past 12 000 years. In 1824, British bricklayer, Joseph Aspdin, experimented on his kitchen stove by heating limestone and clay to create the first Portland cement. This process was further refined using higher temperatures, of 1 400 – 1 500°C, resulting in what is known as clinkering1. This remains the backbone of the cement manufacturing process, now serving a global market that produces over four billion tonnes of cement annually.

1The formation of lumps and nodules of crude cement when limestone, clay and other materials react at high temperatures in the kiln. The product resulting from this is clinker – a simplified form of cement.

Cracks on the local front

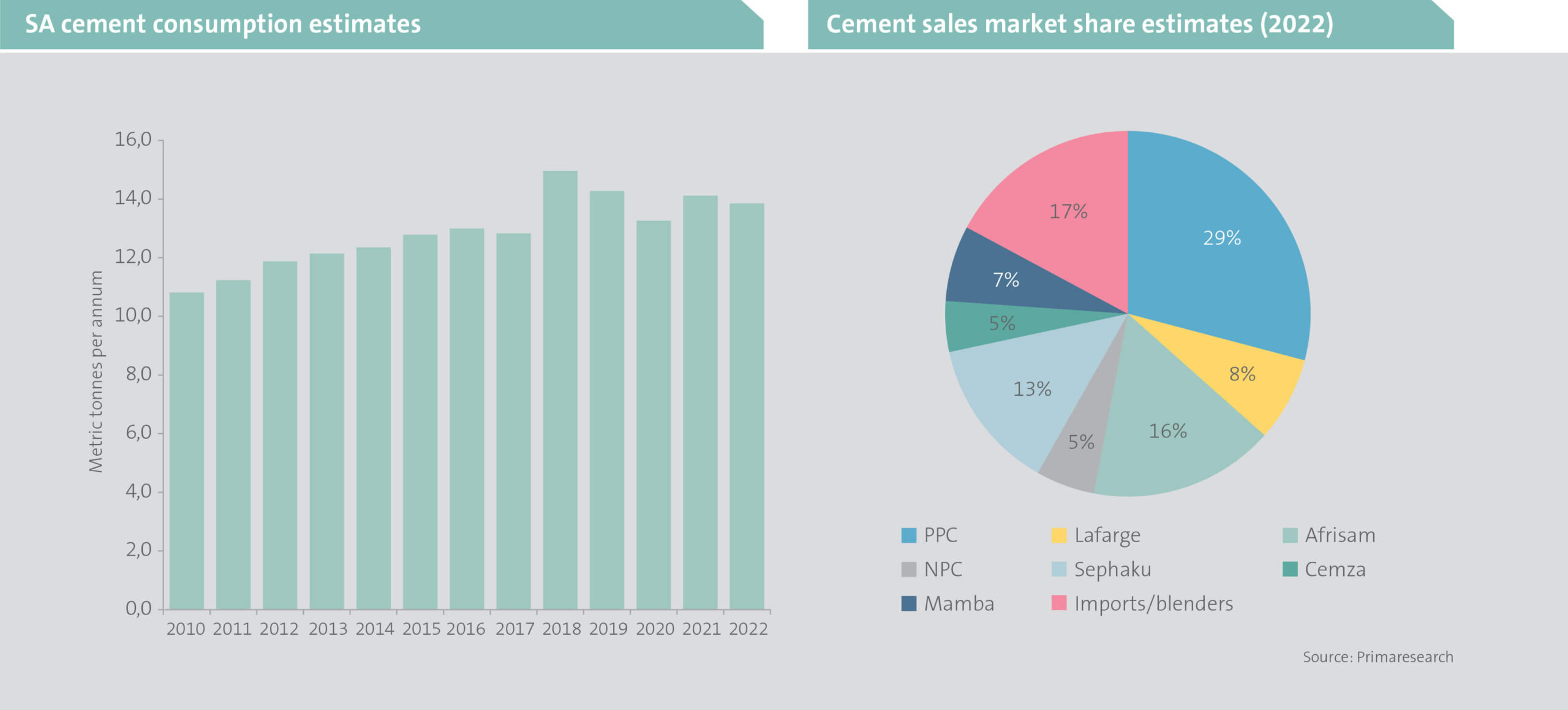

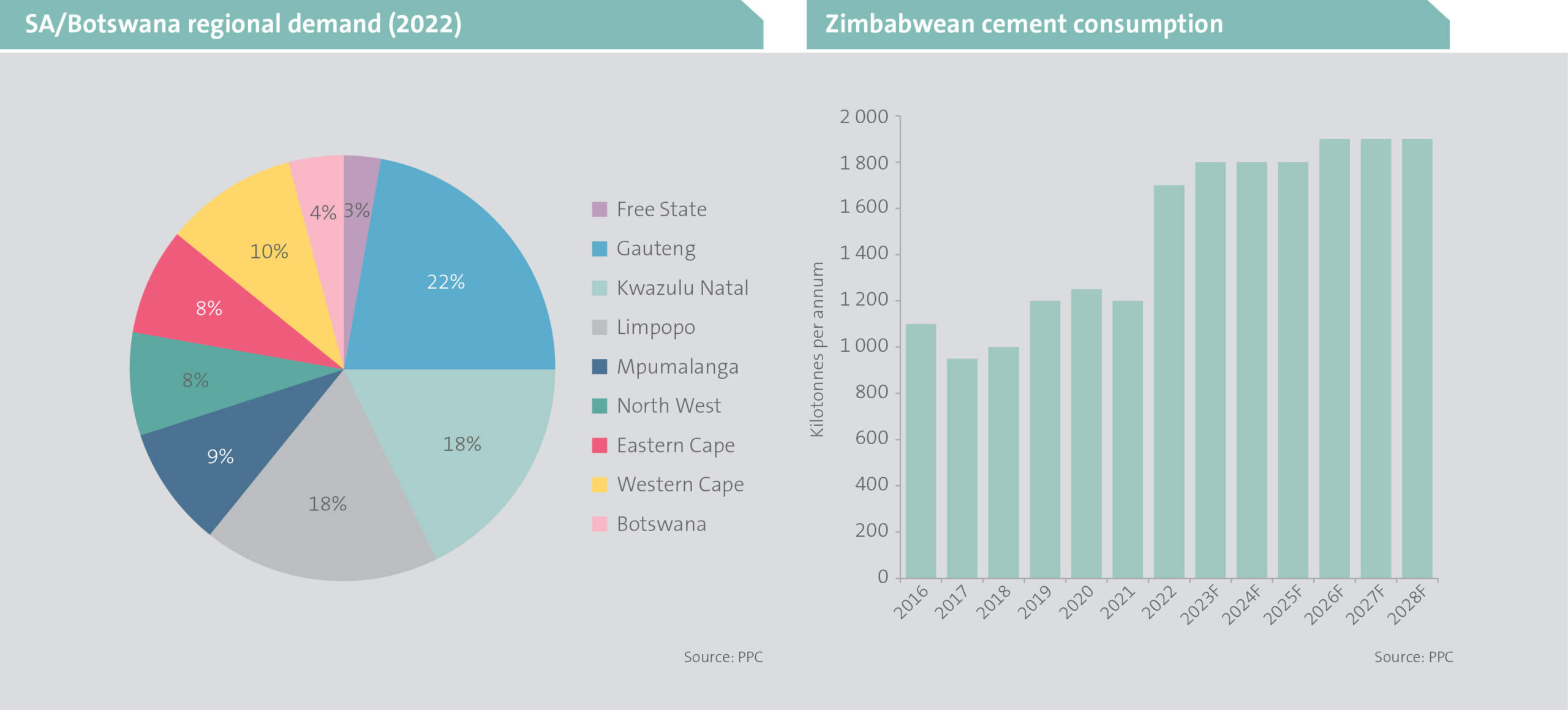

As indicated below (left), the past two decades have seen the South African cement industry challenged by subdued market demand. Government infrastructure spend post the 2010 Football World Cup has been very low and the negative economic and political environment has been unconducive to the levels of private sector capital investment typically associated with an emerging economy. Limited demand has been compounded by the entrance of additional supply from new competition (below right), namely Sephaku (a Dangote subsidiary), Mamba Cement and Cemza (a grinding facility). Imported cement supply further limits the pricing power of domestic manufacturers, particularly in the coastal regions of the country.

South African production capacity, currently at around 16 million tonnes per annum, exceeds the annual local cement demand of 13-14 million tonnes. Certain cement manufacturers have consequently engaged in poor pricing discipline, endeavouring to win market share to maximise their utilisation rates. This erodes margins and causes a market reluctance to increase prices in response to cost pressures. As a result, sub-economic returns are delivered as industry profitability suffers.

Route to market

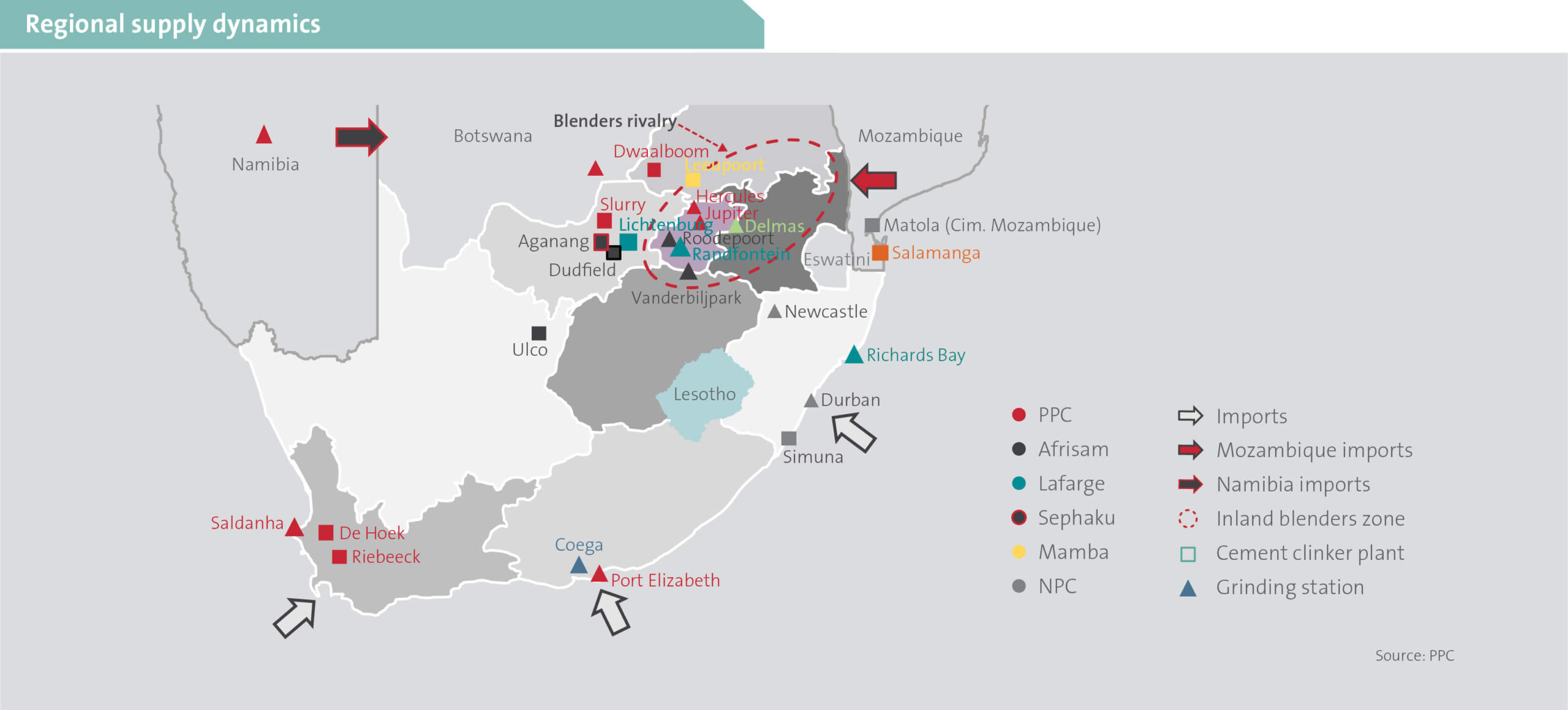

As illustrated below, many of the South African cement manufacturers are based between the large demand centre of Gauteng and inland limestone deposits.

The Western Cape has recently realised higher levels of demand due to a thriving provincial economy supported by increasing semigration trends (below left). Being the sole integrated cement producer in the Western Cape, PPC is well placed to capitalise on this prevailing regional demand.

As a low value per kilogram, heavy product, transport costs are a very material input cost for a cement manufacturer. Long distance transport, particularly via road, is prohibitively expensive and therefore regional pricing trends can be quite divergent. Historically, PPC chose to outsource their distribution function, which has arguably hindered their insight into some of the regional pricing dynamics. Taking greater control over this key capability could help optimise their distribution footprint.

‘Blenders’ purchase clinker from vertically-integrated cement manufacturers, such as PPC and Afrisam, and add extenders like fly ash to clinker to produce cement. If successfully managed, blenders can provide an avenue for cement manufacturers to target customer bases they would not otherwise have access to. However, unscrupulous blenders use excessive amounts of extenders, which are cheaper than clinker, to produce a cement that i) does not meet the required strength and quality standards, and ii) undercuts the price from vertically-integrated manufacturers. In South Africa at present, regulatory enforcement to ensure compliance with industry standards is inadequate and market share is unfairly being lost to these unscrupulous blenders.

Sitting on solid ground

PPC has attempted to adapt to this challenging operating environment, remaining cash generative and demonstrating reasonable cost control. The business exited territories in which they had inadequate scale (Rwanda, Ethiopia and the Democratic Republic of Congo), which helped to significantly deleverage their balance sheet. The rationalisation of PPC’s international portfolio allows management to focus on optimising their Southern African operations.

One of PPC’s competitive advantages is that it has greater operational flexibility than competitors, enabling them to respond quickly to changing demand dynamics. Certain production capacity can be ramped up relatively inexpensively – as was demonstrated during the temporary spike in building activity witnessed in South Africa post the COVID lockdowns.

Despite the cost curtailment that has occurred to date, opportunities remain to further limit cost growth. The recent appointment of a new CEO and executive team, with a strong operational track record, should initiate a rigorous interrogation of the existing cost base. Additionally, they should correct market practices that leak economic value, particularly via a renewed distribution strategy to market.

Longer-term initiatives such as the potential use of alternative raw material inputs (eg calcined clay) can, if successful, materially reduce energy consumption in the production of clinker, delivering the added benefit of lower carbon emissions.

Zimbabwe – a diamond in the rough

PPC retains a market-leading position in Zimbabwe, where they have operated since the early 2000s. Despite the very challenging political and economic environment, these operations have delivered a commendable performance over an extended period (charted above right). Robust demand continues to be buoyed by development finance-funded infrastructure projects and residential construction supported by diaspora remittances. Property continues to be seen as a means to preserve wealth in an unstable, inflationary economy. Furthermore, an in-country shortage of clinker, alongside rational pricing by local competitors, has resulted in significantly higher profit margins being achieved than those in PPC’s South African operations. Cement prices in Zimbabwe can exceed South African prices by well over 50% per bag in US dollar terms.

In addition, the rapid US dollarisation of the Zimbabwean economy has protected PPC from being exposed to the consistent devaluation of the local currency. PPC has been able to consistently repatriate profits to South Africa over the past few years. PPC Zimbabwe’s solid performance has attracted the interest of investors, who have been rumoured to be keen to acquire the Zimbabwean operations at a favourable price. This could potentially represent a material percentage of PPC’s market capitilisation.

The rise of the concrete jungle

South Africa’s cement consumption levels remain well below global averages. It is estimated that Sub-Saharan Africa consumes 190 kg per capita per annum, whereas South Africa, a vastly higher income country, is at 230 kg per annum. In comparison, the global average is at 550 kg per annum (314 kg per annum in the USA and 1 620 kg per annum in China).

New housing development is a key cement demand driver. The gradual formalisation of housing structures and increased urbanisation is supportive of greater cement usage. Any recovery in building plan completions, which are at a multi-decade low, can significantly improve South African cement demand dynamics and the resultant profitability of the sector. The underinvestment in infrastructure spend is also increasingly evident, with persistent challenges across energy, logistics, housing, water and sanitation. Improvements here from a very low base should be very positive for cement demand.

Value despite the slump

PPC has demonstrated its ability to sustainably generate cash flows despite industry and broader economic challenges. Although demand is unlikely to change materially in the short term, PPC is well placed to respond to any uptick in demand, incurring negligible capital investment to restart their mothballed operations. Higher volumes will significantly improve profits. Even in an environment where volumes remain stable, continued efforts to reduce costs will aid cash generation from the business. We view PPC as attractively valued, with the current share price failing to adequately capture the cash generating ability of the business.