Early history

Founded in 1884 by Rinaldo Piaggio, Piaggio was a producer of naval fittings before its expansion into the railway industry, manufacturing and repairing carriages. During the First World War, the business started constructing seaplanes and quickly expanded into the aviation industry via numerous acquisitions. Throughout this early period, Piaggio assembled a team of skilled engineers empowered to innovate. In anticipation of a post-Second World War boom, the team turned its attention to two-wheeled scooters and in 1946 began the production of its most celebrated brand, Vespa.

Brands

As illustrated below, Piaggio sells scooters and motorbikes within its two-wheeler division, with scooters contributing approximately 90% of segment sales revenue. Its scooter brands, Piaggio and Vespa, cater for metropolitan mobility needs and are positioned as premium brands – Vespa being its most stylish and aspirational brand. Motorbike brands, Aprilia and Moto Guzzi, were acquired in 2004. Aprilia is Piaggio’s flagship sport brand, while Moto Guzzi is positioned for road travel.

The commercial vehicle segment comprises the Ape and Porter brands. Ape three-wheeled vehicles were first manufactured in 1948 to fulfil the need for a compact, light transport vehicle that initially played a role in reviving trade activities in Italy following the Second World War. Today, it is also used for the transport of passengers. The Porter is a four-wheel vehicle, that was first manufactured in 1992, designed for short-range cargo transport.

Two-wheel vehicles are cheaper than cars, easier to park and move around in dense urban environments, and have lower costs of ownership (ie congestion charges, insurance costs and servicing costs). Notwithstanding the relative affordability, Piaggio’s two-wheel brands are positioned as premium vehicles and generally sell at higher prices than competing options.

The average selling price also differs by region. For example, Piaggio’s two-wheelers sell for a substantially higher price in Europe than in Asia: in 2023 the average selling price in Italy was €4 164 compared to €1 159 in India. This differential is because manufacturing costs are substantially higher in Europe and European consumers can afford higher prices, given their far higher incomes.

European market opportunities

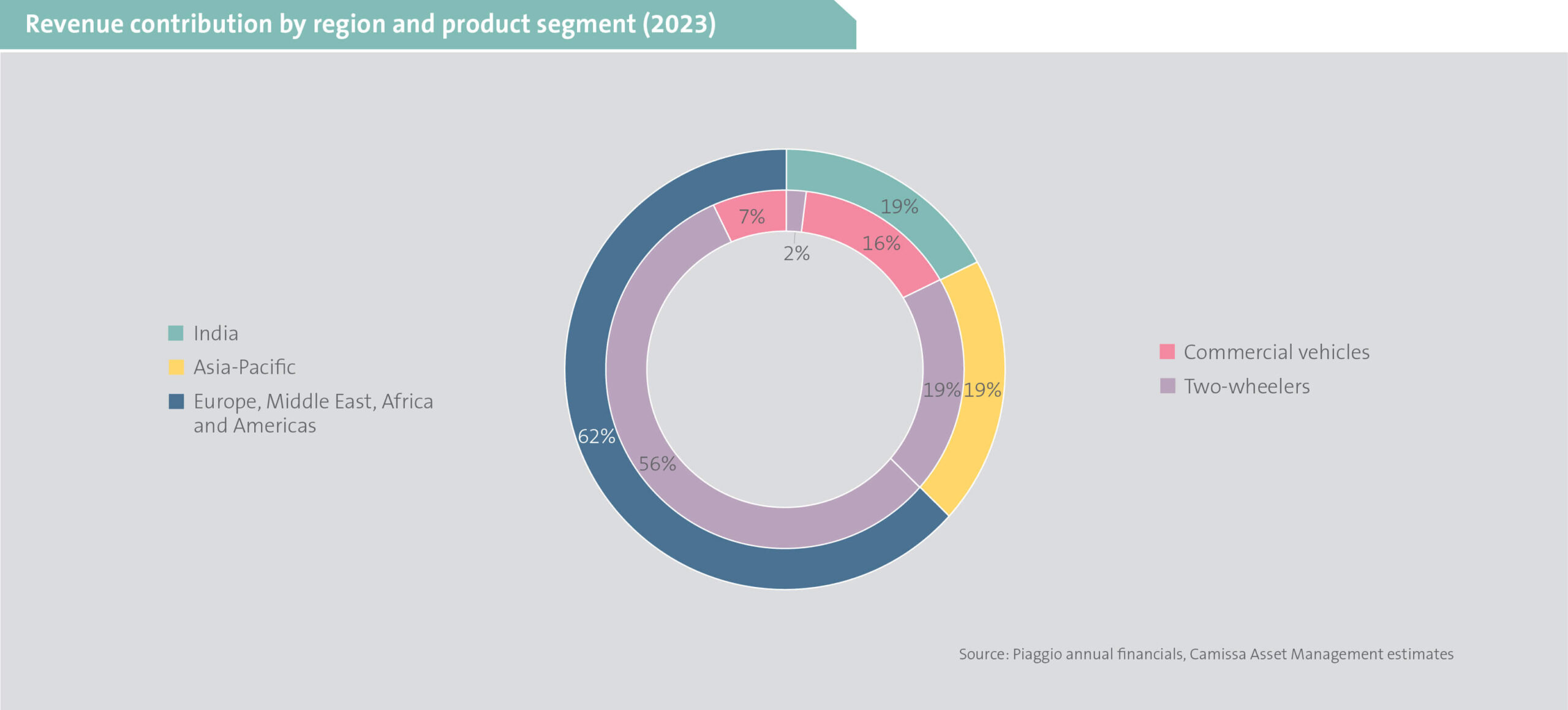

In 2023, 1.6 million two-wheelers were sold in Europe, which is a mature market. Piaggio commands a 12.3% market share in the two-wheeler market and a 22.4% share in the scooter sub-segment. Its European commercial vehicle sales are less material in the sales mix, comprising 3% of volumes and 11% of revenue (charted below). While the annual sales of two-wheelers has declined from the early 2000s, the total number of units in use has increased substantially. Furthermore, the average age of two-wheelers in use has approximately doubled. Given the old age and large size of the existing scooter fleet in use, it is probable that annual sales increase somewhat in future as vehicle owners increasingly need to replace their old models. This should boost sales volume growth for Piaggio.

The European Union has introduced a series of emission standards that regulate the extent to which vehicles emit polluting gases. Euro 5 Plus is a new, more stringent standard that is due to be introduced before the end of 2024, to regulate vehicles sold after the date of introduction. Two-wheelers already in use will not be regulated by this standard. Nonetheless, two-wheel manufacturers have been forced to safeguard the sustainability of their future sales through innovation that addresses the reduction of harmful emissions.

Piaggio has been at the forefront of the transition to more sustainable transport. In 2009, it completed the design of the first hybrid scooter powered by twin engines, one electric and one thermal. Since then, Piaggio has introduced the Vespa Elettrica and Piaggio 1 electric scooters, in 2018 and 2021 respectively. In 2023, electric scooter sales volumes comprised approximately 12% of total European scooter sales volumes. Considering the increasingly stringent regulation of internal combustion engines, coupled with rising environmental awareness among consumers, electric vehicles should increase in market share, for which Piaggio is well placed.

Asia-Pacific market opportunities

In 2023, the Asia-Pacific region (excluding India) tallied 19.2 million two-wheeler sales, with scooters accounting for the significant majority of the volume. Indonesia and China are the two most important markets within this region, comprising a combined 58% of regional sales.

The use of two-wheel transport for daily commuting is a deeply entrenched way of life in this region due to their effectiveness in handling the extremely high congestion in urban areas and their affordability for the large lower income population. Piaggio only sells two-wheelers in Asia-Pacific and its strategy is to increase scooter sales and explore opportunities for motorcycles with a medium-capacity engine. In China specifically, Piaggio seeks to strengthen its sales in the premium segment as real income levels rise.

In many of the Asia-Pacific countries that Piaggio sells into, incomes are growing rapidly, which has made two-wheelers more affordable. The business is well-positioned to benefit as the addressable market grows and as individuals trade up from entry-level scooters to the premium brands.

Indian market opportunities

India is the world’s largest two-wheeler market, with just over 17 million sold in 2023. Approximately two-thirds of two-wheeler volumes sold in India in 2023 were motorbikes, a product segment in which Piaggio is substantially under-indexed. Piaggio sold 41 000 two-wheelers in India in 2023, indicating its small presence yet large potential for market share growth.

Indian two-wheeler sales volumes grew consistently until 2018, when the Indian government cracked down on credit provision by non-bank finance companies. The COVID-19 pandemic also severely disrupted vehicle manufacturing activities and supply chain functioning in the following years. Two-wheeler annual sales volumes are still due for a further rebound after these disruptions.

To expand market share in India, Piaggio is seeking to enlarge its Vespa and Aprilia brand ranges. Its Baramati factory in India commenced the production of the Aprilia RS 457 motorbike towards the end of 2023, marking the inauguration of motorcycle production at the plant.

Almost 90% of Piaggio’s existing revenue generated in India is from the sale of light commercial vehicles. The commercial vehicle market size in India is much smaller than the two-wheeler market, with just over 640 000 new vehicles registered in 2023. Piaggio has a large market share of commercial vehicle sales, at 15.7%.

Between 2013 and 2019, the business was selling an average of 186 000 commercial vehicles per year in India, yet this declined by more than 50% during the COVID-19 pandemic to a low of 68 100 vehicles (2021). Since then, volumes have slowly recovered, seeing Piaggio vehicle sales at 110 600 in 2023. This is still 40% below its average volumes between 2013 and 2019, indicating considerable room for further recovery.

Premium positioning for progressive growth

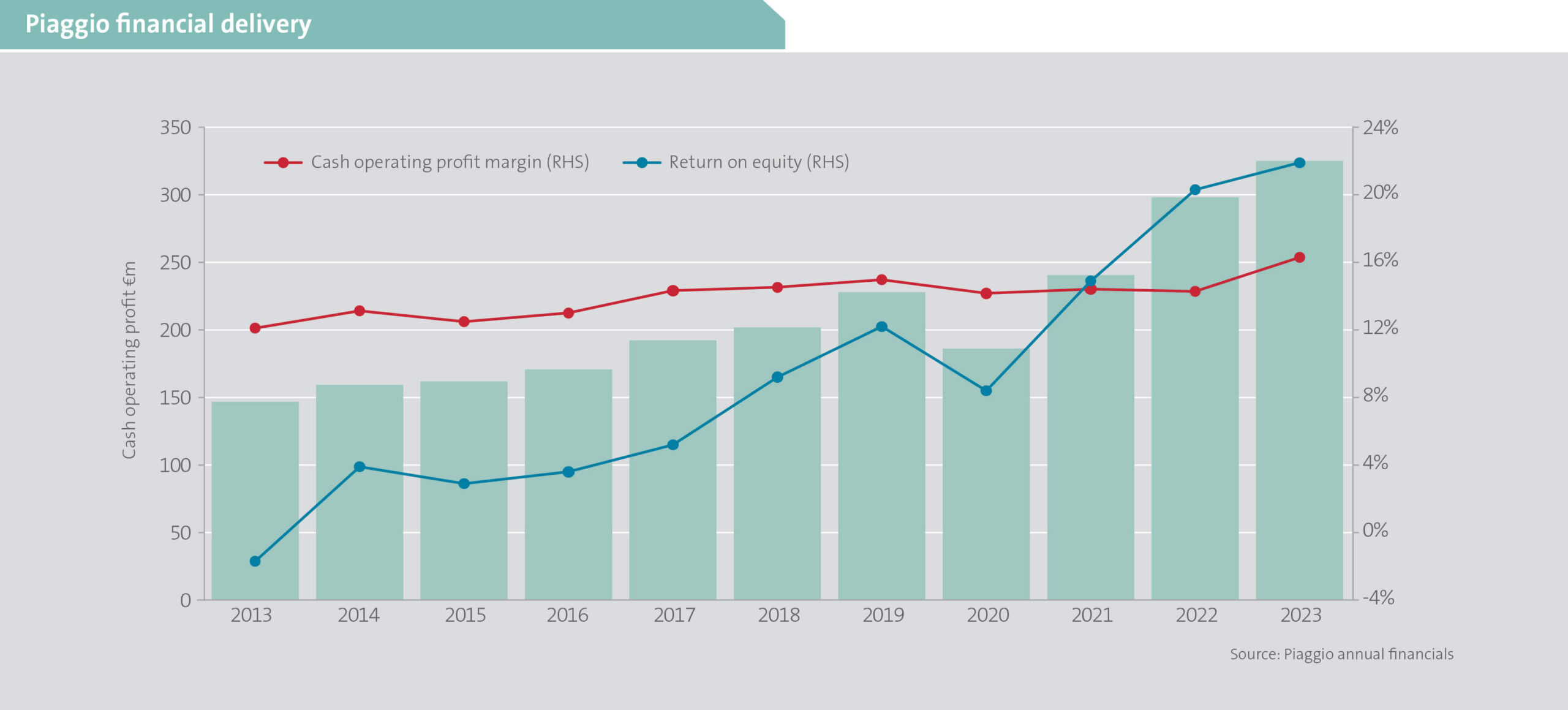

Piaggio’s focus on uncompromisingly superior quality standards that underpin its premium brand positioning, continued innovation success and resonance with its target markets has seen it consistently improve operating profits and margins (shown below). Piaggio is adeptly navigating a changing regulatory environment by offering more environmentally friendly mobility solutions. We believe these dynamics and its growth outlook should result in strong shareholder returns.