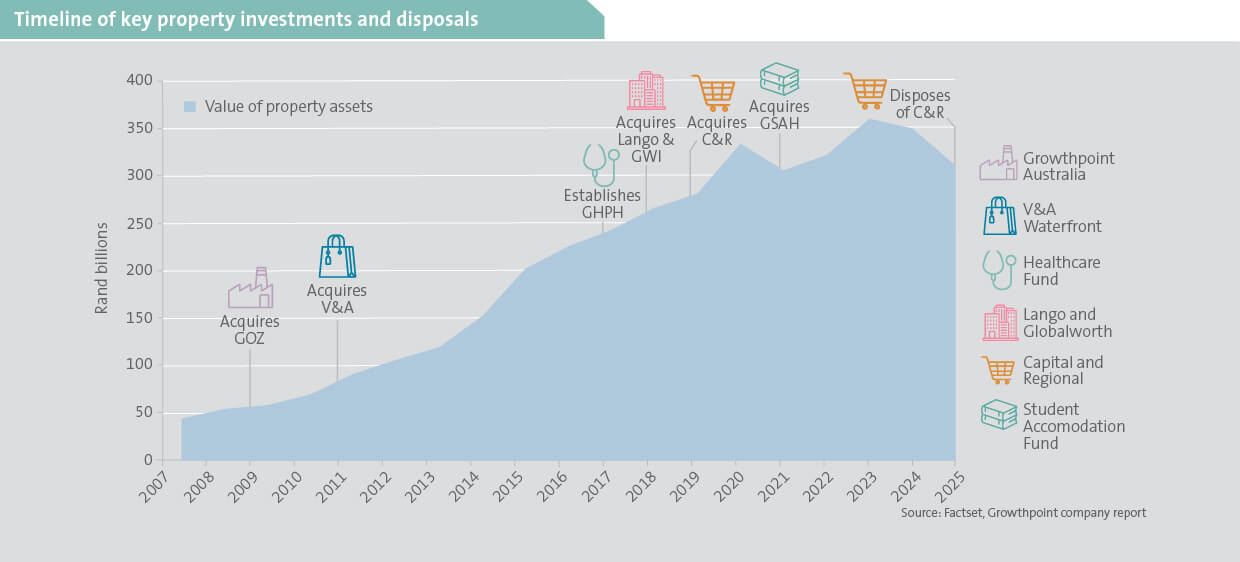

Growthpoint’s portfolio growth

Through acquisitions, developments and strategic partnerships, Growthpoint has built a diversified global property portfolio (charted below). While the core portfolio remains anchored in South Africa, recent performance here has been underwhelming, trailing that of competitors. Despite this, the domestic properties produce consistent cash flows from steady rental income, and along with conservative property valuations, support the case for a potential share price re-rating.

Reshaping retail in South Africa

South Africa’s retail landscape has shifted meaningfully since the pandemic. While larger malls (>70 000 m²) and smaller convenience centres have led the recovery, small regional centres (25 000 – 70 000 m²) have lagged. These centres, a core component of Growthpoint’s portfolio, located in urban areas and targeting middle- to upper-income shoppers, have experienced weak trading density. Performance is however normalising higher, though still lags the high-end and value-focused retail segments.

In addition, Growthpoint is shifting its approach from preservation to growth. It is streamlining the retail portfolio by reducing exposure to lower-income areas, refining the retail mix in response to tenant trends, and investing in centres that offer shoppers the right blend of convenience, affordability and accessibility. To this end, they are also shifting focus to the faster-growing Western Cape region. This responsiveness to shifting market dynamics signals a more thoughtful and adaptive retail strategy for the business.

The redevelopment of the Bayside Mall in the Cape, for example, has yielded positive results from a measure aimed at broadening the mall’s appeal by creating a more compelling mix of convenience, affordability and variety. Growthpoint repositioned Checkers and introduced Shoprite as a second anchor tenant. The improved tenant mix in the centre has translated into above-average rental growth, longer leases and increased foot traffic.

Rethinking the office playbook

Growthpoint holds one of the largest office portfolios in South Africa – a scale that provides breadth but not definitive pricing power. As demand dropped in response to evolving work-from-home dynamics, earnings from this portfolio contracted. With the office market now shaped by structural oversupply and demand concentrated in high-quality, well-connected locations, Growthpoint has been steadily shrinking their office portfolio:

- selling off underperforming office properties, mostly to owner-occupiers or developers; and

- converting certain properties for alternative uses, such as the current redevelopment of a Cape Town building into a Hilton Hotel.

Combined with tenant incentives and more supportive market conditions, these efforts have resulted in decreased vacancies in KZN and the Western Cape. Gauteng, however, still struggles with vacancy levels in the high teens, posing a substantial challenge to turn this around and realise value.

Refining the industrial focus

Growthpoint’s logistics and industrial portfolio predominantly comprises modern logistics and warehousing facilities, particularly spaces ranging from 5 000 to 20 000 m² – in key growth areas. The industrial property sector has been a relative outperformer in the market, delivering better cash generation and maintaining low vacancies. Growthpoint is committed to actively refining this portfolio by reducing its 55% exposure to Gauteng and the manufacturing sector. This aims to mitigate concentration risk and focus on logistics hubs with stronger tenant demand.

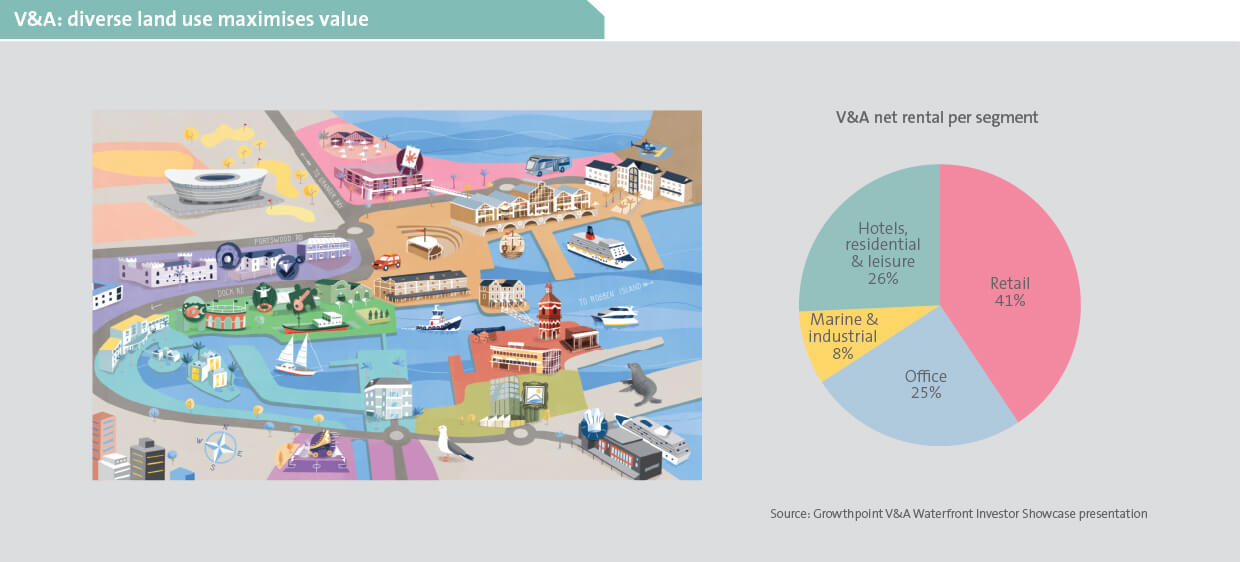

Tapping into tourism in Cape Town

The V&A Waterfront, originally a harbour that was redeveloped by Transnet in 1988, has become one of Africa’s leading mixed-use destinations. Jointly owned by Growthpoint and the Public Investment Corporation (PIC), it spans nine precincts and is a significant contributor to Growthpoint’s earnings. The illustration below highlights the many precincts and their diverse uses, which together attract high foot traffic and support strong trading densities. Diversifying asset types shows the strategic benefit of mixed-use developments in building resilience and sustaining long-term value through engaging, well-used spaces.

Not only has the V&A Waterfront exhibited exceptional rental growth and been fully occupied, but in December 2024 alone it attracted three million visitors and achieved record tenant sales of R1.4 billion. Boosted by a considerable rebound in tourism, this performance reaffirms the V&A as the standout property in Growthpoint’s portfolio.

Furthermore, Growthpoint’s commitment of more than R7 billion in planned investments for the V&A highlights its conviction in the long-term value of this mixed-use property.

Projects such as a luxury retail expansion, hotel upgrades and other precinct extensions are focused on enhancing the V&A’s appeal and thus its earning capacity. A broader 15-year development pipeline in the adjacent Granger Bay area further supports the case for sustained value creation.

Mixed global success

Growthpoint’s international footprint now accounts for 38% of total group assets, with Growthpoint Properties Australia (GOZ) at the centre of the offshore strategy. Since entering the Australian market in 2009, capitalising on opportunities emerging from the post-global financial crisis environment, GOZ has grown into a high-quality platform managing AUS$5.4 billion in office and industrial property assets. This comprises AUS$4.1 billion in directly owned properties and AUS$1.3 billion managed on behalf of other investors, with plans to expand this fund management business.

The industrial segment benefits from strong demand for modern, well-located logistics space. Despite broader sector headwinds, income remains stable in office, supported by leases to government entities and listed corporates. The growing fund management proposition allows GOZ to capitalise on generating incremental earnings from its operational expertise without a commensurate increase in capital commitments.

GOZ continues to be rated in line with other office-focused REITs, despite industrial properties (normally higher rated) comprising more than a third of its portfolio. This highlights a potential disconnect between market pricing and fundamentals. Although recent weak economic conditions and rising interest rates have led to a drop in the reported value of GOZ’s properties, intrinsic value remains well above Growthpoint’s initial investment, reinforcing this as a sound, well-timed offshore allocation.

In contrast, Growthpoint’s stakes in Globalworth (a Central and Eastern European office-focused investor) and Capital & Regional (a UK retail property group), have underperformed. Both faced challenging markets and structural shifts resulting in valuations significantly below original cost. By selling Capital & Regional, Growthpoint is refocusing, though it retains some indirect exposure.

Healthcare and student properties

Established in 2014, Growthpoint Investment Partners (GIP) was created to co-invest in alternative, high-demand real estate sectors through a capital-light model. Today, it manages R18.1 billion in property assets, earning both management fees and dividends without bearing the full capital burden.

Current strategic investments span healthcare (GHPH1) and student accommodation (GSAH2), enabling Growthpoint to diversify income while limiting balance sheet strain. GHPH focuses on acquiring and developing acute, day and specialist hospitals along with laboratories, biotechnology manufacturing facilities and warehouses. These healthcare properties typically have long leases, providing stable income streams.

GSAH focuses on student housing, whereby a significant portion of its tenants are supported by the NSFAS3. Despite rental caps imposed by NSFAS, that are growth constraining, it benefits from robust demand.

Growth achieved, focus required

Growthpoint is a major local and international property owner, with recent actions demonstrating a clearer focus on its strengths. While historical performance has been mixed, we believe Growthpoint is entering a phase of value realisation, with the current share price undervaluing the portfolio’s intrinsic cash-generating potential.

1GHPH: Growthpoint Healthcare Property Holdings

2GSAH: Growthpoint Student Accommodation Holdings

3NSFAS: National Student Financial Aid Scheme