We view the company’s current value as underappreciated. In support of this, we examine the mining and commodity trading segments of the business, which produce and trade over 60 commodities across more than 30 countries worldwide.

Glencore was formed following the merger of Glencore International Plc (the commodity trading company) and Xstrata Plc (the mining company), in May 2013. This united two businesses with a decade-long history of collaboration through numerous commodity trading agreements. Glencore would acquire commodities produced by Xstrata (and from other sources) and sell them to end customers.

Enduring demand trends

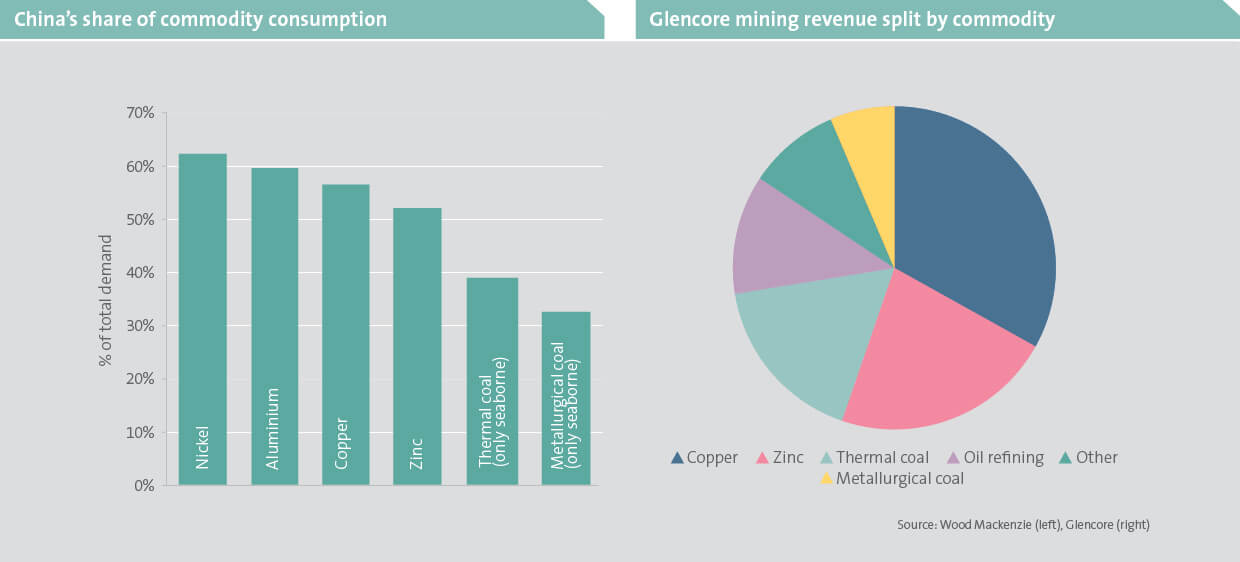

Rising industrialisation and urbanisation in developing economies have substantially boosted commodity demand in recent decades. China has experienced rapid growth in this period and now accounts for up to half of global demand for key commodities, which are produced by Glencore (below left). China’s extensive infrastructure investment to date suggests, however, that demand growth rates for these commodities could be lower in the future as the economy reaches maturation.

The shift in global energy sourcing from fossil fuels to renewables and the consequent need for electrification is, nonetheless, expected to generate material additional commodity demand in the medium to long term. This will be boosted by continued population growth and economic development outside of China, particularly in Africa and South-east Asia.

Robust outlook for Glencore’s mined metals

Glencore’s portfolio of mined commodities (above right) includes metals such as copper, cobalt, zinc, nickel and ferroalloys, that are crucial to a low-carbon future and developing economy industrialisation.

Copper is Glencore’s largest mining revenue contributor, with a total production output amounting to 4% of global supply. The business can sustain the current level of copper production for the next 100 years given its large resource base. Its mines are located in the copper-rich areas of South America and the Democratic Republic of Congo (DRC) and are cash-generative and run at low cost. If prompted by a higher copper price, overall production could be doubled from current levels. This would be through increasing production at existing mines and building new mines in South America, with relatively low capital required.

We expect copper prices to rise to incentivise this new supply, as demand is set to outpace supply over the next five to 10 years. A substantial source of this increased demand will come from the automotive sector, supported by drivetrain electrification, with electric vehicles (EVs) containing large quantities of copper. Copper is also used in electricity transmission networks and charging infrastructure. Given its thermal qualities, malleability and electrical conductivity, copper is evidently a critical component in this industry. Increasing demand is therefore likely, well into the future.

Glencore also produces large quantities of cobalt – primarily from its DRC mines. Cobalt is a by-product of copper production and is also an essential component in the production of EV batteries and other renewable energy technologies.

Zinc, used primarily in the coating of steel to protect against corrosion, is Glencore‘s second largest mining revenue contributor. It is a key material for the industrialisation of developing economies, used in construction, transportation and renewable energy technologies. Glencore’s low-cost zinc mines (amounting to 7% of global supply) are polymetallic, producing zinc alongside other metals such as gold, lead and silver. The recent high gold price has led to strong cash generation for these mines.

Glencore also produces other metals such as chrome, ferrochrome and nickel. These metals are essential in the production of stainless steel, which is used widely in applications such as kitchenware, vehicles and construction.

Glencore’s energy commodities will support the global transition

Glencore is the world’s largest producer of exported metallurgical and thermal coal, with operations located in Australia (close to growing Asian markets) and Canada (very low-cost mines producing high-quality coal).

Metallurgical coal is used primarily in the production of blast-furnace steel. Currently, roughly 70% of steel is produced in this way and there are no viable at-scale substitutes in the steelmaking process. The continued increased demand for steel needed for industrialisation in developing countries (eg Asia-Pacific region), supports the production of metallurgical coal.

While a third of global energy production comes from burning thermal coal, it is also responsible for a third of the world’s carbon dioxide emissions. To curtail carbon emissions, thermal coal usage will need to be significantly reduced in favour of cleaner energy sources. Glencore has committed to running down its thermal coal mines to closure, while continuing to capitalise on the meaningful demand in the interim.

Astron Energy, a crude oil refinery located in Cape Town, is owned by Glencore and makes up 12% of Glencore’s mining segment revenue, with growth potential across the rest

of Africa.

Trading commodities

Commodities are traded in massive volumes worldwide as supply is routed to demand for them. Glencore’s commodity trading division sources a diversified range of commodities from third-party suppliers and from its own mines. These commodities are then sold to a broad range of consumers and industrial end-users, often together with services such as freight, insurance, financing and storage.

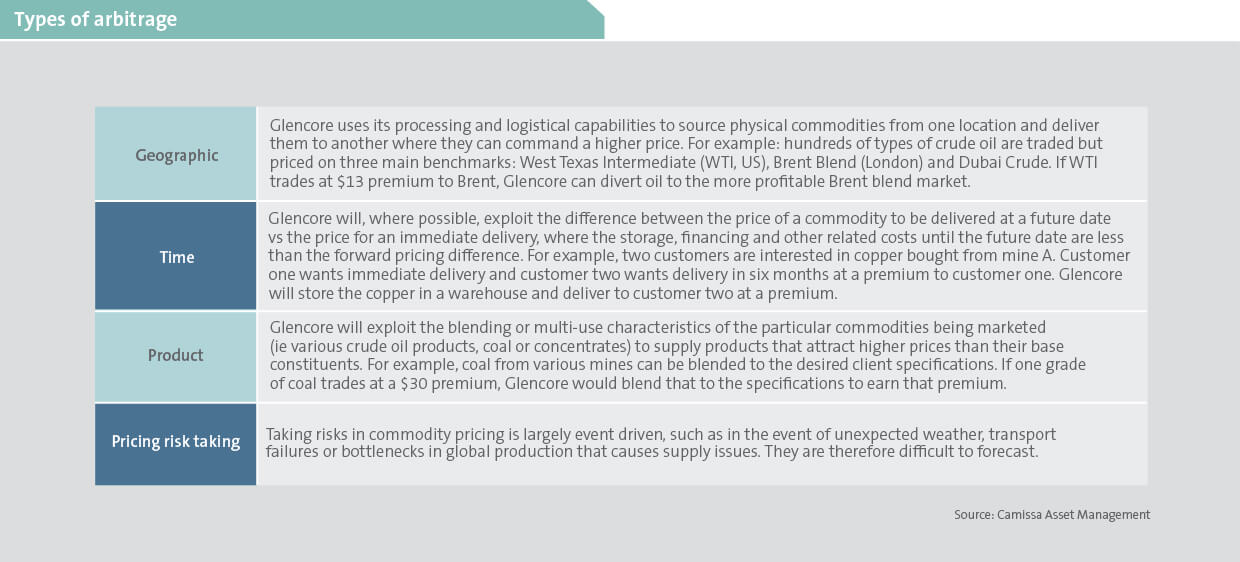

Profits from Glencore’s trading activities are generated from fees created for the distribution of commodities, and from exploiting mispricings in commodity markets, which gives rise to arbitrage opportunities. The pursuit of arbitrage opportunities by commodity traders contributes to more efficient and competitive markets, delivering value to producers and end-consumers. Examples are tabled below.

Glencore’s extensive and integrated infrastructure, including warehouses, ships and processing facilities (ie smelters and refineries), supports efficient global operations.

As indicated below, commodity trading profits tend to be less cyclical than mining-related earnings, providing a more stable income stream.

Positioning for the future of energy

We are positive on the outlook for Glencore’s mined commodity basket as demand for affordable, carbon-intensive energy (thermal coal and oil) grows in developing countries. Demand for metals that aid industrialisation and decarbonisation will also rise – growing copper, nickel, zinc and chrome demand specifically. Moreover, the business earns cash flow from the global trade in commodities and the pursuit of arbitrage opportunities available through its commodity trading division. We believe the market currently undervalues Glencore’s prospects.