Low-cost model, premium returns

Dollar General stores offer convenience and value to customers, providing a focused selection of national and private-label brands across a variety of categories. The main customer segment is the lower income individual or family, with an annual household income between $35 000 and $40 000. These customers prioritise affordability and consistently find this at Dollar General, thanks to their low-cost business model. The key components of this model include: low-cost store locations, large scale, narrow product breadth and low employee headcount per store.

Decentralised store locations and large scale

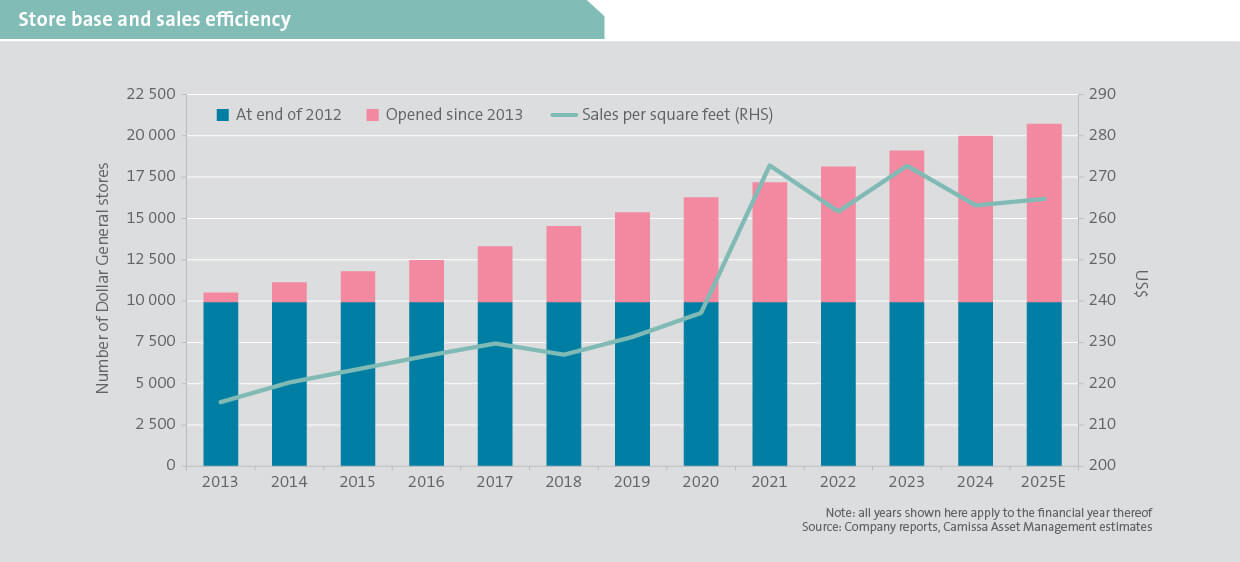

Dollar General’s smaller format stores are primarily situated in rural towns across the US. The abundance of such towns has provided scope for Dollar General to rapidly expand – doubling its store count over the last 12 years (charted below). This store footprint contrasts with that of large format US retailers, such as Walmart and Kroger, that have a much smaller presence in rural areas. Their disproportionately large store sizes and product breadth work less well where catchment areas are smaller. Dollar General therefore faces lower competition in these decentralised, underserved areas with small communities seeking convenient local stores.

Although Dollar General does compete with independent, family-owned grocery stores, it maintains a cost advantage due to its large scale and bargaining power with suppliers. With the material increase in new stores, the business has continued to grow sales per square foot, as shown below. This is clear evidence of their success in identifying underserved areas where they can compete effectively.

Focused product range

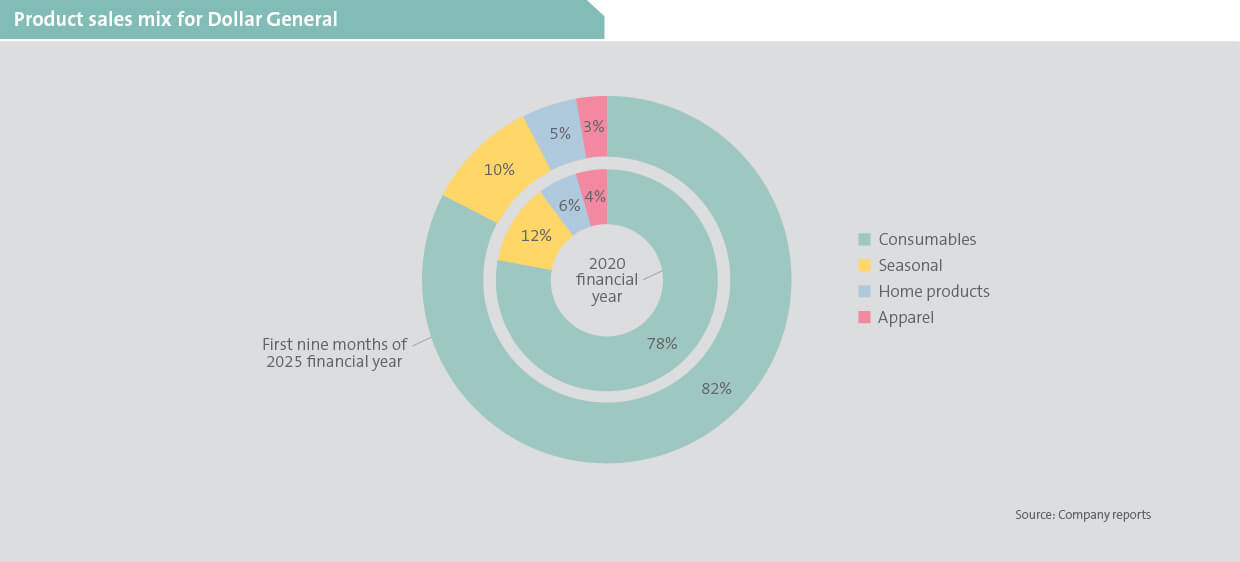

Dollar General stores stock between 11 000 and 12 000 unique products, most of which are national brands from leading manufacturers, and some are private-label products. Approximately 80% of its stock is consumables including packaged food, fresh produce, snacks, and health and beauty products (chart below). The remaining stock categories include seasonal products (ie toys and holiday items), homeware (ie kitchen appliances, bedroom and bathroom soft goods) and apparel.

Only a few variations of each product are stocked, which, together with the scale from their high store count, ensures higher volumes with suppliers and therefore strong bargaining power and ultimately better pricing.

Low operating costs

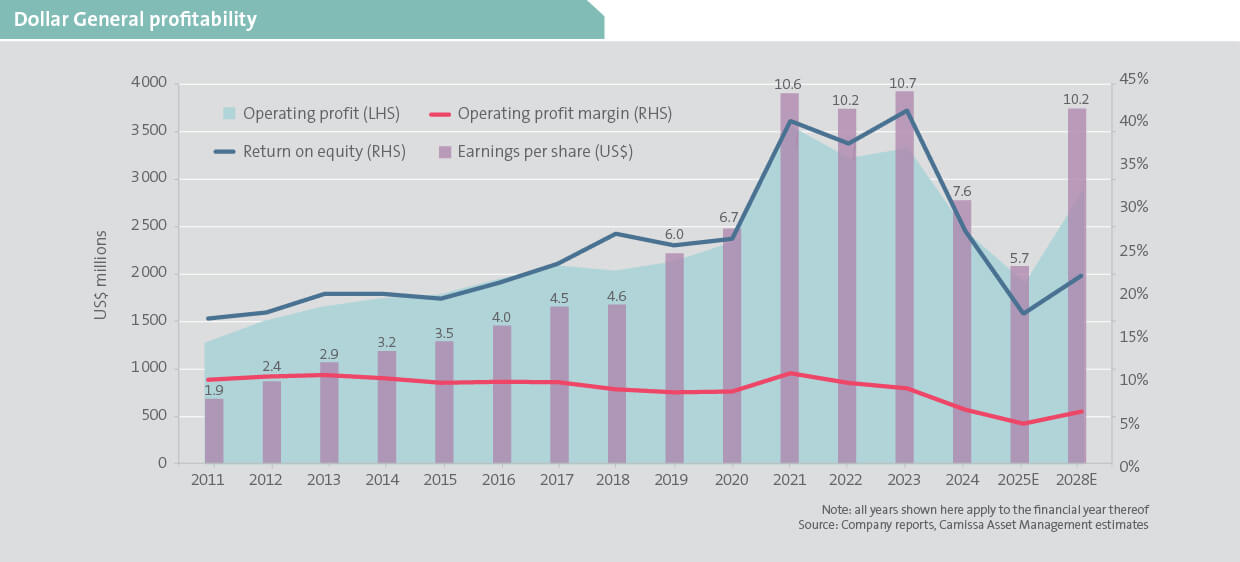

Rent and labour are the main operating costs for Dollar General. Yet, rental costs in rural towns are lower than those in suburban and urban areas, and labour costs are also low as each store typically has only two or three employees on duty per shift – fulfilling checkout, packing, customer queries and other responsibilities. This structurally low-cost business model, the results of which are evidenced below, supports low product prices. Growth of this high volume, low-cost model, together with careful cost management, has contributed to sustained profit growth and high shareholder returns.

Recent underperformance

Dollar General’s performance deteriorated in the 2024 financial year. Over this period, its core low-income consumer segment has struggled with high inflation that has eroded discretionary incomes. Consumers are tending to buy fewer products per store visit and fewer non-consumables, which typically carry higher price points and gross margins. This has resulted in lower sales growth and contributed to a large decline in gross margin.

Additionally, lower than expected sales volumes indicate that warehouses have been overstocked. This has led to inefficiencies in the supply chain and delays in sorting, stock-picking and delivery to stores. The resulting deterioration in on-shelf product availability has further contributed to lower sales growth.

To alleviate warehouse overstocking, Dollar General had to lease 12 additional temporary storage facilities, incurring significantly higher rental and labour costs. Furthermore, to reduce this excess level of stock, the business has had to temporarily discount prices, which has reduced revenue generated per product sold and overall gross margins. A combination of lower consumer discretionary income and heightened in-store stock levels has also given rise to a drastic increase in theft, adversely effecting profitability for the business.

Recovery and prospects

An improving consumer environment in the US from real wage growth, as inflation is softer, is expected to lead to better sales volumes for Dollar General in the coming year. In addition, increased discretionary incomes should result in the reversal of the negative sales mix experience of late, with a greater proportion of higher-value, non-consumable products translating into increased gross margins.

Management has also embarked on a recently announced Back-to-Basics strategy, which incorporates three key pillars with the following respective objectives:

- Stores: A higher staff headcount in stores, together with the training required to execute perpetual inventory management, is expected to reduce inventory offloading and packing times, supporting better on-shelf product availability and overall store cleanliness. The aim is higher sales. Moreover, management is removing self-checkout counters to mitigate theft and improve customer engagement and in-store experience. Considerable store growth opportunity has been identified and management estimate that they could open up to 12 000 stores over the long term, seeking to win market share while further strengthening scale and bargaining power.

- Supply chain: After stock volume is optimised, following their marked down stock clearance, there should be a higher proportion of full price sales realised – increasing overall revenue and gross margin. The consequent closure of temporary warehousing will achieve cost savings on rental, labour and transport. In addition, the consolidation of stock into fewer warehouses, along with additional investment in warehouse automation for more efficient stock sorting and picking, is expected to support on-time and in-full delivery of orders to stores.

- Merchandising: A reduction of approximately 1 000 of the unique products on offer, plus consequent adjustments to store plans, should sharpen the focus of Dollar General’s product offering – honing in on products that resonate with customers. This is anticipated to lead to higher sales per square foot of retail space.

Despite Dollar General encountering a period of lower profitability, the structural characteristics and economic advantages of its business model remain. Management has proven their ability to manage costs and expand store numbers, thereby achieving market share gains. We believe the current challenges are transitory and that the business has favourable future earnings growth prospects, from which our clients are positioned to benefit.