More intense focus on curbing contributors to global warming is prompting stricter regulations prohibiting harmful refrigerants, and increased urbanisation in developing countries is fuelling global demand for HVAC solutions. We investigate these trends, unpacking Daikin’s business model, its strength in innovation and its strategy for capturing growth into a hotter and more climate-conscious future.

Regulatory standards fuel a replacement cycle

Global warming is caused by the accumulation of greenhouse gases that trap heat in the earth’s atmosphere, leading to extreme weather patterns and higher average temperatures experienced on earth. Refrigerant gases are made up of hydrofluorocarbons (HFCs), which are a type of greenhouse gas. These gases are grouped according to their Global Warming Potential (GWP) measure, with a lower GWP score indicating a less environmentally harmful refrigerant. Carbon dioxide (CO2) is the least harmful benchmark refrigerant, with a far lower GWP than currently available HFCs.

169 nations have agreed to phase out HFC usage in an effort to reduce the effects of global warming, in accordance with The Montreal Protocol1. Effective January 2025, the EU banned refrigerants with GWP scores greater than 750 in residential multi-split2 air conditioners. This is expected to expand to include other HVAC products such as heat pumps, by 2027. The US also followed suit, banning the use of refrigerants above 700 GWP.

Daikin’s pioneering R-32 refrigerant technology, developed in 2010 and later released as open source, is one of the most widely used alternatives that is closest to the CO2 benchmark, with a GWP of 675. Competitors who do not use Daikin’s R-32 may adopt R-454B, an HFC with a GWP score of 466.

Rising global temperatures and stricter climate policies in proactive developed markets are driving households and businesses to adapt or replace non-compliant HVAC systems. This has resulted in a structural demand shift in favour of Daikin and other HVAC companies such as Carrier, Trane Technologies and Johnson Controls. Daikin recognises that no single refrigerant meets all performance and safety requirements. For instance, although R-32 is commonly used in residential and commercial systems, it is generally unsuitable for industrial use.

Daikin’s businesses

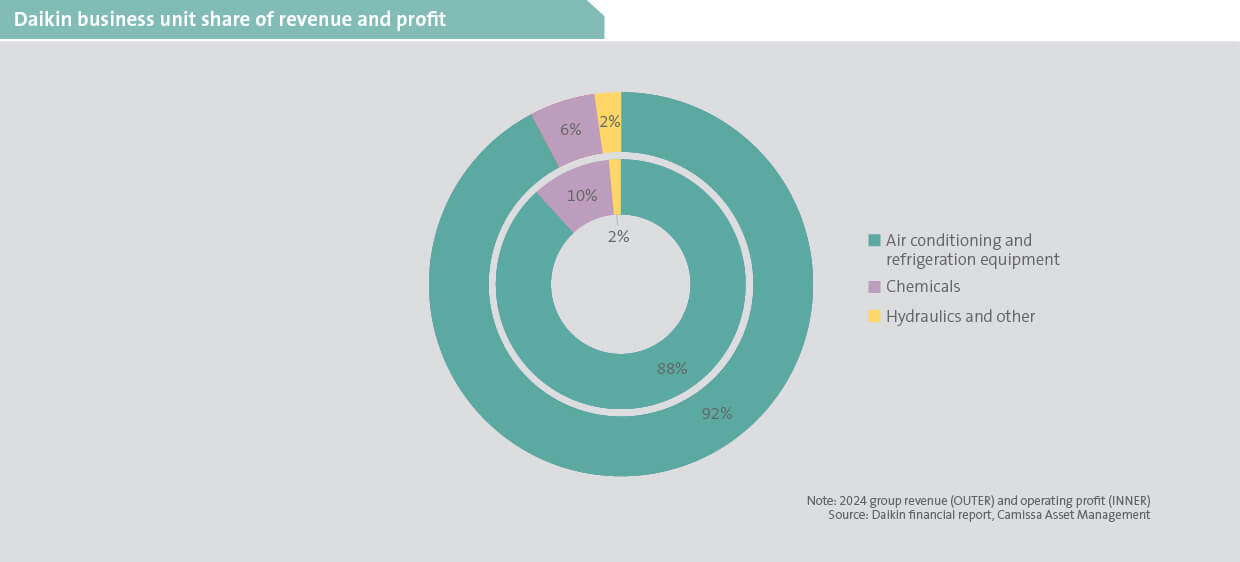

Daikin Industries is mainly an air conditioning business with two minor business units: chemicals and hydraulics (respective contributions to group revenue indicated below). Production sites are based in local markets targeting local demand and products are sold to third-party distribution partners. This model is serving Daikin well in the US in the higher tariff environment.

Daikin’s air conditioning business, established in 1952, constitutes approximately 90% of sales and operating profit and is one of the largest global manufacturers of air conditioners, heat pumps and chillers – collectively known as HVAC products. Homeowners represent the largest customer segment, followed by commercial and industrial clients.

The chemicals business, founded in 1933, contributes 6% of revenue and 10% of operating profit. It produces high-performance chemicals used to minimise defects and enhance the heat resistance of semiconductor chips, and fluorocarbon gases (for example refrigerants used in HVAC products to heat and cool spaces).

The hydraulics business was founded just after Daikin’s inception, today contributing 2% each of revenue and operating profit. It manufactures oil hydraulic power equipment components incorporating inverter technology. These components control hydraulic oil flow and pressure to drive machine tooling and construction equipment. The hydraulic oil lubricates internal systems, reducing heat generation, lowering energy consumption and improving operational accuracy.

Daikin’s US business

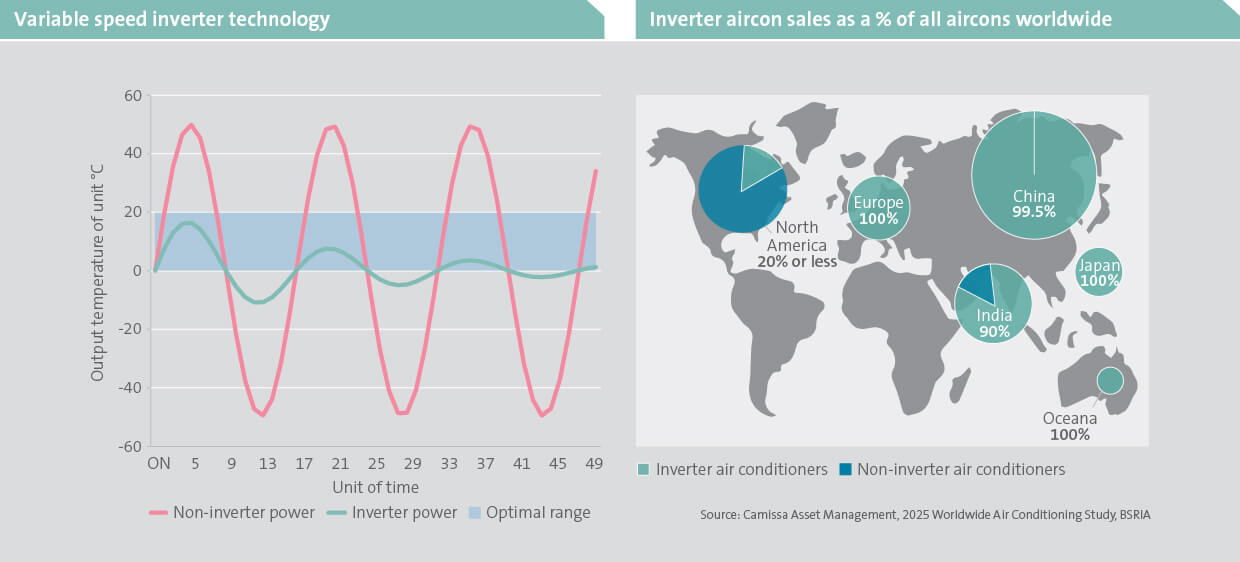

Daikin entered the US market in 2006 through acquisitions and the consolidation of two main local HVAC companies, OYL and Goodman Global. North America is currently Daikin’s largest high-penetration market for air-conditioning, as customers tend to replace older, fixed-speed HVAC products with more energy-efficient, inverter-based models. As charted below (left), fixed-speed products consume significantly more energy through the cycle due to wider temperature fluctuations. Unlike variable-speed systems, they cool or heat a space to the set point, then switch off, only to restart when the temperatures drift beyond the optimal range.

Inverter based products run continuously within the desired range, thereby using less electricity and providing more consistent levels of comfort. In addition, by incorporating smart thermostats, comfort and efficiency is further improved by conveniently enabling temperature control via smartphone. In North America, 20% of air-conditioners sold in 2024 use inverter technology (below right).

The Inflation Reduction Act offered US homeowners tax credits covering up to a third of the cost of energy-efficient HVAC systems, capped at US$3 000 per household. This has effectively supported the demand for system upgrades, which has benefited Daikin and competitors. However, new tax and spending laws in the US will see these benefits fall away at the end of 2025, following which the upgrade-led demand will depend on energy saving credentials, comfort and reliability for continued growth in sales.

Daikin’s European business

Daikin has operated in Europe since 1972, expanding its footprint by introducing multi-split air conditioning and inverter heat pumps. It is currently their second-largest market, where air-conditioning penetration is still low but growing rapidly, supported by energy-efficient inverter heat pumps that outperform the gas- or oil-based boilers that currently dominate heating. With Europe facing persistently high energy costs post-Russian gas sanctions, and temperatures ranging from -5°C in winter to 35°C in summer, demand for reliable, energy-efficient and climate-friendly solutions is growing.

Turning up the heat on growth

In developing countries, growing urbanisation and higher incomes are fuelling a surge in HVAC demand. The global HVAC market – already worth around US$223 billion in 2025 – is forecast to grow to nearly US$403 billion by 2034, highlighting a significant long-term growth trajectory.

Major growth is forecast for densely populated, rapidly expanding, heat-prone cities in regions such as India, the Middle East and Africa that have historically been underserved – many households rely on basic electric fans for cooling (less than 10% of households in India have air conditioning). As electricity access improves and disposable incomes rise, modern-air conditioning is increasingly seen not as a luxury but as essential for comfort, health and productivity. Daikin is positioning itself to capitalise on transformation by rolling out energy efficient inverter air-conditioners, which consume roughly half the power of traditional units, initiating local assembly in key Africa markets to reduce costs and lead times, and even piloting usage-based subscription models to lower entry barriers for consumers.

Industry-leading commitment to innovation

Research and development (R&D) is a key differentiator for HVAC manufacturers and Daikin strategically allocates a larger share of sales to R&D than its competitors. This enables it to lead in innovation. These investments have yielded products such as the award-winning Desica air conditioner and heat pump system. Unlike traditional systems, this system does not require piping or water, thereby offering customers efficient cooling and heating with lower energy use than prior technologies.

Commercially, Daikin pioneered the R-32-based VRV Five Star Zeas Air Conditioner for office buildings in 2013 – a product that also won a Japanese innovation award post launch. As the first system to use Daikin’s in-house R-32 refrigerant, it has set a new benchmark for environmentally friendly, energy-efficient commercial HVAC products.

Positioned for a climate-conscious future

Daikin has exhibited dynamic growth in its journey from a Japan-based radiator manufacturer into a comprehensive global HVAC producer. Yet, despite proven leadership and innovation in technology in this area, and consistent development of century-old climate solutions brands, the scale of these achievements remains underappreciated in its market rating. This offers our clients the opportunity to benefit as Daikin keeps its customers cool and reduces the world’s use of harmful greenhouse gases.

1The landmark multilateral environmental agreement that regulates the production and consumption of nearly 100 man-made chemicals referred to as ozone depleting substances.

2Home cooling/heating systems where one outdoor unit is connected to multiple indoor units.