Fleet management beginnings

Corpay began as the first company in the US to offer fuel cards to long-haul truck drivers to pay for vehicle-related expenses. Compared to traditional credit cards, fuel cards offer the benefits of improved spend control, fuel efficiency monitoring and real-time tracking to prevent fraudulent transactions. Importantly for fleet managers, these cards entitle users to discounted fuel rates and mark-downs on vehicle-related purchases at any of the four million hardware and convenience stores within Corpay’s merchant network. This results in significant cost savings and predictable billing cycles supporting strict operating cash flow management for their fleet-operating customers.

Scale in mobility payments

Corpay’s extensive merchant network creates a strong and reliable selling system, that keeps existing merchants loyal and attracts new ones. With a network four times the size of their closest competitor, Wex, Corpay’s scale and long-standing entrenched retailer relationships make it impossible for competitors to offer the same level of benefits and support without enormous capital investment. Moreover, their established presence and expertise in navigating the complex regulatory landscape provides a competitive edge that protects market share and profitability in a fragmented industry.

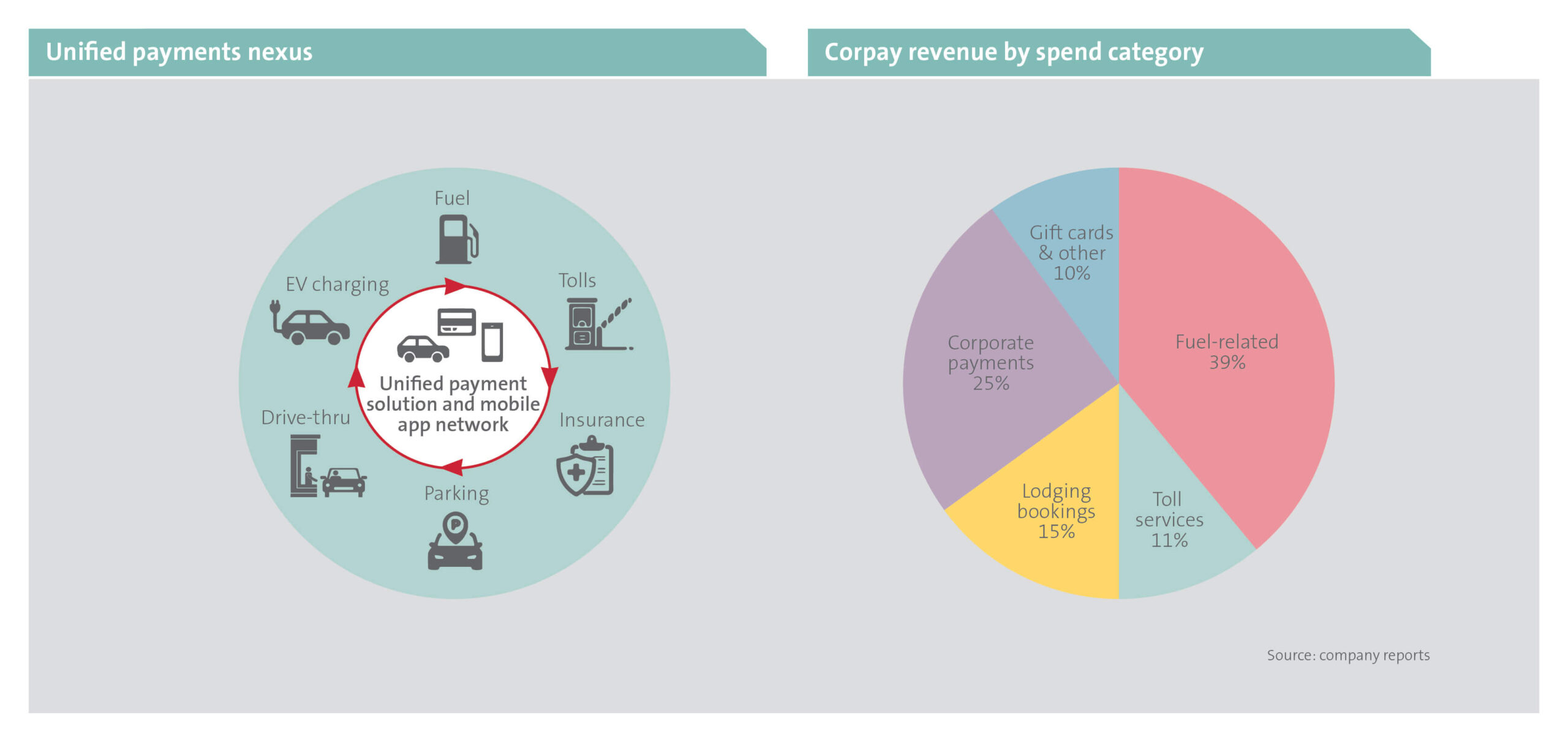

Over time, the company has expanded beyond fuel cards to create a unified vehicle-centric payments nexus (below left), powered by an internally developed payments processing mobile application. Corpay solutions use radio frequency identification (RFID) technology, which is a barcoded sticker that can be attached to a car windshield. The barcode communicates with RFID readers installed at toll booths, parking lots and fuel stations, capturing and authenticating the tag’s information before processing the related payment as the vehicle passes. This contactless solution enables seamless transacting on the road – streamlining the checkout process, reducing waiting times and providing a real-time mechanism for vehicle tracking.

Toll services and fuel-related products comprise about half of Corpay’s revenues (below right). Complimentary to its vehicle-related services, the business expanded into workforce travel solutions, providing access to a wide chain of hotels at discounted rates. Borrowing from their fuel card strategy, Corpay contracts with lodging providers for lower room rates in exchange for capturing large volumes of customers across their established network of blue-collar field workers, pilots and flight attendants.

Network advantage in corporate payments

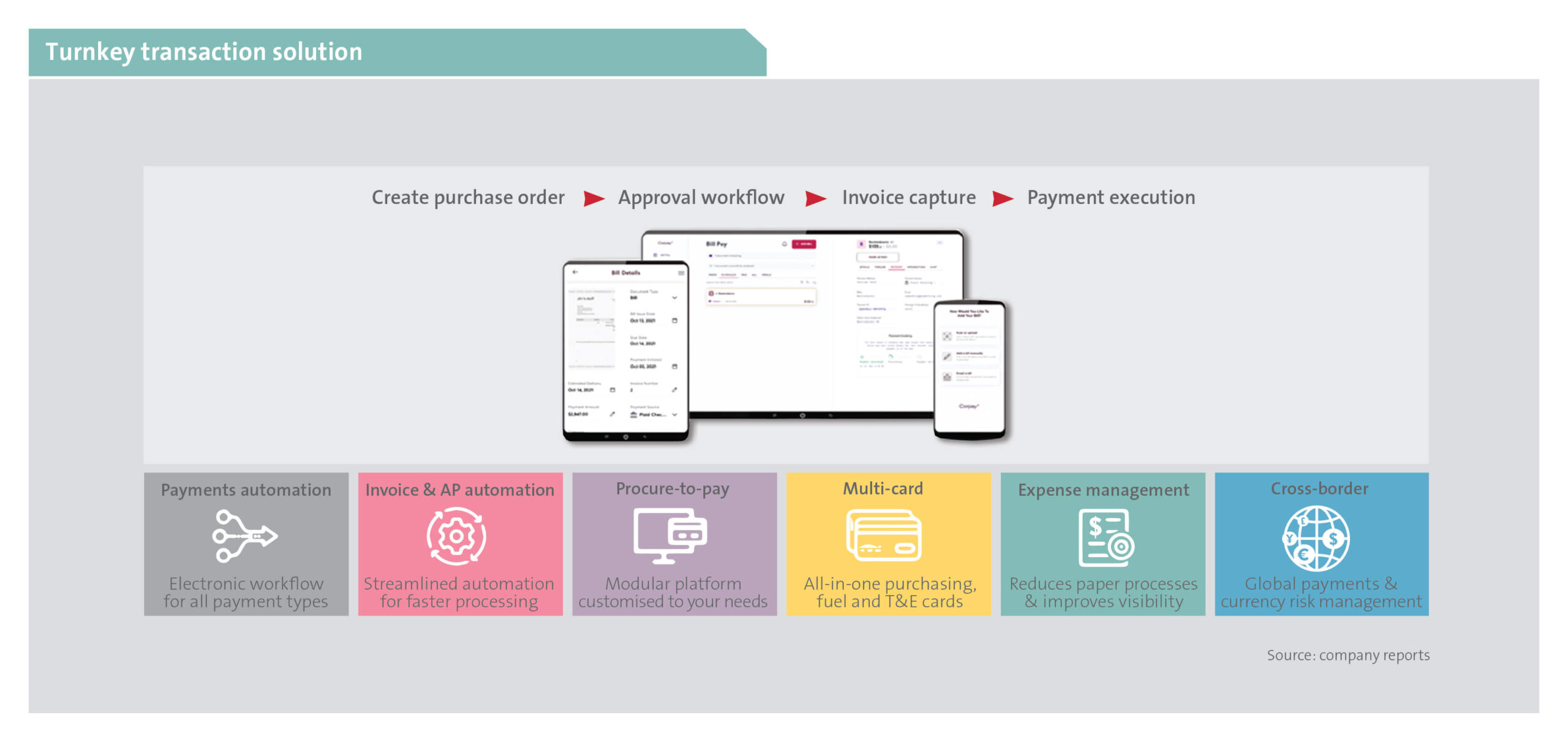

Corporate payments refer to the disbursements that businesses make to their suppliers and employees – amounting to $80 trillion per annum globally. Corpay’s value proposition is rooted in simplifying these transactions, enabling systematic spend control for their clients. This turnkey solution (illustrated below) generates purchase orders, sends approval notifications to account managers, audits invoices and executes virtual payments, without requiring manual input. Clients benefit from the resultant saving on administrative expenses (like data capturing and account reporting), ultimately enhancing financial oversight.

Corpay’s cross-border solutions enable fast and secure international payments to mid-sized businesses (typically underserved by large banks), with minimal transaction fees. The company leverages global banking networks to trade currencies and develop hedging products to protect against unfavourable currency exchange rate moves, which offers customers a convenient and versatile mechanism to pay suppliers in different countries and currencies.

Currently the largest non-bank, cross-border payment processor in the world, Corpay handles over $110 billion in foreign currency annually. They typically earn a fee on the total value of transactions processed, a margin on the difference between the rate at which they buy the currency and that at which they sell it to the customer, and additional service fees for expense tracking services. Unlike prominent payment processing competitors such as Visa and Mastercard, Corpay offers an inexpensive, easy-to-use solution covering a wide range of financial, operational and administrative services. This eliminates cost redundancies involved in running multiple systems.

New name for an evolved business

After more than a decade of building vast customer interchanges across adjacent industries, the business has evolved far beyond their fleet-based origins. The rebrand to Corpay not only better reflects their core competencies, but also serves to strengthen their brand positioning and improve the return on marketing spend. Corpay aims to capture a large cross-sell opportunity in their customers’ overlapping needs for vehicle-related and corporate payment solutions. For example, businesses with frequent travel needs can be offered virtual cards with cross-border payment capabilities, fuel and lodging discounts, spend limits and expense tracking. By bundling offers in this way, Corpay can expand services provided to their existing customer base to achieve further revenue growth, without having to invest additional capital.

Early mover in EV fleet management

The complexities involved in electric vehicle (EV) fleet management pose unique challenges to managers. These include lifetime battery health, charging infrastructure, location and route planning. Battery replacement is the highest single cost factor in an EV, as its lifetime can be shortened by improper charging habits, temperature variations and inefficient usage patterns. Charging costs can also vary depending on location and time of use. For instance, public charging during peak hours can be up to six times the cost of at-home charging.

Corpay’s ChargePass solution – currently deployed in the UK – offers a one-stop mobile application for route mapping, discounted public charging rates and EV cards, with merchant discount benefits. Their at-home charging products can integrate with smart electricity meters to accurately measure usage and pay the related utilities directly – effectively eliminating the pay and reclaim process. Employees are therefore never out of pocket. Fleet owners can also monitor battery health in real time, analyse detailed reports on total electricity used and optimise cost per charging session – enabling valuable control over the health of, and expenses relating to, their electric fleet.

The EV card market is still nascent and controlled by a handful of players, who focus solely on charging infrastructure, with limited fleet management tools. For Corpay, the economics of EV fleets are better than their legacy fuel card business because of the additional complexity associated with charging and battery health, thereby offering them opportunities for higher revenues from value-added services. This includes a profit share on public charging sales, installation and service fees for at-home charging, and subscription fees for maintenance and expense reports. EV cards already represent half of Corpay’s vehicle-related revenues in the UK, with a long runway for growth as EV adoption accelerates.

Underappreciated growth

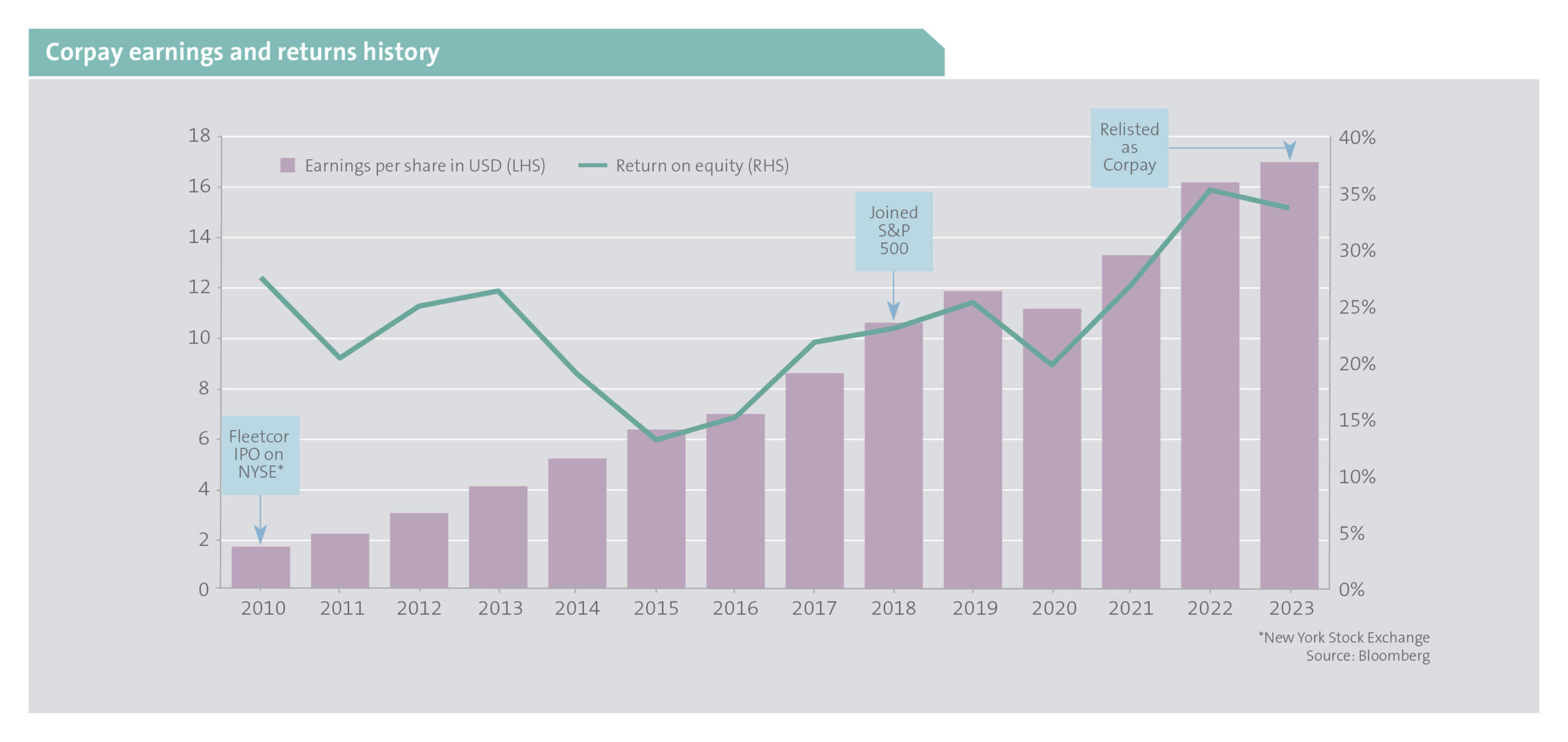

The combination of Corpay’s efficient selling system – aided by deep and wide network advantages – and their expansion into complementary product verticals, has resulted in strong organic revenue growth since inception. A predictable fixed cost base also enables high operating leverage, which has translated to a tripling of per share earnings over their listed history – as seen in the chart below.

As a capital-light, software-focused business, Corpay’s maintenance costs are low, making it highly cash generative. Payouts to equity-holders, special dividends and share buybacks have increased commensurately with earnings. Corpay’s healthy balance sheet provides the company with ample resources to invest in new growth opportunities and further expand services offered to their deep, propriety networks.

With a large addressable market in vehicle-related and corporate payments, we believe that Corpay is well-positioned to expand profit per customer, while growing their earnings in EV management solutions as EV’s gain market share. Our clients with global exposure are benefitting from the market’s undervaluation of these prospects.