Having deftly navigated the transition from horse drawn carriages to internal combustion engine (ICE) vehicles over time, the business faces its next challenge: the global movement towards battery electric vehicles (BEVs) in support of net zero emissions targets. We investigate Continental’s positioning for this.

Net zero demands a powertrain shift

Significant changes are in store for the automotive sector as the world steers toward the goals set by The Paris Climate Agreement in 2015. This will see an increased market share of BEVs in the passenger vehicle segment relative to the now dominant ICE-powered vehicles. The shift in powertrain1 will necessitate new, different transmission component parts and far fewer of them, which will materially alter the sales prospects for parts suppliers. To power a vehicle, BEVs employ a mechanically simple electric motor with few component parts, whereas ICE vehicles contain multiple components within the engine and propulsion system.

1The mechanism that transmits the drive from the vehicle engine to its axle.

Continental’s products

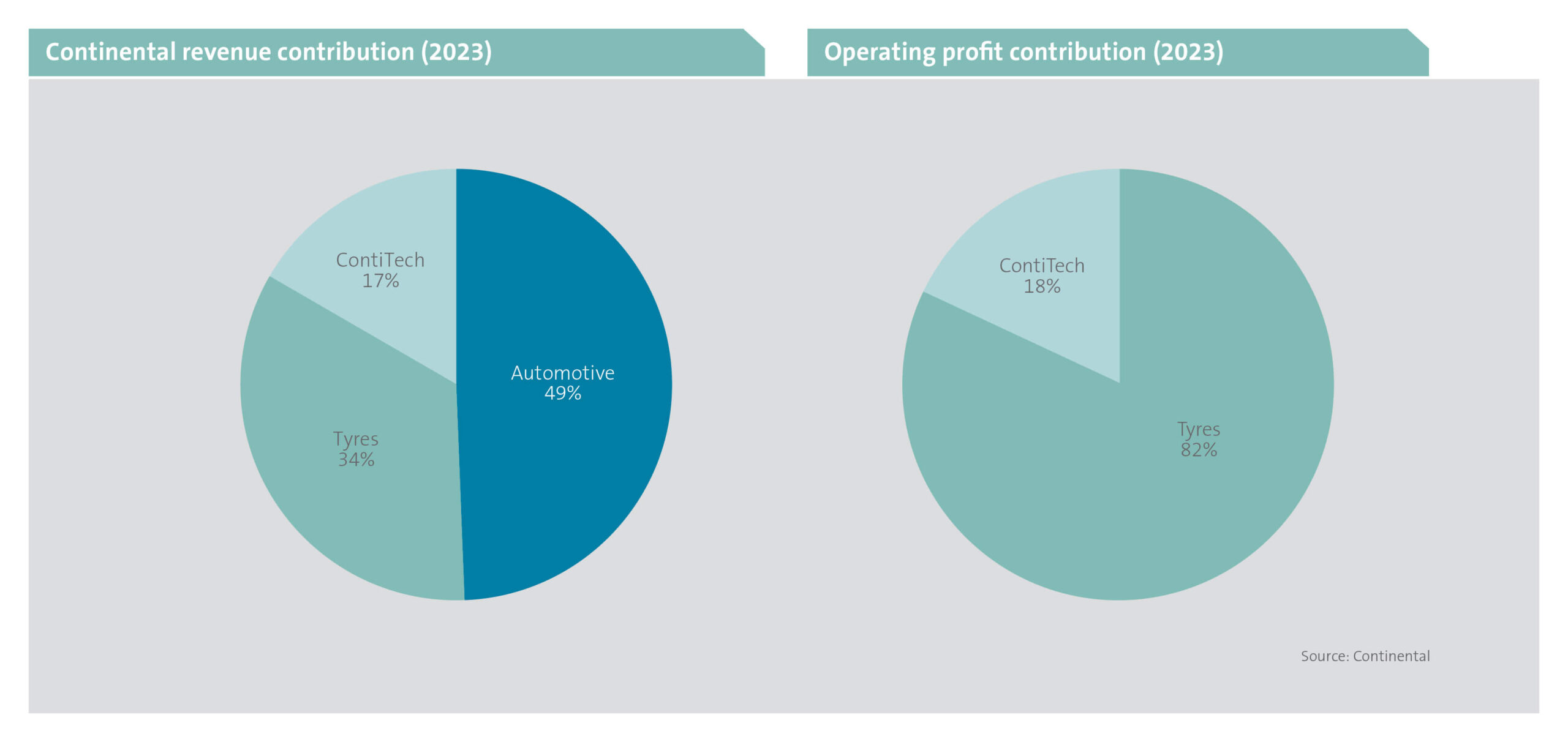

While Continental remains a prominent tyre manufacturer (for passenger vehicles, trucks, bicycles and motorcycles), it is positioning itself to benefit from the changing market. It is also one of the most prominent producers of automotive components and related software. As charted below left, the company is structured into three divisions.

ContiTech manufactures specialist rubber products for many industries. Rubber hoses have numerous applications in vehicles including power steering, air conditioning, brake systems, radiators and fuel tanks. Conveyor belts are used to move material (eg in mining), and drive belts are used in power transmission systems.

This business makes up 17% of group revenue and is currently the second largest generator of profit (below right). Products sold into the automotive industry are highly commoditised, therefore Continental has no clear competitive advantage relative to other suppliers. To combat this, ContiTech has shifted its focus away from the automotive sector and towards other industries (energy, agricultural, construction and mining), where it can offer unique products with longer lifecycles to generate higher margins and more sustainable revenue.

Continental Tyres makes up 34% of sales and over 70% of group profits. The bulk (over 70%) of tyre sales are made in the more profitable replacements segment, while new vehicle production accounts for the balance. Tyre demand is linked primarily to total distance travelled, regardless of drivetrain, as it is a necessary component for all vehicles. BEVs need higher value tyres designed to support a heavier vehicle weight due to the battery, and the replacement cycle of these tyres is shorter given the increased wear and tear from a heavier vehicle. Therefore, not only will the tyre industry stand to benefit from drivetrain electrification, but the drivetrain transition is set to materially increase revenue and profitability.

Continental Tyres is well represented in the European market (over 50% of sales), the Middle East and Africa. It is also currently building capacity in under-represented regions, including Asia and the Americas, anticipating strong growth due to market share gains given their competitive technological advantages.

Continental Automotive manufactures technologies related to vehicle safety and innovative solutions that support automation, communication and connectivity. Despite being the largest division (49% of group sales), it has not been profitable since the supply chain crisis that followed the pandemic lockdowns and hugely impacted global automotive production. This business supplies hardware and software components to auto manufacturers in Europe and North America (markets that are still operating well below pre-Covid levels) and has identified the importance of competing in the Chinese market, where sales are growing.

We believe that Continental Automotive’s profitability stands to benefit from powertrain-related developments in high-growth key focus areas, such as:

• Autonomous mobility supports automated/assisted driving and autonomous vehicles with products like high-resolution cameras for parking/driving assistance, sensors and radar systems. This segment is heavily reliant on semiconductors, which were in short supply and highly priced post-pandemic – decimating margins.

• Safety and motion specialises in passive safety technologies and vehicle control systems including airbags, brakes and tyre sensors with low-pressure early warnings.

• Architecture and networking aids vehicle connectivity to cloud or other software-based interactions. Products include digital key systems, smartphone integration devices and on-board computer systems.

• User experience focuses particularly on vehicle display screens and dashboards.

In addition to renegotiating contracts that are currently loss-making, this business is firmly focused on remaining competitive in an increasingly complex and evolving manufacturing environment. Positively, the demand for specialist products and technologies is on the rise.

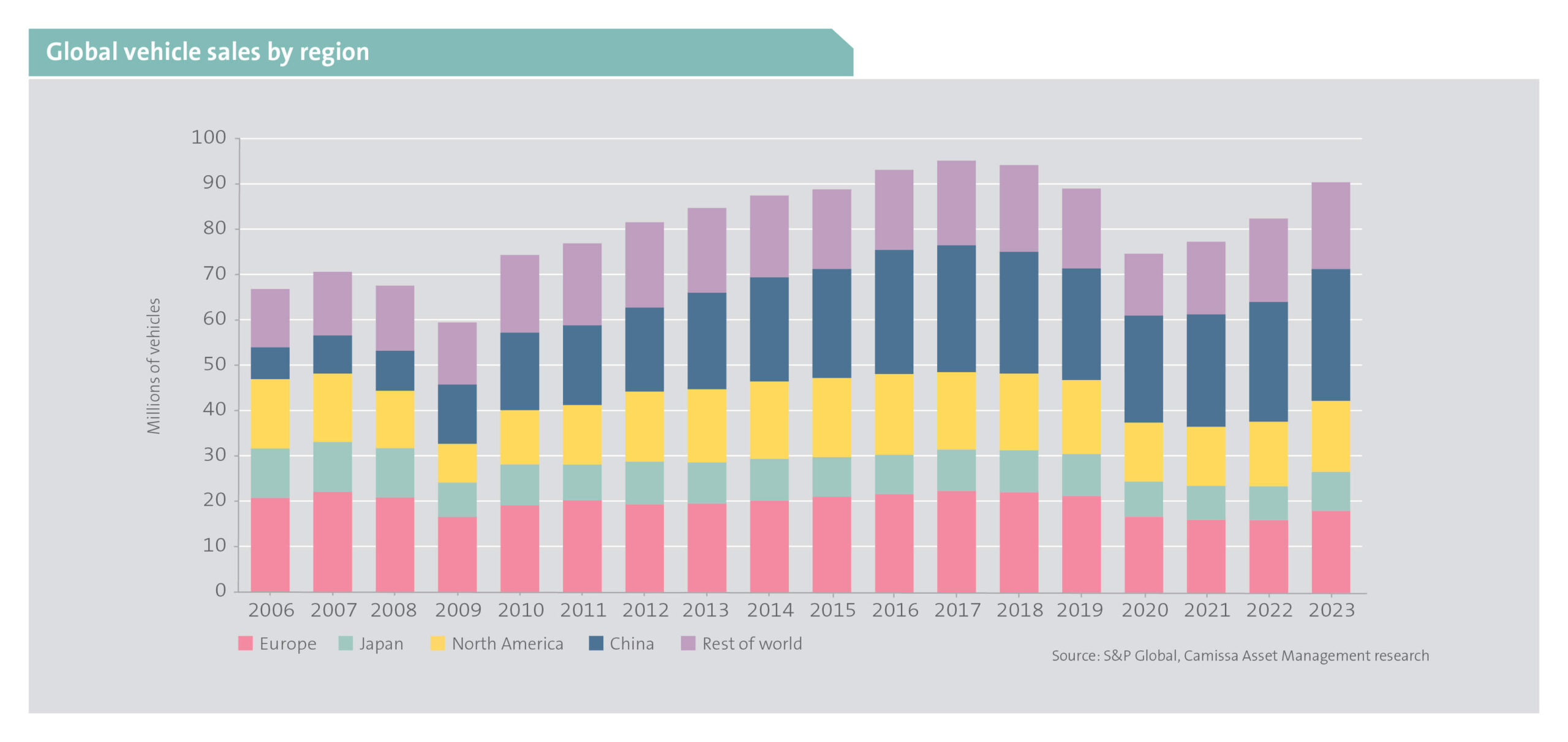

Automotive market dynamics

As indicated below, the global automotive production peak of 2017 was followed by a marked decline in 2020 due to the pandemic slowdown and subsequent industry supply chain complications that led to severely constrained levels of production. The market has rebounded strongly in China, now the world’s largest, while production in Europe, North America and Japan remains well below pre-pandemic levels.

European manufacturers and suppliers, including Continental, have experienced significant increases in costs particularly with respect to energy, wages and freight rates, while revenues have declined due to low production levels. Consequently, earnings are severely depressed.

Chinese manufacturers, particularly in BEVs, have contained costs through economies of scale as they have expanded, the vertical integration of supply chains, low energy costs and lower labour costs – all aided by significant government subsidy support. Lower production costs allow Chinese vehicles to be significantly lower priced than those of Western competitors. Substantial excess capacity in China has enabled material exports of its lower cost vehicles into Europe and other parts of the world. In response to this strong competition, Western countries have implemented protective measures, such as imposing hefty import tariffs on Chinese vehicles to try safeguard their local automotive industries.

Still recovering European car manufacturers make up a significant portion of Continental’s sales (64% at present). Such depressed market conditions have seen the company strategically focus on cutting costs, transitioning its loss-making automotive business towards profitability and providing quality products that can compete with those made in China. This means continuously investing in technology.

Software increasingly disruptive

Powertrain developments and the increasing reliance on software in vehicles present an opportunity for new industry entrants to take market share and disrupt markets for incumbents. With a competitive advantage in software development, Huawei and Xiaomi are prominent new entrants despite being new to auto manufacturing.

Continental’s automotive division has invested extensively in software development and is looking to increase its share of the vehicle software market. Coupled with the development of a software subscription revenue base, this should significantly add to the profitability of the business. Continental’s competitive advantage is its ability to integrate software and hardware, given that it produces both. As shown below, this would result in increasing the value of its content supplied to auto manufacturers, in turn significantly boosting profitability.

Substantial growth and recovery ahead

Despite new competition in the market and a rapidly evolving industry, Continental is competitively advantaged through its very profitable and resilient tyre business and the significant investment made in its automotive technology business. We believe that the current market price undervalues Continental’s prospects for growth, expansion in profitability and recovery in its automotive division.