Corporate retail pharmacies rise

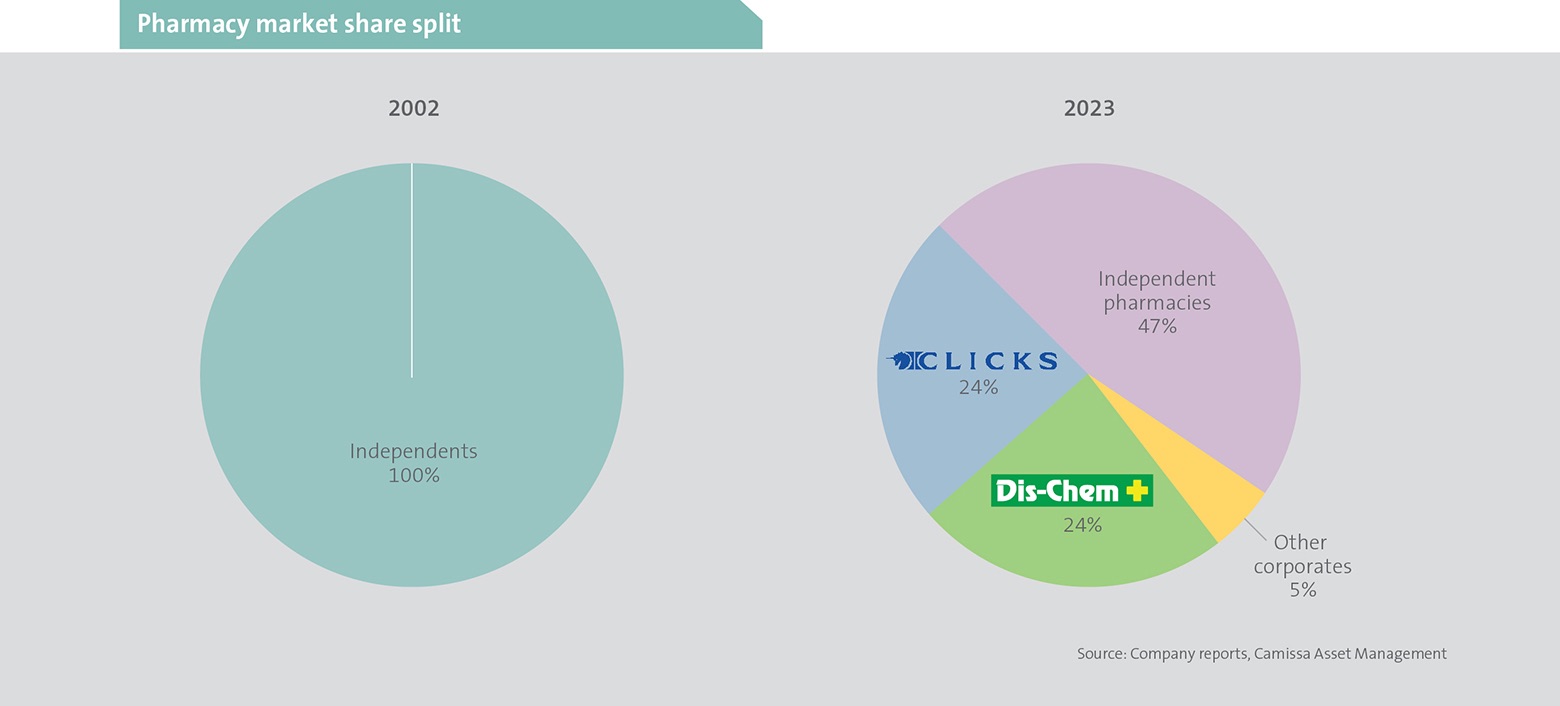

Prior to 2003, only licensed pharmacists were allowed to own pharmacies in South Africa. This resulted in a fragmented industry comprising many small, independent pharmacies. Legislation passed in 2003, aimed at providing more affordable medicines with a wider access to the public, allowed for corporate ownership of retail pharmacies. With greater access to capital and massive economies of scale owing to the centralising of many functions (eg procurement, landlord relationships, marketing, loyalty schemes and IT systems), corporate-owned pharmacies have grown substantially and now constitute 53% of the market. As shown below, the main beneficiaries, Clicks and Dis-Chem, account for around 48% of domestic pharmacy revenue.

The Clicks growth path

Clicks began incorporating a pharmacy offering through the acquisition of Link Pharmacies in 2003. Growth has since been exponential and the current 24% market share has been attained through acquisitions of independents, the buying of hospital pharmacies and the opening of new pharmacies – resulting in the in-store pharmacies now making up 80% of Clicks-branded stores.

Complementary Clicks business divisions

Clicks consists of the retail division and the pharmaceutical wholesale and distribution division. Currently, retail accounts for 65% of business revenue and is further divided into two segments – pharmacy and front shop. Front shop sells product categories such as beauty and personal care, and general merchandise.

Clicks and Dis-Chem achieve far larger contributions to revenue from the non-pharmacy front shop sales than the independent pharmacies do – as charted below. Clicks’ largest front shop segment, beauty and personal care, enjoys huge procurement scale benefits and thus negotiates very favourable terms with suppliers. This allows Clicks to consistently offer competitively low prices and attractive promotions to customers.

Pharmacists generate income by charging a fee on medicines dispensed, which is a function of medicine pricing and is determined by the regulator. Dispensing fees have, however, been driven lower due to the increased availability of, and demand for, generic medicines. Generics are priced significantly lower than the original medicine and now constitute the majority of medicines dispensed.

To combat the effects of these declining revenues, in 2011 Clicks established its own generic medicine importer to exclusively supply its retail stores: Unicorn Pharmaceuticals. Unicorn products make up 11% of Clicks pharmacy sales but 13.3% of pharmacy volumes and, by our estimation, 19% of overall group pharmacy profits.

The ability to source affordable generics coupled with the high levels of profitable front shop sales makes it difficult for independents to compete with Clicks. Furthermore, the low corporate pharmacy dispensing fees are favoured by major medical aid schemes looking to reduce costs. Clicks and Dis-Chem are therefore preferred suppliers over independent pharmacies by these large healthcare funders.

Healthy positioning but not immune to competition

While Clicks and Dis-Chem currently dominate the corporate pharmacy market in South Africa, grocery retailers such as Shoprite (with Medirite) and Spar (Pharmacy at Spar) are fast becoming competitors through their growing in-store pharmacy offerings. Pick n Pay sold its 25 pharmacies to Clicks in 2021 to focus on its core grocery business. What differentiates grocery retailers from independents is that they have sufficient scale to compete with Clicks in the front shop domain and can achieve many of the other competitive advantages of centralising shared functions. The pharmacy category is currently an insignificant revenue contributor for the grocery retailers, but it presents an area they are actively looking to grow.

More for less

Promotional activity remains a key sales strategy for Clicks’ front shop. The Clicks Clubcard, with more than 10 million active members, is currently the largest and longest-running loyalty rewards programme in South Africa. These members generate up to 80% of Clicks sales. The Clubcard attracts customers into stores via its discounts and its effective communication of special offers.

Additionally, Clicks increases the profitability of their front shop through their extensive offering of private label products, which also provides further value to customers. It sources and produces these at a lower cost than comparable branded products. This currently makes up 30% of front shop sales – the highest private label retail contribution in South Africa (Dis-Chem is at 20%).

South African medicine pricing

The entire pharmaceutical value chain is regulated by the Medicines and Related Substances Act. Key issues governed by this Act include the issuing of pharmacy licences, the registration of new medicines and the pricing of scheduled medicines. The Act also prescribes the Single Exit Price (SEP) for scheduled medicines. The SEP considers the following pricing elements:

• the manufacture price, which is the proposed price by the manufacturer or importer of the scheduled medicines, and is reviewed and approved by the Department of Health;

• the logistics fee, which is payable to wholesalers, distributors and manufacturers for the processing and distribution of medicines to dispensing authorities; and

• Value Added Tax (VAT).

These components add up to the fixed price at which the medicines may be sold. Pharmacists and dispensing officials may additionally charge a regulated dispensing fee. This is calculated as a percentage of the SEP and is endorsed by the Department of Health. The price that the consumer ultimately pays is the combination of the SEP and the dispensing fee.

A sophisticated distribution network

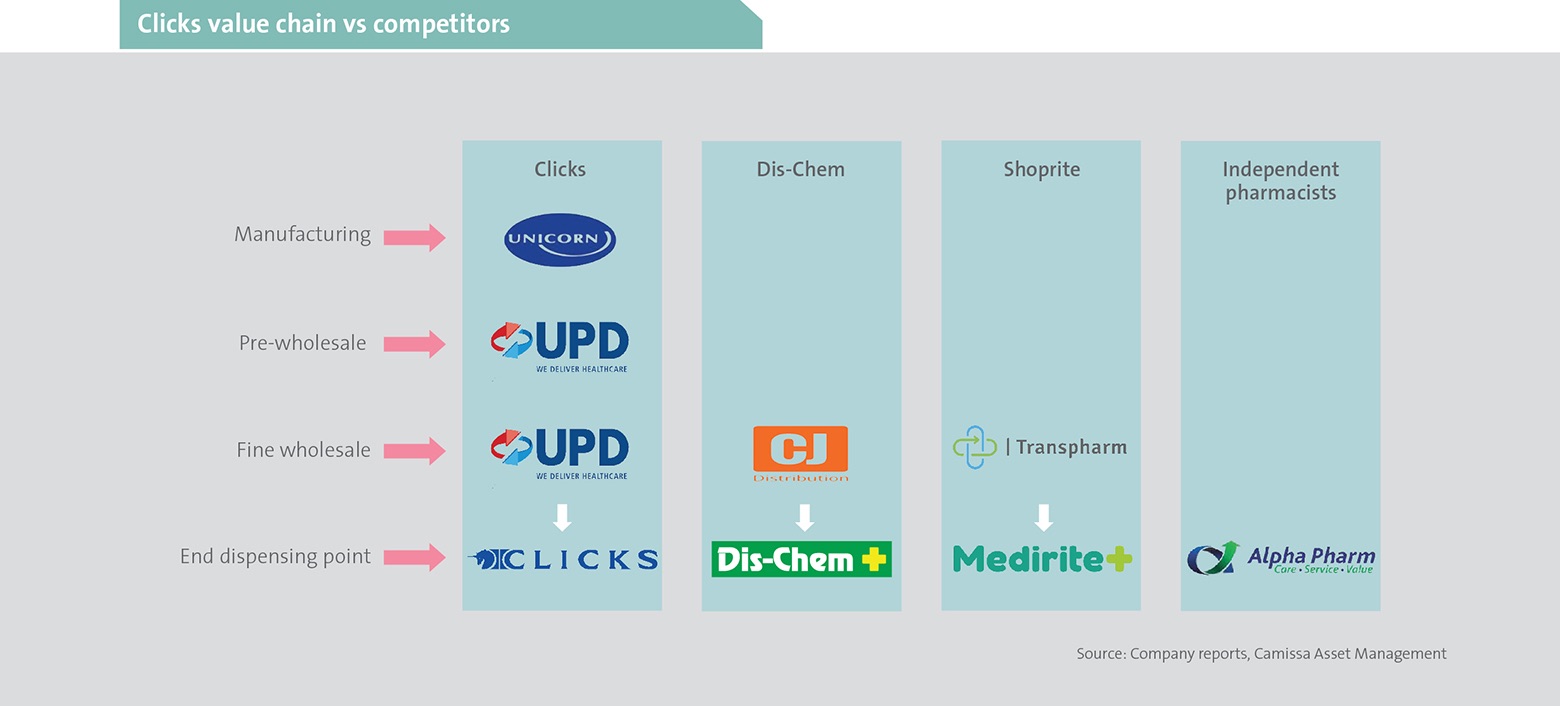

As illustrated below, Clicks participates in a large portion of the pharmacy value chain and therefore generates profits at many stages. This is a key differentiator and competitive advantage.

United Pharmaceutical Distributors (UPD) is the pharmaceutical wholesale and bulk distribution business owned by Clicks, that caters to Clicks’ value chain. It is responsible for transferring pharmaceutical goods from product manufacturers through to distributors, wholesalers and retailers.

The wholesale chain is further segmented based on ownership of inventory. ‘Pre-wholesalers’ take ownership of medicines and break-pack large quantities into appropriate amounts for individual pharmacies, whereas ‘fine wholesalers’ transport product from manufacturer to retailer without taking ownership. The pre-wholesale process garners higher fees as more infrastructure is required to hold and process medicines. Wholesale and distribution are low margin, capital intensive and competitive operations, but perform a strategically important function for the Clicks retail business. Through UPD, Clicks participates in both segments of wholesale activities. This results in superior profitability, relative to its corporate competitors.

Continued growth

With a vertically integrated business and impressive expanding store footprint of 950 retail outlets, Clicks (and its corporate competitors) continues to take market share from independents. In developed markets, corporate pharmacies typically make up 60-70% of the market, while in South Africa they are currently at 50%. This may indicate that there is further market share available to Clicks over the medium to long term, despite increased corporate pharmacy competition.

The thorn in Unicorn

Unicorn Pharmaceuticals has been the subject of a seven-year legal battle with the Independent Community Pharmacy Association (ICPA), based on the law that states that a retail pharmacy cannot also manufacture its own medicines. The ICPA believes that the ownership of Unicorn constitutes a conflict of interest for Clicks as their pharmacists may be incentivised to recommend Unicorn generics to customers above other options. This may be against the best interests of customers in pursuit of greater profits for Clicks.

The South African Constitutional Court’s recent ruling in favour of the ICPA, sets out that Clicks is yet to reach a resolution with the Department of Health to resolve the inherent conflict. While the matter remains unresolved, Clicks is unable to obtain any new pharmacy licenses before they resolve this issue, hampering their growth ambitions. Potential recourse may be to strategically divest their majority shareholding in Unicorn, which is likely to negatively impact profitability.

A bright future despite the challenges

Clicks has successfully delivered consistently strong profit growth over the past two decades. With its aggressive growth ambitions to open over 200 new stores in the medium term and expand its in-store private label brand offering, there remains plenty of opportunity for expansion. With an outstanding management team and proven execution capability, we believe Clicks will continue to thrive, albeit with heightened competition and the Unicorn challenge to deal with. Unfortunately, we believe all these factors are more than priced into the current Clicks share price, which is very high.