Founded in 1982, Bytes began as a distributor of IT hardware and software during the early boom years of personal computing and has since evolved into a leading IT solutions provider. Following years as a subsidiary of Altron, a 2020 spin-off of Bytes unlocked significant value for Altron shareholders. Since listing, Bytes has continued growing, doubling gross profit over the last five years. Bytes operates through Bytes Software Services and Phoenix Software, focusing on the UK mid-market. They are also one of Microsoft’s largest partners in the UK.

The VAR advantage

With organisational technology needs becoming more complex, resellers such as Bytes act as a trusted partner and intermediary between software providers (eg Microsoft, Amazon and CrowdStrike) and enterprise customers. They add value through software implementation, product billing, project design and integration.

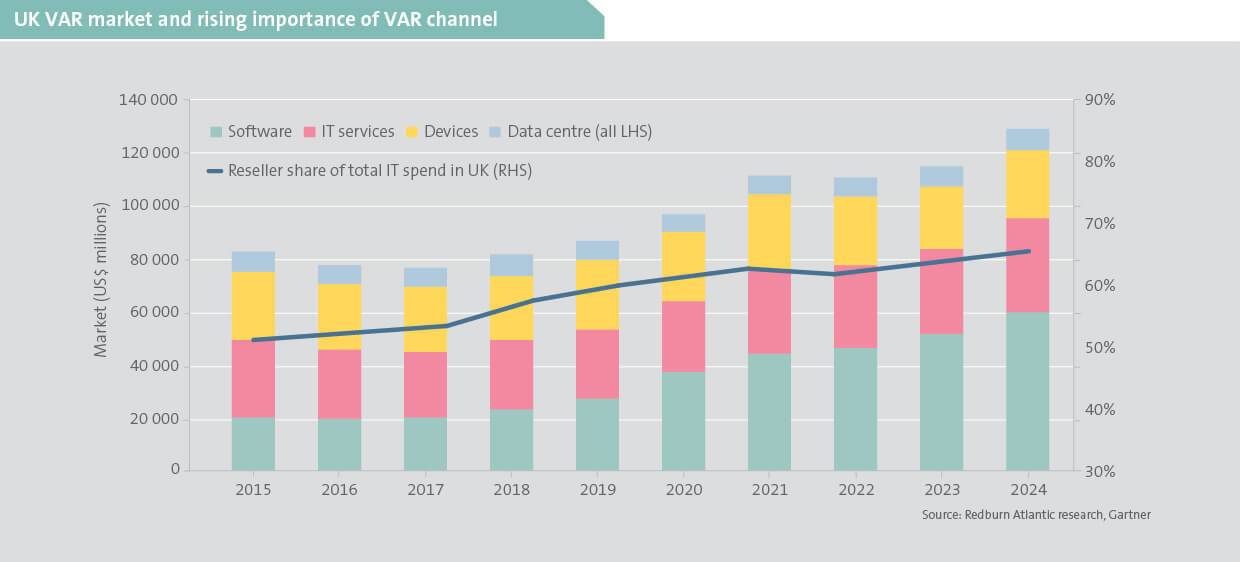

For software vendors, developing direct sales and support infrastructure across every region, to serve a large and dispersed set of small and mid-size customers, is costly and inefficient. Instead, they rely on resellers to cater to these markets and thus the importance of the reseller channel has grown over time. Newer technology companies in particular (ie CrowdStrike) are choosing to rapidly scale their offering through this channel, with 80% of products sold in this way.

For enterprise customers, rising IT complexity makes managing multiple vendors for software and infrastructure needs increasingly cumbersome. While legacy IT environments included on-premise servers running a handful of software packages, with upgrades or renewals every few years, today’s IT infrastructure ecosystem is far more complex. IT environments now comprise infrastructure integrated with various public clouds, hundreds of software-as-a-service applications with varying renewal cycles, complex security controls and ongoing cybersecurity monitoring.

In this context, resellers are increasingly valued as a trusted partner that designs, procures and implements solutions, and provides expert advice. Furthermore, their scale enables them to secure better vendor pricing, which can be partially passed on to clients. Strong underlying demand and a growing reliance by vendors on the reseller channel have led to robust growth and expanded the resellers share of spend over time. This is particularly the case for software spend via resellers, which has tripled over the past decade (charted below).

A software-focused player

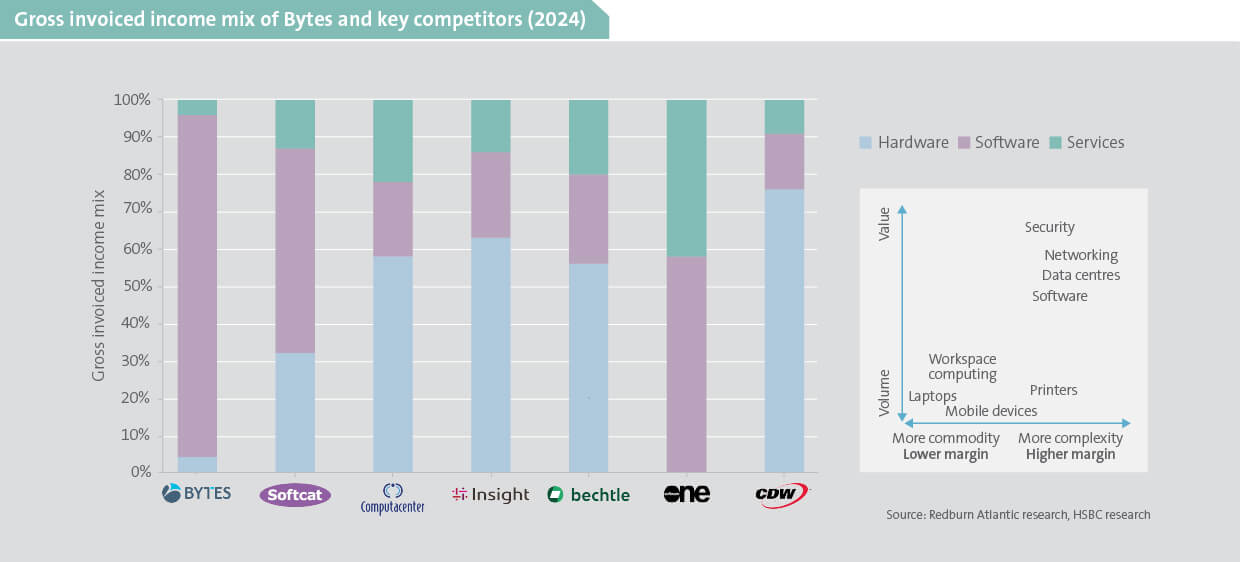

Bytes distinguishes itself primarily as a software reseller. As illustrated below, 90% of its sales are software related, which has been the fastest growing area of IT spend globally. Importantly, the value increases with complexity. Routine hardware procurement is reasonably commoditised, while software, security and cloud services are more specialised, therefore generating higher margins and profit per sale.

While hardware is more cyclical and easier to defer, software and security spend is much harder to cut as it forms part of essential operations and largely requires renewal over shorter intervals. Consequently, Bytes’ sales are more uniform through time and produce higher margins. A significant portion of revenues are recurring via monthly or annual subscription renewals. Moreover, the model is capital light relying on skills, relationships and vendor programs with low working capital requirements.

Cash generation is further supported by a favourable working capital cycle, where customers typically pay for services in advance (or within 30 days of delivery), while the company pays vendors later.

Opportunities to gain market share

Bytes operates in a large, fragmented UK reseller market (main competitors indicated above) where it holds low single-digit market share, leaving ample room to grow. The UK’s mid-sized businesses are currently underserved by the large global players, while the long tail of smaller VARs struggle to match Bytes’ scale and depth of service offering. With roughly 40 000 mid-sized businesses in the UK and approximately 6 000 customers within Bytes, the runway to gain market share and grow is substantial.

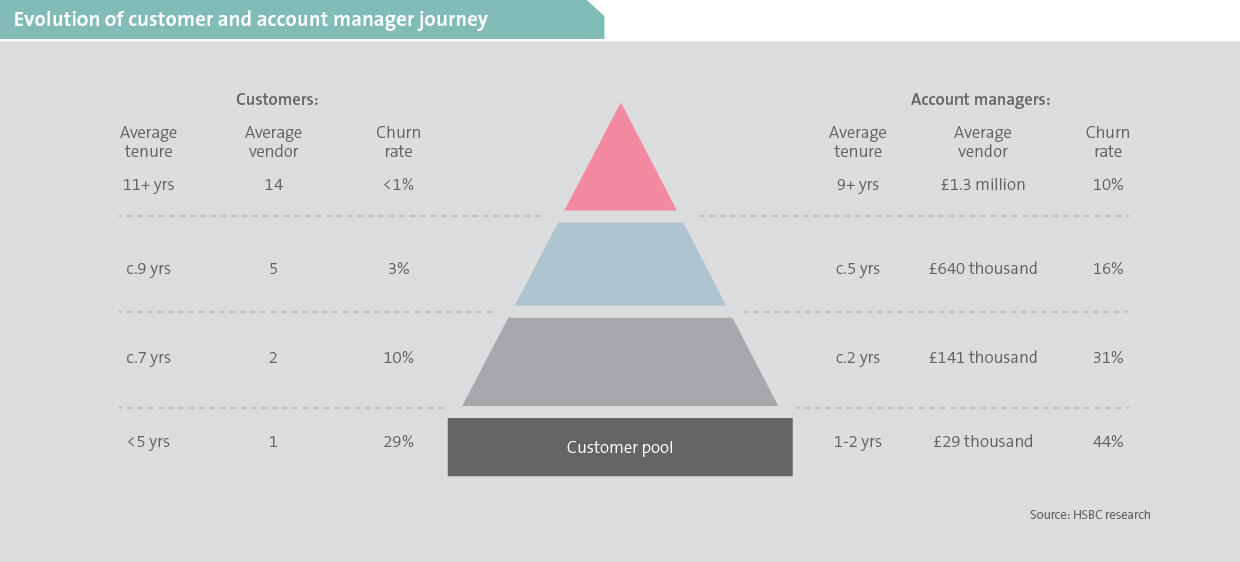

Existing clients tend to spend more over time as trust and relationships grow (shown below). Approximately 95% of Bytes’ gross profit is generated from existing customers and renewal rates are consistently close to 100%, highlighting this pattern.

A digital ally to the UK’s public sector

Bytes has a long-standing history of servicing the UK’s public sector, including agencies like the National Health Service (NHS) – a key customer. Bytes played a pivotal role in supporting the NHS during the COVID pandemic, enabling remote work for the NHS’s leading cancer centre. They assisted with the implementation of an Azure cloud virtual desktop solution that saved over £500 000 in hardware costs. Bytes was also involved in the optimisation of the HS2s1 software estate (including products from Microsoft and Oracle), helping the government save an estimated £1 billion on a £11 billion budget.

In 2023, Bytes was awarded a five-year contract for the nationwide procurement of Microsoft licenses for the NHS. This is part of a multi-year upgrade to digitise infrastructure

(ie patient records, shared data platforms and cyber resilience), with spend expected to double over the medium term. The NHS also plans to expand their staff cohort to address the country’s growing healthcare needs. These initiatives present good growth potential for Bytes, especially given its established public sector credentials and strong track record of delivery.

Seeding future growth

In recent years, Bytes has deliberately ramped up investment in sales staff and technical talent2. As employee costs account for over 80% of group expenses, this investment has temporarily dampened the group’s profitability yet lays the groundwork for future growth.

Bytes typically hires young, tech-savvy employees, training them via its well established ‘Seven steps to a million’ programme, which builds the necessary skills for new sales executives to become highly productive over time. Programme participants are expected to deliver £1 million annual gross profit by the seventh year. Notably, their top account managers are achieving this milestone in just three years. As new hires become more productive, we expect a meaningful increase in revenue per employee, and consequently higher profit growth as revenue grows well ahead of costs.

Microsoft’s incentive reset

Microsoft has made substantial changes to its rebate model focusing on recurring subscriptions rather than one-off license sales, and channelling reseller efforts to the mid-market. The rebates have also been structured to concentrate on Microsoft’s priority areas like Azure, security (Defender/Sentinel) and Copilot. As a portion of their customer base is impacted by this transition, the result has seen a dampening of Bytes’ recent profitability. Despite the near-term headwinds, over the long term the shift aligns well with scaled, accredited resellers like Bytes, with a strong mid-market footprint.

Hidden value in the decline

Bytes sits at the intersection of several favourable trends – rising IT complexity and a robust software-led technology spending outlook. The business model has high revenue predictability – given the largely recurring nature of customer spend – high returns and strong cash generation.

The company’s software focus provides a more resilient base than hardware-led competitors, while its public-sector track record provides another growth opportunity. Significant staff investment ahead of competitors provides a clear path to steady market share gains in a large, fragmented market.

Recently, the Bytes share price has declined materially, coincident with the substantial incentive changes from Microsoft, which have negatively impacted profitability. This has provided our clients the opportunity to invest in a fundamentally strong company with a solid growth outlook, now available at a low price relative to its prospects.

1A major infrastructure project in the UK aimed at developing a high-speed railway to connect London with major cities such as Birmingham, Leeds and Manchester.

2 The company headcount has increased by 36% per year since 2022.