Uniquely British luxury

In 1879, Thomas Burberry invented the gabardine – a revolutionary lightweight yet breathable, tearproof cloth – where the yarn is waterproofed before weaving. His design outcompeted the rubberised cotton coats available at the time and quickly gained popularity among prominent explorers and pioneers. This success sparked public interest and fostered a strong association with innovation, durability and sophistication.

Burberry’s outerwear became a symbol of British identity when the company was commissioned by the armed forces to design ‘trench’ coats for World War I and II soldiers. The introduction of the nova check pattern on its coat linings became a defining brand feature that evolved into a fashion statement signalling British luxury, elegance and quality.

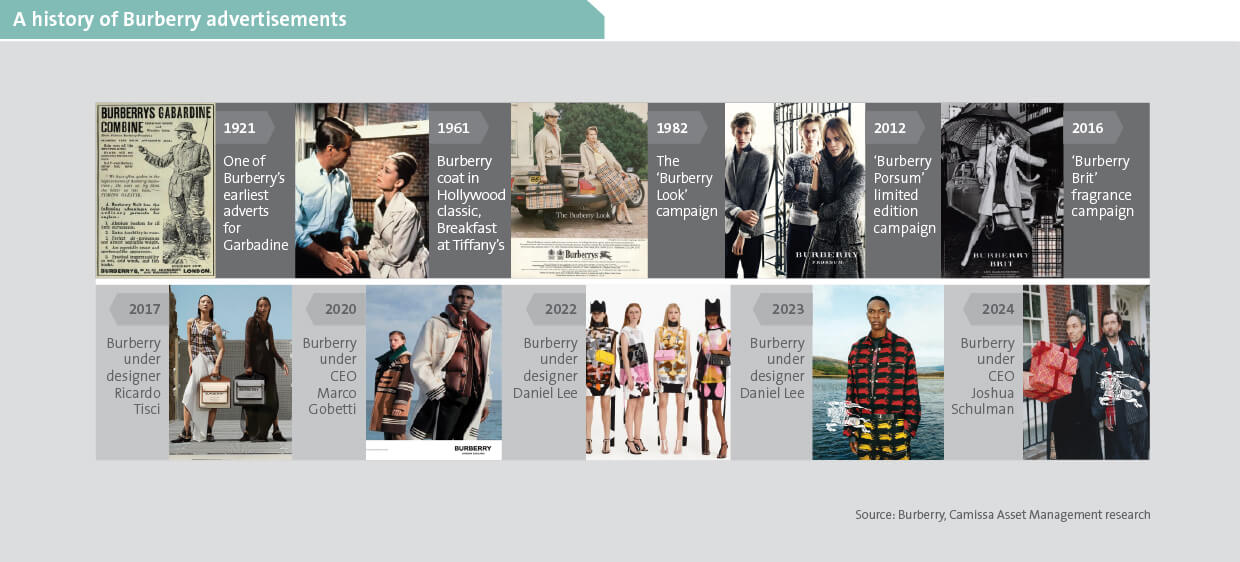

To further establish the image, Burberry invested in advertising campaigns that highlighted its heritage and craftsmanship, often featuring British icons and landscapes (illustrated below). In so doing, the brand reinforced a prestigious national identity and attracted the attention of international consumers seeking authentic British luxury apparel. Their marketing strategy evolved over time, from traditional print adverts in elite publications to high-profile celebrity endorsements and digital campaigns. Burberry’s ability to adapt to changing consumer preferences and digital trends, while staying true to heritage, has been key to enduring relevance across generational audiences.

A diversified luxury global brand

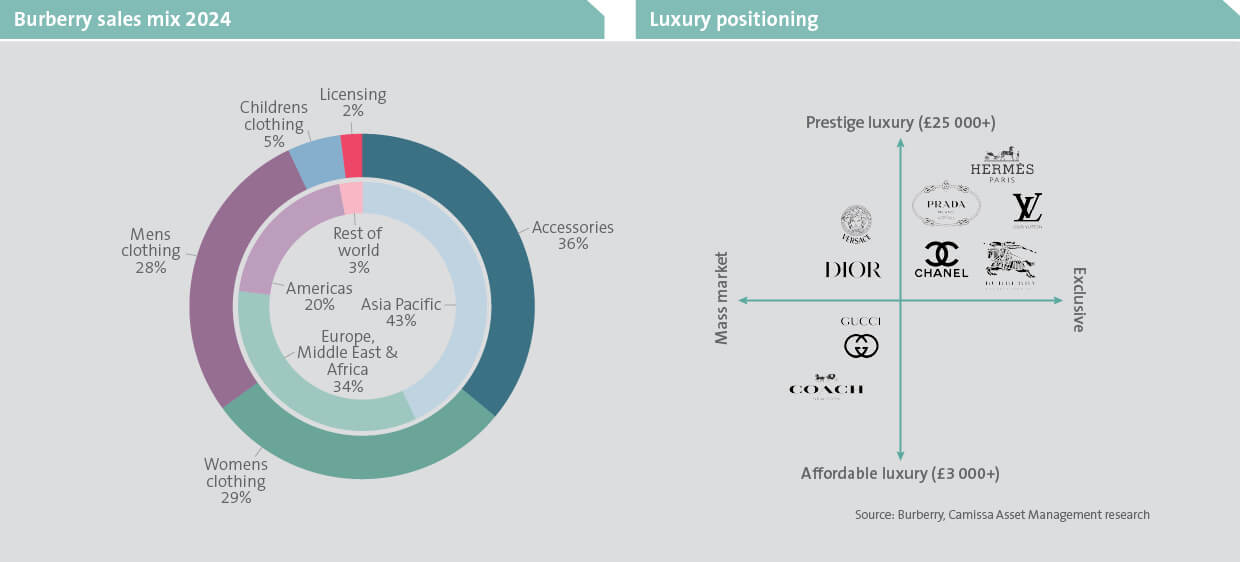

By the 1990s, one in five coats exported from the UK was a Burberry. This success prompted an expansion into fast-growing high-income Chinese cities, Beijing and Shanghai, where the brand capitalised on high-margin local sales and tourists seeking premium shopping destinations. Today, Burberry has high exposure to Asia Pacific (40% of sales), driven by strong demand from Chinese and Japanese shoppers.

Burberry boasts a well-diversified portfolio of luxury products, led by accessories1 and a relatively equal split between men’s and women’s clothing, as shown below (left). The brand is positioned between premium and ultra-luxury competitors such as Hermes and Chanel (below right), with strong outerwear dominance and a unique contemporary British aesthetic.

Burberry is vertically integrated in that it maintains strict control over design, production, marketing and direct sales. This allows for faster product lead-times and ensures superior quality and cost management, providing a long-term advantage over brands like Coach and Versace, which rely heavily on third-party manufacturers.

Skewed toward the lower end in luxury, Burberry’s entry-level apparel garners price tags around the €3 000 mark – appealing to the aspirational consumer. These people pursue luxury purchases as a means of expressing status or a lifestyle image that might otherwise be unaffordable. The Burberry narrative of sophistication, style and success resonates deeply with these shoppers, cultivating strong brand loyalty and, ultimately, higher lifetime sales compared to ultra-wealthy customers.

Heritage is an irreplicable moat

Built on the invention of the trench coat, Burberry’s military heritage adds historical authenticity, which cannot be replicated. It represents an identity that Prada or Versace cannot imitate. The brand’s legacy acts as a long-term competitive advantage and ensures continued relevance in the global luxury industry. Although fashion trends change, Burberry’s iconic trench coat and other outerwear remain timeless essentials, guaranteeing strong demand across generations.

Burberry cultivated a loyal customer base by blending classic British culture with modern innovations to appeal to older customers seeking tradition and younger audiences drawn to trendy yet timeless products. By investing early in digital retail with the first-ever livestreamed interactive fashion show on Twitter in 2010, Burberry transformed into a contemporary lifestyle brand. In the process, it created urgency, aspiration and exclusivity, while modernising the brand image to appeal to a younger demographic.

Brand concerns create compelling investment opportunity

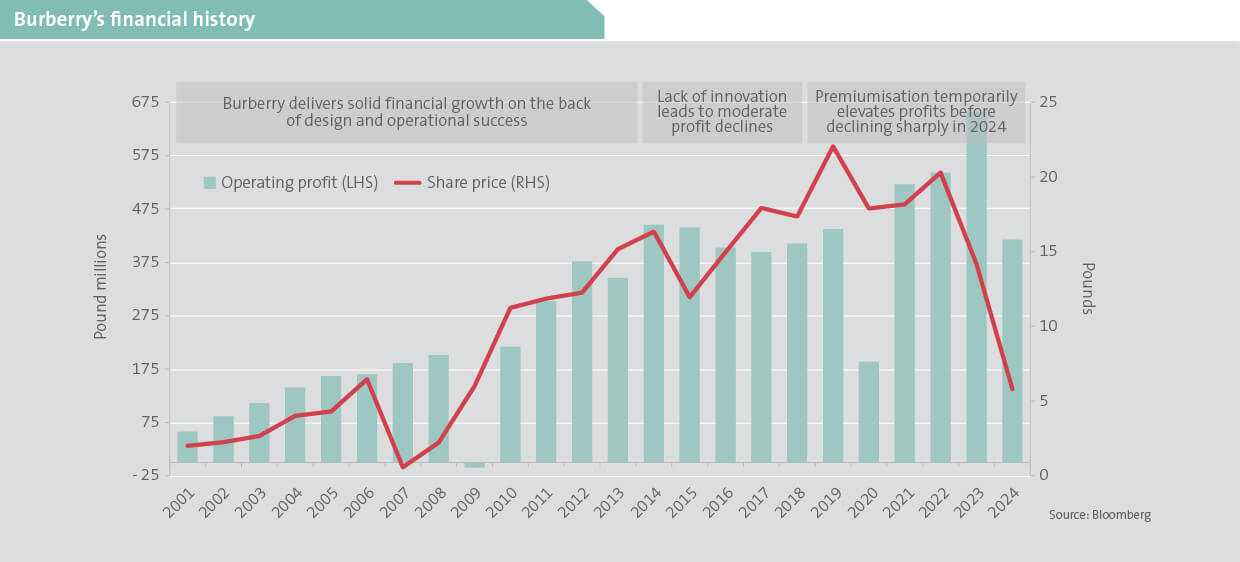

Under new leadership in 2017, Burberry sought to elevate its position and improve profitability through higher pricing and exclusive offerings. Despite design developments, it continued to increase price points without corresponding improvements in innovation, quality or product appeal. Several creative director appointments brought significant shifts in style and brand perception. This is evident (previous chart) in the refined, elevated designs from Riccardo Tisci, versus the bold, contemporary aesthetic of Daniel Lee – aimed at attracting younger, more fashion-conscious consumers. However, inconsistent product imagery, an over-extension into low-authority categories like bags and shoes, and over-pricing has contributed to the dilution of Burberry’s brand equity.

An array of disparate products that seemed disconnected from Burberry’s core identity, combined with incoherent marketing campaigns, have led to fragmented brand perception across its operating markets. Sales and profits decreased significantly in 2024 as the brand fell out of favour with consumers, particularly in the key Asian markets. After downgrading profit estimates for three consecutive quarters, cash balances dwindled. At the same time, the company’s CEO stepped down, causing market uncertainty about the brand’s prospects.

Burberry’s share price subsequently plummeted by more than 70% from 2019 peaks (indicated below), which relegated the British heritage stock from the FTSE 100 Index for the first time in its listed history. This provided an opportunity to purchase shares in a company with strong brand heritage, trading at a massive discount to luxury comparatives.

Burberry’s long history of robust cash generation, combined with high and stable returns on equity underscores its fundamental attractions. Additionally, the business’s low debt levels enable a nimble balance sheet and allow for investment to reinvigorate the brand.

Category authority in outerwear and scarves

Newly appointed CEO, Joshua Schulman, an industry veteran known for successful turnarounds at Coach, Michael Kors and Jimmy Choo, is leading a strategic repositioning at Burberry. He has refined product lines and lowered prices in categories like leather bags and shoes, while prioritising outerwear and scarves as core products. This will be complemented by premium cashmere, leather, suede and special edition variations to attract prestige price points. The aim is to reaffirm Burberry’s authority in trenchcoats and rainwear, while emphasising heritage with origins in protective wear. The reintroduction of classic designs that highlight Burberry’s iconic check, neutral colour palette and timeless aesthetic has already improved desirability and market perception.

Since Schulman’s appointment and subsequent positive strategy shift, Burberry’s share price has more than doubled. While Burberry’s classic British heritage remains its most valuable asset, the brand’s future will depend on being able to harmonise tradition, innovation and accessibility to retain and grow the customer base.

1Including scarves, hats, bags, shoes, belts, sunglasses and other wearables.