A shift in momentum

Established in 1965, Altron has positioned itself as a pioneer in the local technology space, offering a broad range of products and services. These include:

- vehicle tracking and recovery through Netstar;

- information technology (IT) services for large public and private enterprises – to develop, manage, secure and maintain their IT systems;

- financial technology (FinTech), in the form of payment and collection systems for microlenders as well as card issuance and point of sale devices; and

- healthcare technology (HealthTech), incorporating automated billing, claim settlement and digitised patient management systems for doctors and private hospitals.

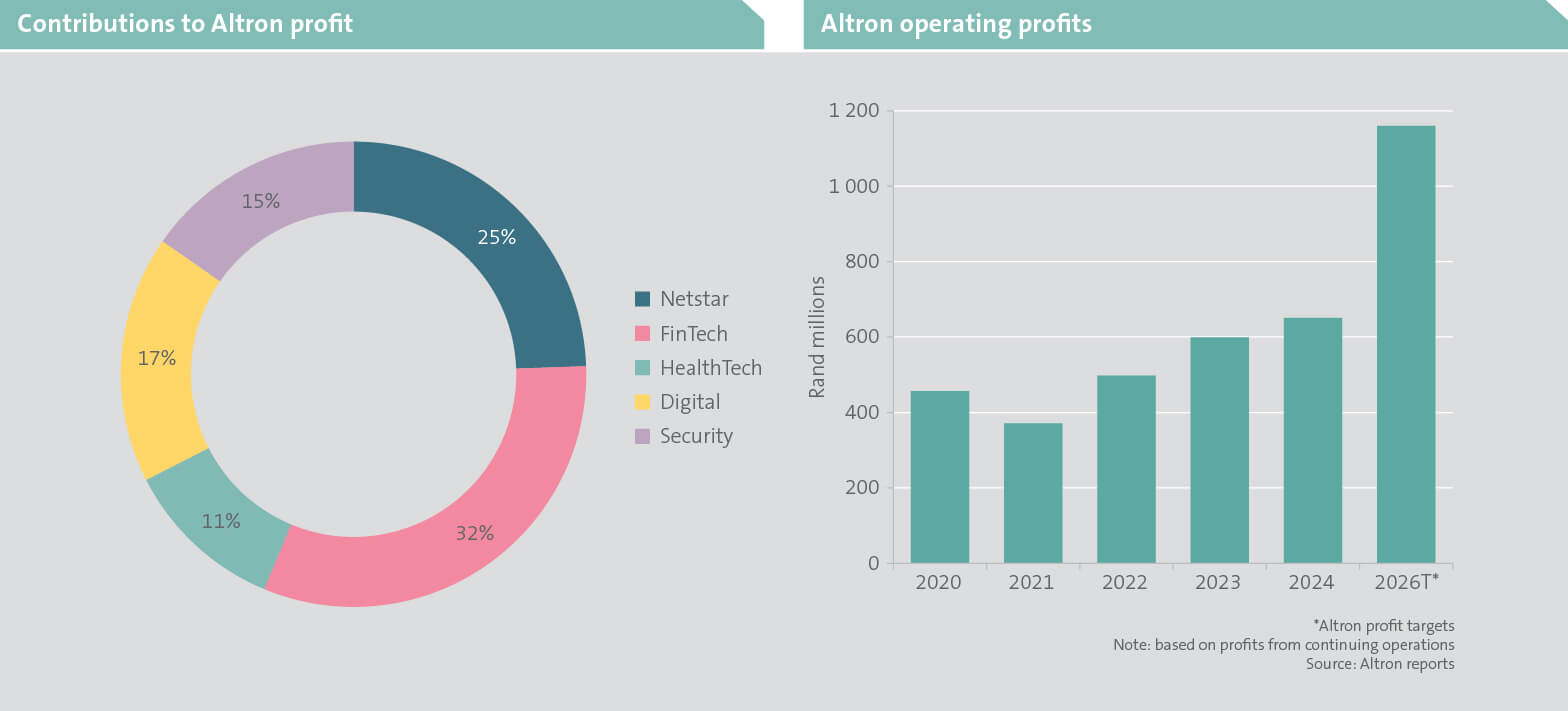

As indicated below (left), Altron’s FinTech division is the largest contributor to profits, followed by Netstar. Looking ahead, Altron aims to boost operating profits to R1.15 billion by 2026 (below right), a significant step up from R651 million in 2024.

Steering Netstar in the right direction

Since inception in 1994, Netstar has established itself as a leader in providing vehicle telematics. It now serves close to two million subscribers (charted below). More than a million of these are South Africa-based, ranking Netstar in the top four SA vehicle trackers. Although Netstar’s growth has lagged competitors such as Cartrack in the last decade, recent acceleration under new management has narrowed the competitor gap. Over the last five years, Netstar’s subscriber growth has averaged a commendable 20% per annum.

Beyond vehicle protection, telematics provides crucial insights for fleet management including real-time driver behaviour, vehicle location and fuel consumption. Netstar has assisted companies like Putco, the largest bus service in the country, improve safety and reduce claims against them. Netstar also provides Putco with security cameras and systems to monitor fuel theft and driver behaviour. Consequently, Putco has realised a 70% decrease in bus accidents and a 36% reduction in claims.

Among the key strategic changes implemented by Netstar management is the refinement of their dealership pre-fitment strategy. Historically, Netstar would pre-install vehicle tracking devices at dealerships, in anticipation of securing post-purchase subscriptions. This approach, which is costly upfront, is being improved upon by narrowing dealer partnerships, terminating unprofitable relationships and negotiating cost-sharing for pre-fitment. This has led to improvements in pre-fitment conversion rates from 33% to over 60%, with the goal being 70%.

Netstar has also focused on improving customer retention and reducing churn. By insourcing its retention call centre, the business now manages customer relationships directly, with a direct line of sight to address customer concerns and offer appropriate products and concessions. As a result, churn rates have dropped from 22% to 16% and the business remains committed to further reduction. Staff deployment has also been adjusted to enhance productivity. Skilled technicians now focus more on complex tasks and less experienced staff handle routine duties.

In addition, Netstar has continued to broaden its network of dealers and insurance partners, including a collaboration with WeBuyCars1 that began in 2021. WeBuyCars dealerships now have on-site Netstar technicians, who can install tracking devices soon after vehicles are purchased, when the owner selects a Netstar tracking package.

In April 2024, Netstar launched the Global Fleet Bureau that provides advanced telematics solutions to enhance its fleet management offering. This has repositioned the fleet management business competitively within the industry. It provides real-time monitoring and AI-powered video analysis, enabling quicker vehicle recovery and dispatch responses.

With around 12 million vehicles on South African roads, and only four million subscribing to vehicle tracking, there remains significant potential for growth. Moreover, Netstar is pursuing international expansion, with Southeast Asia viewed as an attractive market.

Rebooting the IT business

Altron’s IT division, which houses several businesses that are major players within the South African IT services market, has experienced sluggish growth in recent years. These businesses deploy in-house expertise and third-party vendors to deliver integrated IT solutions for corporate clients.

An example of such an IT solution is the development of the Idea Trigger platform used to log and track idea generation for Vodacom staff. Following success in local operations, Vodacom extended the platform across the continent, with parent company, Vodafone, also implementing it. Vodacom has earned an additional R1 billion in revenue through the ideas generated from this platform.

Altron has also supported fast food restaurant chain, Hungry Lion, by providing a workforce management solution that streamlines staff scheduling to ensure effective allocation during peak and off-peak periods. As a result, Hungry Lion has reduced their overtime costs by 22%. Additionally, Altron partners with global tech giants, like Huawei, to provide cloud solutions to their clients.

Strategic steps taken to revitalise Altron’s IT division include the appointment of new leadership that is, among other things, focused on materially improving the sales force. They have integrated the various IT businesses – Altron Managed Solutions, Systems Integration and Karabina – into a single unit, Altron Digital Business. The businesses were previously siloed, which resulted in duplication and an inefficient use of capabilities across businesses. This consolidation is intended to streamline operations, reducing skill and service overlaps and enabling the company to offer a more comprehensive and effective offering to customers.

Typically, IT businesses have high fixed costs due to extensive infrastructure, technology and talent requirements. Sustaining profitability therefore depends on maintaining high business volumes. While Altron’s IT business has been vulnerable to the cyclical nature of the industry due to its low proportion of ongoing, long-term annuity revenue, the business is now focused on increasing the recurring revenue base by securing long-term customer contracts and improving cross-selling efforts. Altron plans to increase the number of customers buying three or more products from 20% to 50%, focusing specifically on its top 20 clients.

Furthermore, Altron has been consolidating their vendor base to reduce complexity and enable more targeted investment in technical capabilities. The business is also committed to steering clear of margin-eroding contracts moving forward, adopting a ‘quality gate’ process to screen out less lucrative opportunities.

FinTech targets micro finance market

Altron’s FinTech division offers a range of solutions that include credit management tools for microlenders, point-of-sale equipment for banks and merchants, and printers used by the government in the production of smart IDs. This latter service is supported by Altron’s security unit, which embeds encryption into ID cards, ensuring the protection of personal data.

The FinTech sector in South Africa and across the continent is set for considerable growth as a large portion of the local market, particularly small businesses, have limited access to traditional financial services.

One of Altron’s core financial technology businesses focuses on providing microlenders with software solutions to formalise their operations. These solutions empower microlenders to:

- manage credit more effectively by conducting credit checks;

- enable more secure disbursements via direct deposits to customer accounts or through cards such as NuPay; and

- manage collections.

Altron generates income from transaction fees across the value chain. As the microlending sector grows and becomes more formalised, the FinTech business stands to benefit from client growth, particularly as microlenders open new branches. Altron is also aiming to boost market penetration by expanding the sales team and capitalising on word-of-mouth advertising, as clients experience the advantages of its solutions. By broadening the FinTech portfolio through exploring new opportunities and positioning the business to open space for those with limited access to financial services, Altron is actively creating other growth avenues within the business.

A promising path forward

A reinvigorated and focused Altron is pursuing ambitious growth objectives, exhibiting very positive trends to date. Through the strategic initiatives discussed pertaining to Netstar and the IT and FinTech businesses, substantial earnings growth can be realised. We believe the market has underappreciated the extent of these prospects and Altron is well positioned to deliver excellent shareholder returns.

1Currently, one of the fastest-growing used vehicle dealers in South Africa.