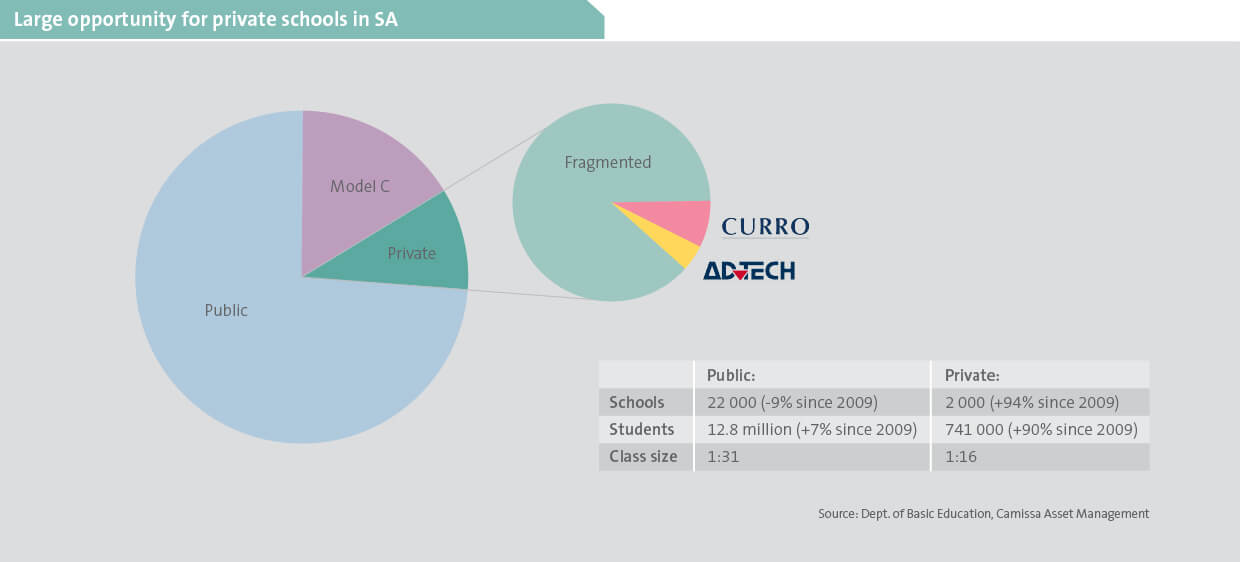

As South Africa’s largest independent private school network, Curro serves learners across a broad income spectrum and has taken strategic steps to address the growing need for affordable, high-quality education. Considering the continually evolving education sector, we explore Curro’s operations and how it is positioned to capitalise on emerging growth opportunities.

Differentiated model addresses diverse needs

Established in 1998, Curro has grown significantly over the past two decades, now with more than 180 schools in operation countrywide. Through a tiered pricing model, it is able to deliver quality private education to a broader segment of the population, competitively positioning the group against traditional high-fee private schools (charted below).

Curro differentiates itself by offering modern facilities, extensive sports and cultural activities and an enhanced curriculum using various models (including the Cambridge International programme – typically not available at smaller private schools and Model C1 schools). It achieves this at more affordable price points through a varied portfolio of school models. These include:

- Meridian Schools: Curro’s most affordable model is developed in partnership with the PIC and Old Mutual. These English-medium schools serve lower-income urban communities and follow the South African National Senior Certificate (NSC) curriculum.

- Academy Schools: Located in urban areas and aimed at lower- to middle-income families, these English-medium schools also follow the NSC curriculum.

- Curro Schools: The group’s core model serves middle- to upper-income families. These co-educational schools offer grades R to 12, often including preschool phases. They follow the South African Independent Examination Board (IEB) curriculum, with class sizes limited to 25 learners.

- Select Schools: These well-established schools are acquired by Curro and maintain their original identity while benefiting from Curro’s support. They are English-medium and offer the IEB or Cambridge curriculums, with class sizes capped at 25 learners.

This tiered approach allows Curro to diversify its revenue base and mitigate risks associated with exposure to particular income segments. It also enables the group to strategically grow its footprint, entering underserved markets.

The business of schools

Curro’s business model is built on a steady stream of school fee income, providing predictable cash flow throughout the academic year. This is buoyed by ancillary income from facility rentals, uniform sales, catering services, aftercare and boarding facilities. Strong learner retention and upfront enrolment improve revenue visibility, supporting financial planning and operational stability.

Opening a new school requires substantial investment, with significant upfront costs for building infrastructure and hiring staff (approximately 70% of total costs) well before learners are enrolled. Consequently, schools tend to operate at a loss in the early years. As each new intake of learners builds momentum, fee income rises, and the financial performance steadily improves.

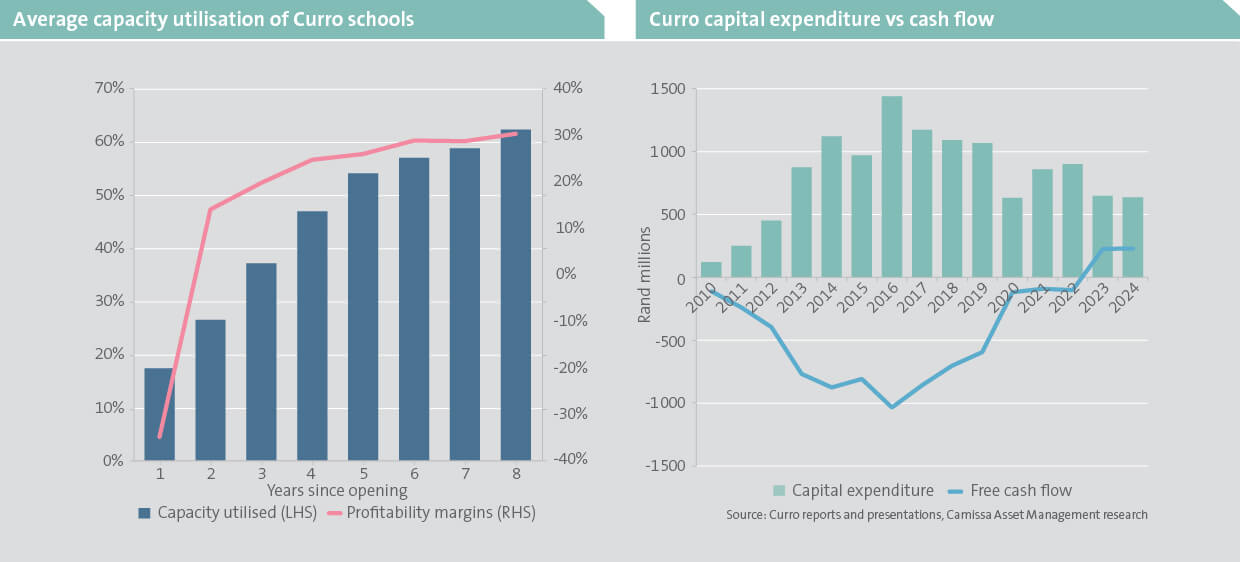

A new Curro campus can take three to five years to reach profit break-even point. A grade one class might begin with fewer than 10 learners, which is well below the cost coverage threshold. However, as the school expands annually, new grades are added and learner numbers grow accordingly. Once a school reaches the breakeven level, additional learners can be added at minimal incremental cost, growing income faster than expenses. As enrolments escalate, revenue grows at a faster rate than costs, leading to growing overall profitability (below left).

Curro’s strategic pivot

Curro has invested substantial capital into building and acquiring schools over the past 13 years. However, a considerable number remain in the early stages of their development lifecycle and have not yet reached optimal learner capacity. Schools operating below breakeven levels have severely weighed down the group’s returns on capital. Curro has subsequently adjusted its strategy to prioritise filling existing capacity above expanding the school network. This is a shift from a growth-oriented approach to one centred around operational efficiency and improving returns on invested capital. As the rate of large-scale infrastructure investment declines and fewer newer schools require upfront funding, capital expenditure is expected to reduce materially.

As indicated in the right chart above, a reduction in capital intensity has significant implications for cash flow. With much of the physical infrastructure already in place, Curro is well placed to generate more cash from operations as it fills up capacity, allowing for debt reduction and improving shareholder returns. The transition from high-growth, capital-intensive expansion to a more cash-generative phase will be central to shaping the group’s future value creation.

Course correction

Curro has faced several challenges over the last couple of years that have impacted learner growth and financial performance. Their decision to raise school fees above inflation (particularly in lower adjacent grades where parents tend to be more price sensitive) has been a critical misstep.

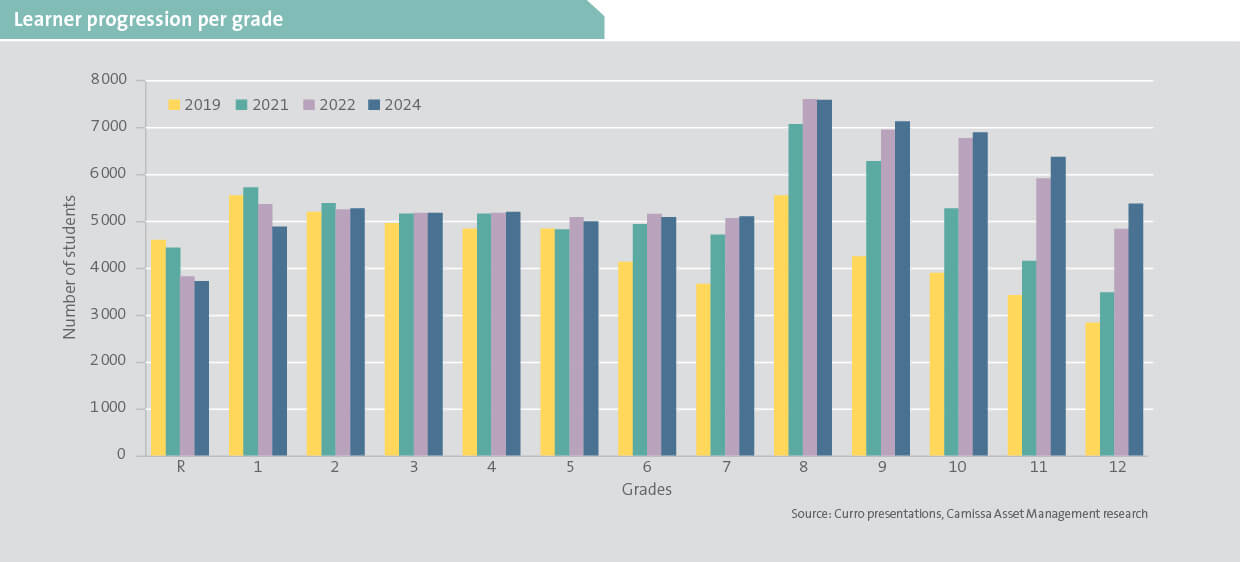

This has notably impacted enrolment numbers and learner retention in lower grades (shown below). While such fee increases were intended to protect margins, they have contributed to affordability concerns during a period of broader macroeconomic strain.

Another area of concern has been Curro’s historical approach to campus development. In some cases, schools have been built in areas with weaker underlying demand and limited levels of affordability, exacerbated by economic pressures. Less-than-ideal locations have therefore made it difficult to achieve the necessary scale for profitability, leading to underutilised capacity, elevated cost structures and a select group of underperforming Curro schools.

Curro has actively sought to address these areas of concern by focusing on refining fee strategies to better reflect market conditions and parental expectations (particularly in entry grades). They are optimising existing capacity and supporting learner retention and gains in key grades. Despite a challenging environment, the underlying issues are largely manageable, with targeted interventions underway to stabilise performance and realign the group’s growth trajectory.

Untapped digital opportunity

Digital education represents a powerful growth opportunity for Curro, that we believe has yet to be realised to anywhere near its potential. Using digital delivery more broadly can enable lessons from top educators to be shared with thousands of learners regardless of where they are based, without the heavy costs of building large campuses or hiring specialist teachers at every site.

Curro’s digital model (DigiEd) was launched in 2019, delivering digital lessons to learners on campus, with facilitators available for support within a structured, full school-day routine. While initiatives such as DigiEd have begun to test the waters, it remains only a small part of the group’s offering and is aimed at a very specific niche market. As these offerings can be priced well below conventional private schooling, they open the door for families in South Africa’s lower-income segment, where demand for affordable, quality education is high but often unmet. By combining greater affordability with enhanced quality, Curro is favourably positioned for profitable growth in this area, while playing a leading role in reshaping access to education in South Africa.

Primed for evolving education

Curro’s multi-tiered school model aligns well with South Africa’s growing demand for accessible, affordable, high-quality private schooling across diverse income groups. It has recently announced a proposed buyout that would see the business delist and transition into a non-profit public benefit organisation. This structure should support faster expansion by allowing all surplus funds to be reinvested into the schools, while offering pricing flexibility to boost enrolments and capacity utilisation.

Although current financial returns are modest, the group is strategically well-placed for improved performance as enrolments increase – unlocking significant long-term value for investors.

1The government retains ownership of these schools and pays core teaching staff, with governance and financial management delegated to elected school governing bodies. They are largely administered and funded by the parent body and fees charged can differ between schools.