We delve into the factors that have propelled Boxer’s success, its competitive positioning and its growth strategy.

Boxing clever

Boxer holds 6.4% of the formal domestic grocery market and operates over 500 stores countrywide. With a people-focused approach, it primarily targets the enlarged middle- to

lower-income consumer segments through three key formats: Superstores (62%), Liquor (31%) and Building Materials (6%).

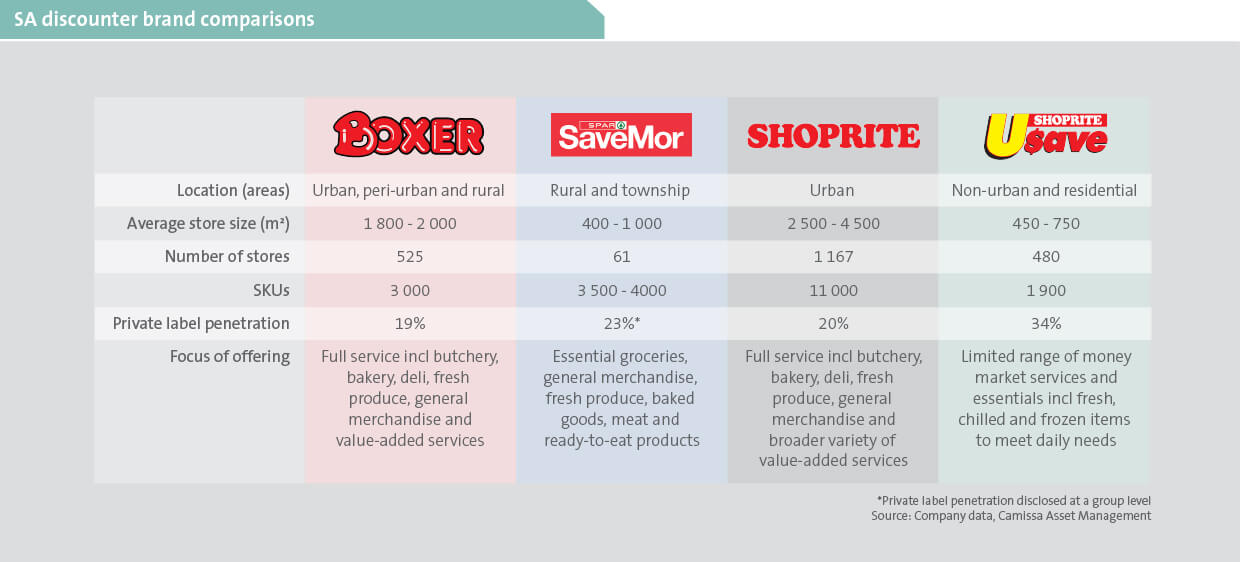

Despite its smaller size relative to Shoprite, its main rival, Boxer has proven to be a formidable competitor. Its differentiated merchandising strategy offers a curated range of 3 000 SKUs1 – compared to Shoprite’s 11 000 (compared below) – with a core offering built around shelf-stable essentials (ie maize meal, rice, oil and beans). These products can be stored at ambient temperatures, negating the need for complex and costly cold-chain logistics.

A narrow product range enables larger order sizes from suppliers, strengthening Boxer’s purchasing power and enabling procurement on competitive terms. Passing these savings on to customers is a fundamental pillar of Boxer’s operating model. In some key product lines, Boxer even holds a higher market share than Shoprite – remarkable given its turnover is roughly one-fifth that of its larger adversary. Boxer’s simplified product range streamlines inventory management and supports consistent stock availability, which is critical in ensuring customer satisfaction.

Location, location, location

Boxer’s store placement strategy is designed to target price-sensitive consumers and is an integral part of its overall business approach. By locating stores near to where customers live and commute, transport costs are minimised. In conjunction with consistently low prices and the convenience of in-store social grant collection, this reinforces Boxer’s reputation as an accessible, community-rooted brand.

Lean, mean, winning model

A key pillar of Boxer’s business model is its strong commitment to minimising costs, reflected in the lowest costs-to-sales ratio2 in the industry. This is achieved through several measures including:

- low-cost, no-frills store layouts designed for high footfall and maintained with simple, scalable IT systems;

- lower store rental costs owing to non-premium but high-traffic store locations;

- distribution centres (DCs)1 that function as warehouses, without the need for expensive cold chain infrastructure; and

- fresh produce sourced directly from farmers, or nationally from fruit and vegetable markets, and transported directly to stores – eliminating the need for specialised storage.

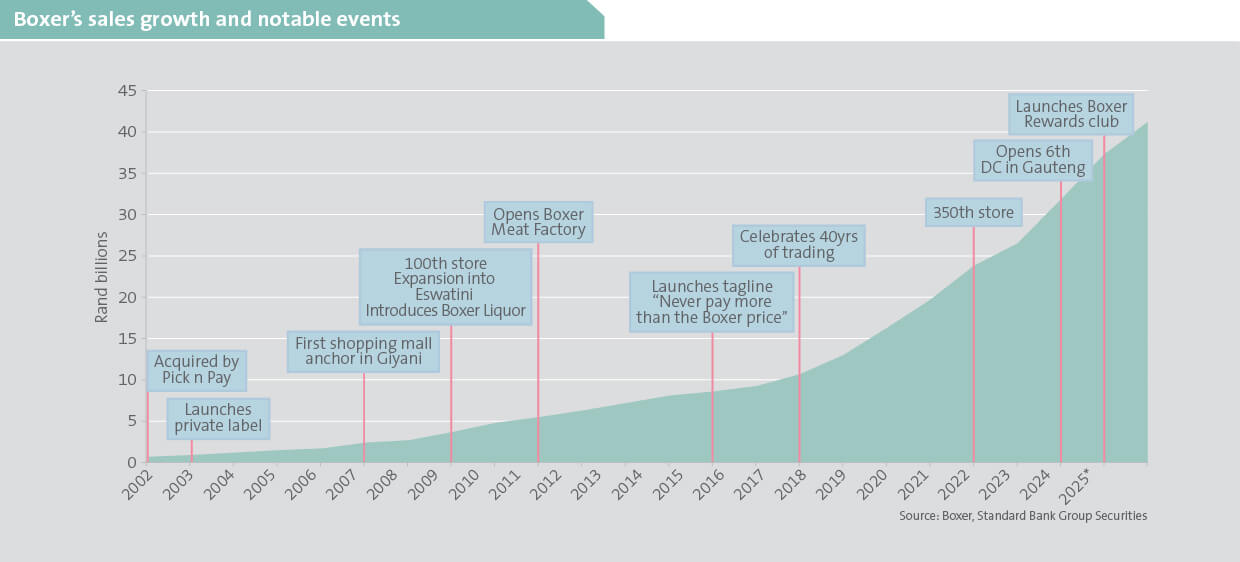

Boxer’s low-cost model also applies to new store development, with a full-service supermarket costing as little as R17 million to open, and a liquor store just R1.6 million. This lean approach reduces capital intensity and supports self-funded growth through strong operating cash flows. The result is exceptional performance: a three-year average return on equity of 84% and a return on invested capital of 26% – significantly surpassing industry averages of 26% and 12%, respectively.

Targeted growth

Lower-income consumers, who make up Boxer’s core customer base, contribute an estimated 52% of South Africa’s formal grocery spend and represent the fastest-growing segment in the market. Within this demographic, population growth and rising living costs support the increasing number of consumers resorting to shopping at value-focused retailers such as Boxer. Their customer base often earns less than R12 000 per month, with many being social grant recipients. Around 60-70% of Boxer’s monthly sales occur at month-end, which is consistent with social grant disbursements and paydays. In contrast, Shoprite’s Usave sees peak trading mid-month, mainly from top-up purchases.

Approximately 45% of the South African population are social grant recipients, highlighting the substantial opportunity for retailers targeting this demographic. Moreover, social grant related spending is forecast to grow 5% annually – from R266 billion in 2024/25 to R300 billion by 2027 – reinforcing Boxer’s long-term runway for growth.

Bang for your buck

Boxer has become famous for their combo deals, designed to help stretch shopper budgets. These essential product bundles are, on average, 12% cheaper than items bought individually – encouraging cross-category and bulk purchasing. In many cases, customers pool their money to purchase larger bulk bundles and then divide items among themselves – also known as a grocery stokvel – allowing all to benefit from the savings.

A standout success has been Boxer’s integration of private label products into its combo deals. Its 23 private label brands – including Boxer, Best Cook and Golden Ray (named after PnP founder Raymond Ackerman) – span 600 products and currently contribute 19% of revenue. These value-led offerings resonate strongly with price-conscious consumers, boosting loyalty and basket size. On average, private labels are 17% cheaper than branded alternatives, with some like Best Cook Baked Beans even outselling well-established brands such as Koo. Including private label products in combo deals offers an attractive, low-risk opportunity for customers to trial Boxer’s own brands. As preference and trust builds, customers are more likely to repurchase these products outside of promotions, improving long-term loyalty and growing the share of private label sales. This benefits the customer and Boxer – the latter through improved gross margins and greater product control. Despite already holding a material sales share, we see meaningful headroom for growth in private label products at Boxer.

Can it compete with the heavyweights?

Boxer’s investment case hinges on expanding its store network and market share. Management has identified R106 billion in expansion opportunities across all nine local provinces – almost three times its 2024 revenue. There are markets where Boxer currently has little or no presence but where the demand for value-focused retail remains buoyant. Boxer aims to double its turnover over the next six years, reflecting an ambitious strategy following a 23-year track record of 19% average annual sales growth (charted below).

However, there are plenty of challenges, particularly in that many regions are already well served by entrenched competition, notably the Shoprite Group through Shoprite, Usave and (to a lesser extent) OK Stores. Shoprite’s brand familiarity, extensive logistics network and early-mover advantage give it a solid foothold that we believe will be difficult to dislodge. This is especially evident in the Western Cape – Shoprite’s home base and stronghold – where Boxer (active since 2015) operates fewer than 15 stores. Conversely, Shoprite and Usave together have more than 150 outlets in the province.

South Africa’s informal grocery retail market is expected to grow from R403 billion in 2024 to R494 billion by 2027 – an average annual growth rate of 7%. Boxer aims to win market share from informal and independent traders by offering proximity, scale and affordability. However, incumbents remain formidable, benefitting from deep community ties that offer valuable insight into local needs. Some traders provide credit and many employ agile pricing strategies. Additionally, their ability to offer ‘break-bulk’ sales that allow customers to buy smaller quantities (eg a cup of sugar instead of a full bag) makes them especially appealing to customers, particularly later in the month. Consequently, the proven resilience and resourcefulness of these traders have earned the respect of customers and the formal retail chains.

A race for space

Boxer plans to double its 525-store estate over the next five years. Concurrently, Shoprite is set to double its footprint with the planned opening of 500 new Usave stores and the expansion of its core brand. Spar’s SaveMor also plans to double its 61-store base over the next two years. This rollout surge intensifies competition for prime sites and heightens the risk of cannibalisation within Boxer’s own network, particularly in already saturated areas.

We acknowledge the opportunity for Boxer to expand into these nodes, however, we are mindful that future capital deployed into these already well-served markets may yield lower returns and sales densities. While we appreciate Boxer’s operational excellence, high returns and strong cash flows, we believe the current market valuation of the company represents over-optimism about substantial rollout success and underestimates the execution risks tied to its bold expansion strategy. We therefore do not hold Boxer shares in our portfolios at present.

1Stock keeping units (SKUs): the number of distinct products.

2Operating expenditure expressed as a percentage of sales.

3Boxer’s newest DC is costing less than R185 million for its 50% ownership stake, with a total project cost of R365 million. By comparison, Shoprite and PnP’s most recent DCs were valued at R1.5 billion and R2.2 billion, respectively.