We investigate the case for Philips following significant restructuring efforts to reposition the company to lead in high-barrier to entry, consumables-driven markets.

Shifting market dynamics prompt change

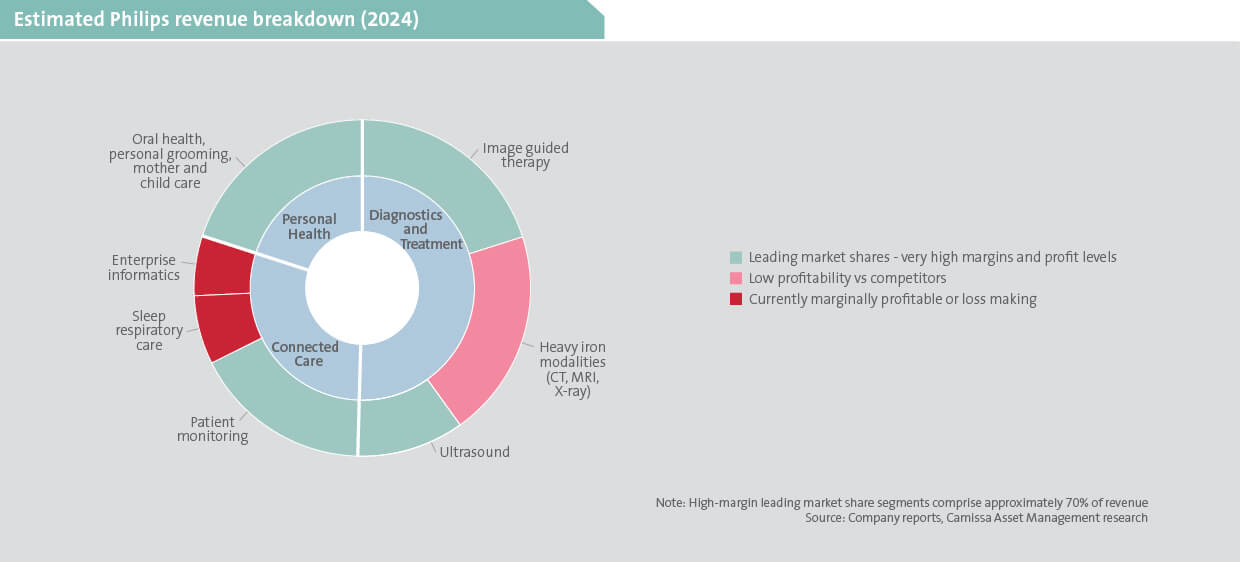

Philips shed its electronics, semiconductor, audio-visual and lighting divisions in the early 2000s as part of a strategic restructuring. More recently, it divested the domestic appliances business, although it continues to earn royalties from brand licensing. Today, it operates (and mostly leads) in three core segments (charted below), within industries defined by high entry thresholds and continuous sales demand1.

Growth in medical imaging fuels rise of Chinese challengers

In alignment with global healthcare developments, Philips stands to benefit from the demand for imaging equipment that is expected to grow 4-6% per annum over the medium term. This is supported by several structural trends, including:

- the rising adoption of imaging technologies in developing economies, where diagnostic infrastructure remains underdeveloped. Growth is expected to be led by China, supported by aggressive government investment in healthcare infrastructure. Concurrently, imaging original equipment manufacturers (OEMs) in China are gaining market share domestically and across other developing regions. This trend is accelerated by Chinese regulatory mandates requiring Western players such as Philips to localise manufacturing and R&D in order to maintain market access. Significant R&D leakage has resulted as technical knowledge, talent and supplier relationships diffused into the Chinese domestic ecosystem. Chinese OEMs have therefore developed rapidly, emerging as credible global competitors, particularly in cost-sensitive markets.

- outdated imaging infrastructure in many developed markets has caused equipment fleets to age beyond optimal replacement cycles, creating a backlog of demand for system upgrades and renewals.

- the expansion of screening programmes has seen public health initiative focused on early disease detection, propelling the demand for additional imaging capacity. Notably, the growing adoption of low-dose CT screening for lung cancer is supporting increased utilisation of diagnostic imaging systems.

- a wider uptake of minimally invasive surgical and interventional techniques is raising the demand for real-time, high-precision imaging. These procedures rely on advanced systems that can deliver accurate visualisation with minimal patient impact.

- the expanding use of AI is improving accuracy, speed and scalability across diagnostic settings. AI is transforming medical imaging workflows, whereby algorithms detect subtle abnormalities, reduce diagnostic errors and accelerate throughput – beneficial amid radiologist shortages. Furthermore, AI-based interpolation can reduce MRI scan times by up to 50%. Teleradiology is expanding through remote image interpretation supported by AI, while emerging AI applications include non-invasive CT-based blood flow assessments and ultra-fast foetal brain ultrasounds.

Diagnosis and Treatment

Philips has two standout businesses in this segment – Image-Guided Therapy (IGT) and Cardio Ultrasound – demonstrating strong performance and global market leadership.

IGT integrates imaging into operating rooms and robotic surgery platforms, combining pre-operative scans with real-time intra-operative imaging to guide minimally invasive procedures. A global shift toward less invasive surgery should underpin long-term growth in this area, where Philips commands the largest share of the market.

In Cardio Ultrasound, Philips ranks second in overall ultrasound and first in the specialist cardiovascular subsegment, globally. This business also delivers the highest margins within the Diagnostic Care segment.

In contrast, however, Philips’ performance in large-scale imaging – specifically the ‘heavy iron’ modalities (X-ray, CT and MRI) – is a drag on overall profitability. This area significantly underperforms competitors like GE and Siemens, mainly due to a smaller installed base, which limits access to high-margin after-sales service revenue, typically accounting for around 50% of imaging sales.

Philips is a frontrunner in R&D investment, demonstrated by its helium-free MRI technology, that reduces infrastructure requirements, thereby lowering installation costs and improving accessibility. Traditional MRIs rely on large volumes of liquid helium, necessitating reinforced floors and venting systems. However, Philips’ lighter helium-free design allows more flexible placement, thereby reducing installation requirements and costs. Despite these advancements, financial returns have yet to improve meaningfully. Management plans to address this by simplifying the imaging portfolio to reduce product variety and focus on scalable platforms that lower manufacturing costs and improve margins.

Connected Care

Locked in on patient monitoring: Philips is an entrenched global leader in this highly profitable business, comprising systems that track patient vitals and key health metrics – alerting healthcare providers to critical changes and enabling timely interventions. High-margin upfront equipment sales and regular periodic revenue from upgrades, services and consumables boost profitability. Philips has the largest worldwide market share, reinforced by a dominant position in the US.

Competitor challengers must overcome high switching costs for hospitals as these systems are deeply embedded into hospital IT infrastructure, workflows and electronic health records. Philips’ modular designs also offer hospitals the option to upgrade components incrementally rather than replace entire systems, resulting in strong retention and long-term profitability. This market is expanding beyond traditional hospital settings, encouraged by advancements in remote monitoring and telehomecare technologies.

Sleep business recovery points to profitability: Philips is a major player in the global sleep care market. Such conditions remain significantly underdiagnosed – with more than 80% of sleep disorders undetected – despite treatment offering clear reductions in morbidity and mortality. Diagnosis rates have improved with the rise of wearable technology evolving from specialist monitoring devices linked to mainstream tools like the latest Apple watches, now with apnea detection.

Obstructive Sleep Apnea (OSA) is closely linked to rising rates of obesity and other lifestyle diseases. The growing use of GLP-12 drugs is helping reduce OSA severity. This may dampen long-term demand for continuous positive airway pressure therapy.

Currently, the market is a duopoly, dominated by ResMed and Philips. ResMed enjoys high gross margins and strong returns, buoyed by the sale of high-margin consumables like masks and connectors. Despite recovering from a product recall and litigation, Philips remains the second-largest player and is on track to return to profitability in this growing segment.

Profit potential in data analytics and software: Philips’ Enterprise Informatics business, built around Picture Archiving and Communication Systems (PACS), originated in the 1980s as a digital replacement for film-based medical imaging. Initially used in radiology and later in cardiology and pathology, PACS relied on global DICOM3 standards, which continue to support standardised, AI-ready data archives.

Although Philips is currently the largest player, it has historically underperformed financially in this area. Motivated by an engineering-led culture, Philips developed complex, customised solutions with costly after-service requirements. Profitability was hampered by software-specific inefficiencies without corresponding pricing power. The business has, however, reached break-even and is expected to deliver stronger profitability, supported by growing contributions from capital-light, software-based revenue streams. A full migration to modern, cloud-based architecture has substantially reduced maintenance costs. In contrast to competitors’ closed systems, Philips provides a vendor-neutral offering, strengthened by its strong US position in patient monitoring, serving as a strategic foundation for informatics cross-selling.

Personal Care

This division operates across four categories within a niche market, namely oral care, male grooming, female beauty and mother and child care. As a ubiquitous consumer brand, this market has robust long-term potential, with considerable opportunities remaining. For example, around 70% of consumers worldwide still use manual toothbrushes and razors. Philips also has significant exposure to developing economies, where China plays a particularly important role.

More strength than strain

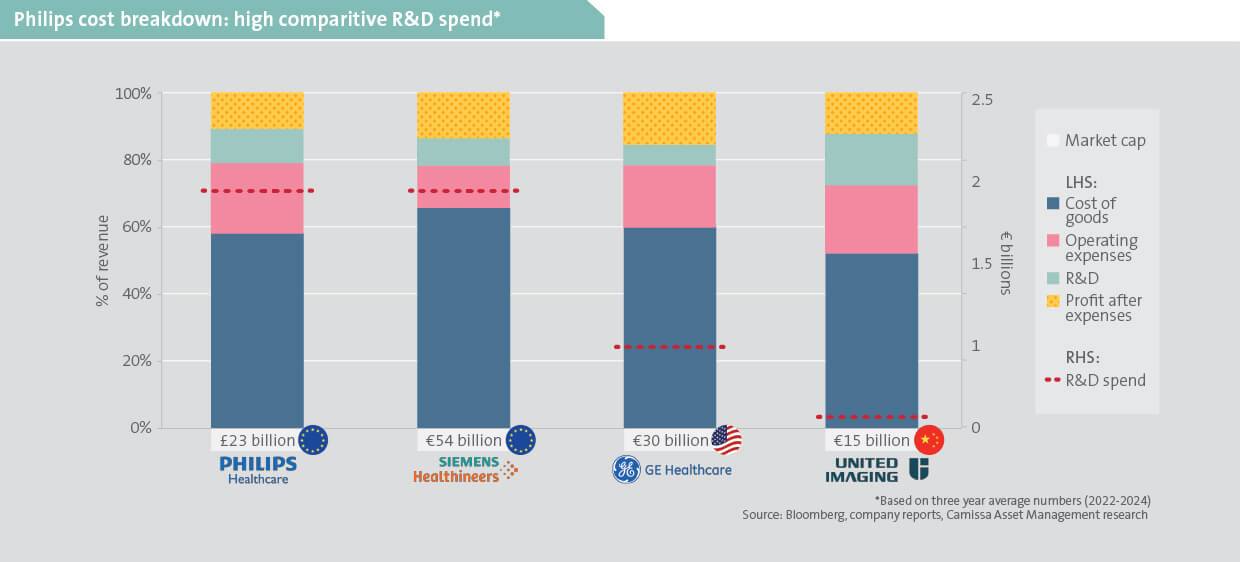

Philips spends a large amount on R&D (illustrated below) – well above Western competitors (as a percentage of sales) and substantially high compared to Western and Chinese players4. This has negatively impacted recent profit margins yet underpins Philips’ strategy to capture long-term value in high-tech, high-margin medical systems markets.

By disaggregating Philips’ three core businesses into their underlying components, we conclude that currently just under 70% of group revenue is generated by businesses with strong profitability and competitive advantages, such as Cardio Ultrasound, Patient Monitoring and Personal Care. These units hold dominant market positions and benefit from strong after-sales and recurring revenue streams. A further 15-20% of the portfolio, comprising Sleep Care and Enterprise Informatics, is temporarily underperforming but set to normalise to far higher profitability in the near term. While the remaining businesses, made up of lower margin imaging modalities, continue to lag competitors, management’s ongoing streamlining efforts offer positive optionality to the broader investment case.

For these reasons, we are optimistic about a strong long-term profit trajectory for Philips, and our clients have exposure in our global funds.

1Patient Monitoring experiences regular upgrade cycles and the rest have a high proportion of consumables.

2Medications primarily used for lowering blood sugar levels and promoting weight loss in individuals presenting with type-2 diabetes or obesity.

3The international standard for handling, storing, sharing and transmitting medical imaging information and related data.

4Notable, given Philips’ large Personal Health business, which has lower R&D intensity than the medical technology businesses.