We examine the key obstacles MTN faces in Nigeria, highlight the group’s competitive advantages and evaluate its growth prospects in data services and mobile money. We also outline positive technological developments and additional areas where shareholder value could be generated.

Fading Nigerian headwinds

Nigeria’s currency, the naira, has sharply devalued over the past year in response to drastic steps taken by the Nigerian government to normalise monetary policy and follow a more orthodox macroeconomic framework. While these interventions should be positive for the long-term prospects for Nigeria’s economic growth, they are currently distressing for economic participants as they face very high inflation and interest rates. Nigeria is MTN’s second largest market, with a large US dollar cost base that increases in naira terms as the currency weakens. The combination of higher costs and the upward revaluation of dollar liabilities will result in MTN Nigeria reporting material near-term naira losses.

Another significant challenge at present is the difficult telecommunication regulatory environment in Nigeria. Despite the industry as a whole being lossmaking, the regulator has not approved any tariff increases. This greatly reduces the industry’s ability to offset material cost inflation. MTN Nigeria has somewhat mitigated this through lowering discounts to customers and bundle optimisation1. Ultimately, tariff increases will be needed for smaller players to be viable. MTN Nigeria’s subscriber market share has already risen from 39% to 51% in the last few months as competitors struggle.

While group earnings from Nigeria will be down substantially this year, we do anticipate an improving performance beyond 2024. This is mostly owing to planned cost reductions, effective tariff increases through bundle optimisation and the recently announced renegotiation of onerous lease contracts in Nigeria. As headwinds fade and earnings recover, investor focus should shift back to MTN’s robust fundamentals and many structural growth opportunities.

1The packaging of voice and data products to encourage consumers to trade to higher cost and value packages.

One of the world’s largest customer platforms

MTN is uniquely positioned as Africa’s largest mobile telecommunications provider, with around 300 million subscribers across 17 countries. It has a strong presence in its key markets and enjoys significant economies of scale.

Excluding South Africa, which is a mature market, MTN is exposed to very favourable long-term demographics. We estimate that the population across MTN’s markets exceeds half a billion people, with mobile subscriber penetration at 70%. High population growth, rising mobile penetration and rapidly growing per capita incomes support a potential doubling of MTN’s revenue over the next decade (in US dollar terms) – charted below.

Data is a multi-year growth opportunity

Unlike developed markets, Africa lacks widespread fixed-line networks for high-volume data use. MTN recognised the data opportunity early and invested ahead of demand to secure its lead in this fast-growing market.

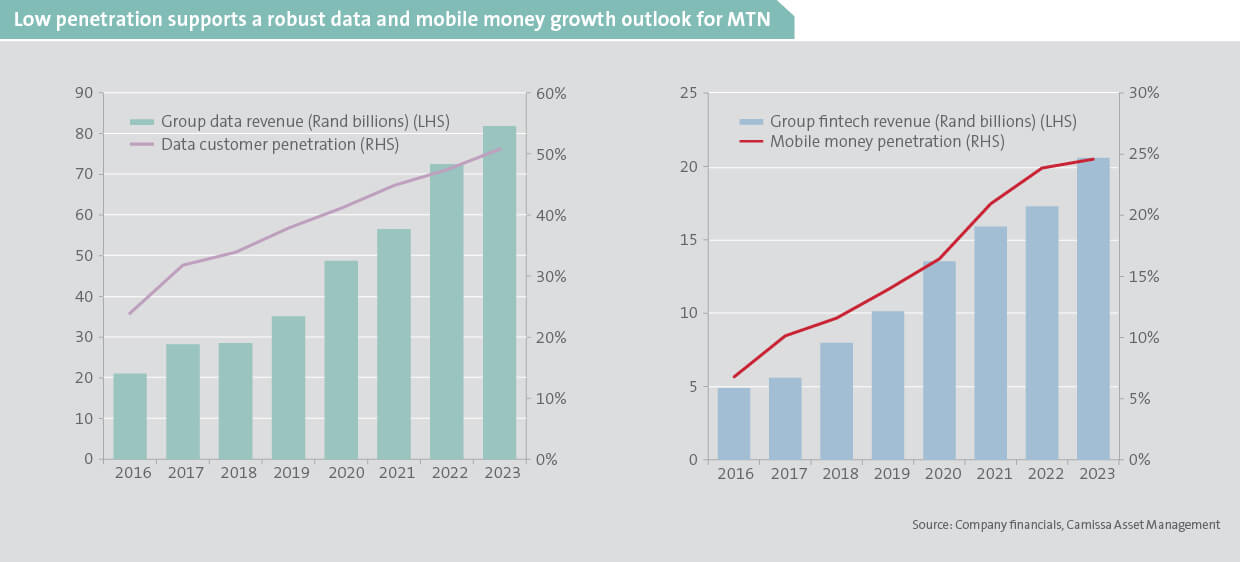

MTN’s data revenue has grown at 21% per annum since 2015 (left chart below) and now accounts for over 40% of the group’s total revenue. The outlook for data growth remains robust, supported by shifts in consumer preferences toward data-intensive services such as gaming, music and video streaming, and the rapid evolution of online offerings in general.

There remains substantial growth potential in data usage across MTN’s markets, with only half of its customers currently using data services at less than 5GB of data per month on average – far below the 25GB average seen in developed markets.

A key enabler of this growth is the rapid expansion of high speed 3G and 4G services across the African continent. Today, around a quarter of MTN’s subscribers still use legacy 2G services and devices with limited internet capability. As affordable smartphones become more widespread, data consumption is expected to surge, with 4G users typically consuming three to five times more data than 2G users.

Significant mobile money potential

Mobile money refers to banking services delivered over mobile phones. Its adoption has grown meaningfully over the last decade, particularly within developing economies, where financial inclusion is low. Supported by rising mobile penetration, the demand for mobile money services continues to grow as access to financial services benefits consumers through lower friction and transactional costs. Mobile money has also supported the development of small businesses that can now transact without handling cash, along with accessing general credit and working capital financing more easily.

MTN’s large customer base, vast distribution network and extensive billing relationships give it a strong competitive advantage over smaller telco players and traditional banks. This has enabled MTN to grow their mobile money operations by around 25% per annum since 2015 (right chart above). Despite this rapid growth, only 25% of MTN’s existing customers use the service, presenting another area of strong growth potential.

Looking ahead, we estimate the future addressable market for mobile money services across MTN’s territories may be as large as $15 billion per annum, substantially bigger than its current mobile money revenue of around $1 billion per annum. The mobile money business model has strong economics, with high returns on capital, low capital intensity and strong free cash flow generation. These capital light businesses typically attract high financial market valuations (ie valuations as a multiple of earnings). Recent transactions, where MTN and Airtel sold minority stakes in their mobile money operations provide very relevant evidence of this (valuation multiples were four times the group valuation multiples).

Technology shifts to boost returns

Building a telecommunication network requires huge capital investment and MTN has spent over R40 billion per annum on network expansion in recent years. Managing a mobile network is also costly, with around one third of total expenses related to network maintenance. Historically, there has been little competition between vendors of telecommunication equipment that supply the mobile operators, such as MTN. These operators are often locked into the ecosystem of a specific supplier. The shift to Open Radio Access Network (O-RAN) and Virtual Radio Access Network (V-RAN) technologies is expected to radically transform the industry.

For example, O-RAN allows interoperability between vendors, enabling mobile operators to use cheaper third-party, or in-house designed, equipment for specific parts of their network. An important benefit of V-RAN, which separates the software (management) layer of the network from the hardware, is that it improves utilisation by allowing operators to scale network resources to address changing demand patterns. It also allows for automated fault finding and network recovery, which reduces the number of engineers needed to maintain the network.

With greater competition and flexibility, it is widely expected that these technological developments will reduce equipment and maintenance costs by 25% to 40%. Considering how much mobile operators spend annually, these savings will support a material step up in overall industry free cash flow and returns on capital.

MTN is leading the way in Africa, having partnered with Rakuten Symphony, a global leader in the implementation of O-RAN technology. Rakuten is among the first companies to implement the technology at scale, with substantial savings realised to date. The two companies have recently completed a proof-of-concept trial, with a plan to roll out the technology across MTN’s key markets over the next three years.

Uncertainty creates a compelling investment opportunity

Despite the near-term challenges, MTN’s long-term fundamentals and growth outlook remain very positive. As Africa’s largest mobile telecommunications company, MTN is well diversified, operating in over 17 African countries that will be growing their per capita incomes rapidly in the years ahead. The business is exposed to several secular growth drivers such as rising data consumption and the rapid expansion of mobile money services to a large unbanked population. Furthermore, technology advancements have the potential to positively alter the long-term economics and returns for the group.

In addition to the secular growth opportunities discussed, management is separately focused on improving financial returns through more effective capital spend, scaling its digital solutions businesses and corporate restructuring – all of which have the potential to add more value over time. While there is some near-term uncertainty around the outlook for Nigeria, the current MTN price already discounts no value for their Nigerian business and therefore presents the opportunity for outsized future shareholder returns.