The value in Naspers now consists almost exclusively of its holding in Amsterdam-listed Prosus. Prosus holds a large stake in Tencent – a Chinese online media giant – and a variety of online businesses (the rump). Over the past decade, the group has made a number of investments across emerging markets in online businesses, with very little success to date, incurring substantial cumulative losses. More recently, the group has changed strategy towards one of realising value for shareholders and pursuing value-adding share buybacks. We unpack the key rump investments and explore the very strong future prospects for shareholders from Prosus (and in turn Naspers).

Visionary early success

Naspers boasts a rich history of investing in emerging technology industries with significant growth potential. The company enjoyed early success, pioneering South Africa’s first pay TV operator, M-Net, and making strategic investments in South Africa’s second-largest mobile network, MTN. In 2001, Naspers acquired a 46.5% stake in Tencent for a mere $32 million – its most successful investment to date.

Recent history

Tencent has since become the world’s largest digital gaming company and China’s pre-eminent digital platform, boasting over 1.3 billion active users. It has one of the most expansive advertising platforms in China and dominates the digital payments sector. Since its listing in 2004, Tencent has grown its revenue and profits by an estimated 33% and 27% per annum respectively, with its market value growing to over $350 billion. Naspers’ investment in Tencent has consequently been the primary driver of value creation for its shareholders, with the Naspers share price compounding at over 30.5% per annum over the last two decades.

Naspers, now via Prosus, has strived to replicate its initial success by venturing into a broad spectrum of high-growth markets encompassing online retailing, online classifieds, digital payments, food delivery and online education. While these ventures have indeed yielded substantial revenue growth, few are profitable and it seems that the group substantially overpaid for them (returns on invested capital have fallen well short of expectations).

A diverse portfolio of growth assets

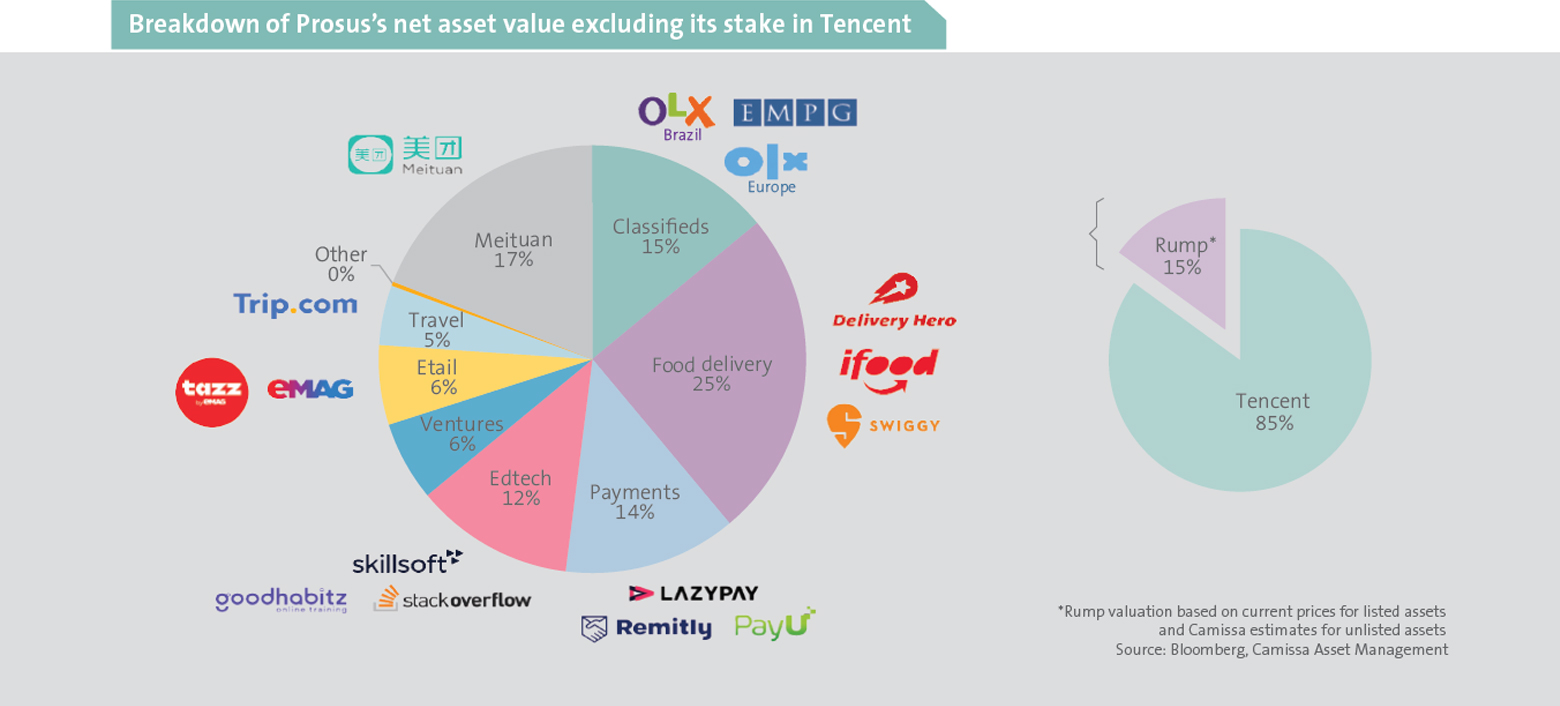

Prosus’s net asset value (NAV) is predominantly composed of Tencent, which accounts for roughly 85% of the group’s NAV. The remaining portion, the rump, encompasses a diversified array of online enterprises, as illustrated below.

The strategy has been to invest early in online businesses in developing economies, with substantial addressable markets and therefore significant growth potential. Prosus has spent over $32 billion since 2008, enlarging its footprint across various online and digital industries.

Approximately 25% of the rump’s value is in the food delivery sector. Notable holdings include a 29.9% stake in the world’s largest food delivery company, Delivery Hero, and a 33% stake in the leading Indian food delivery firm, Swiggy. Additionally, Prosus owns and operates ifood, a dominant and rapidly growing food delivery platform in Latin America.

Meituan, a Chinese-listed digital services conglomerate, contributes another 17% to the rump’s value. It encompasses diverse interests in food delivery, online hotel booking, third-party delivery and various niche online services such as pet care, tutoring, home maintenance and home cleaning. Over the past five years, Meituan has impressively delivered a 45% growth rate in revenue. It also stands out as one of the few profitable food delivery businesses globally, capitalising on China’s high population density in urban areas and a fragmented restaurant landscape that affords the group strong pricing power. The future appears promising for Meituan, with profits expected to more than double in the next five years as the food delivery and hotel booking businesses scale up, while losses diminish across the rest of its portfolio.

Prosus’s investments in classifieds, online education and digital payments constitute the remaining pillars, each representing around 15% of the rump. Among these, the digital payment business, PayU, is particularly well-positioned in India. It stands to benefit from several regulatory changes aimed at supporting the digital economy and the growing acceptance of digital transactions among Indian consumers and merchants. Payment volumes in India have surged at a rate exceeding 50% annually since 2015, with expectations of payment volumes doubling again in the coming years.

The residual portion of the rump comprises online e-commerce in Europe, online travel and Prosus’s Ventures portfolio, which houses a collection of smaller investments in early-stage startups.

Elusive profitability

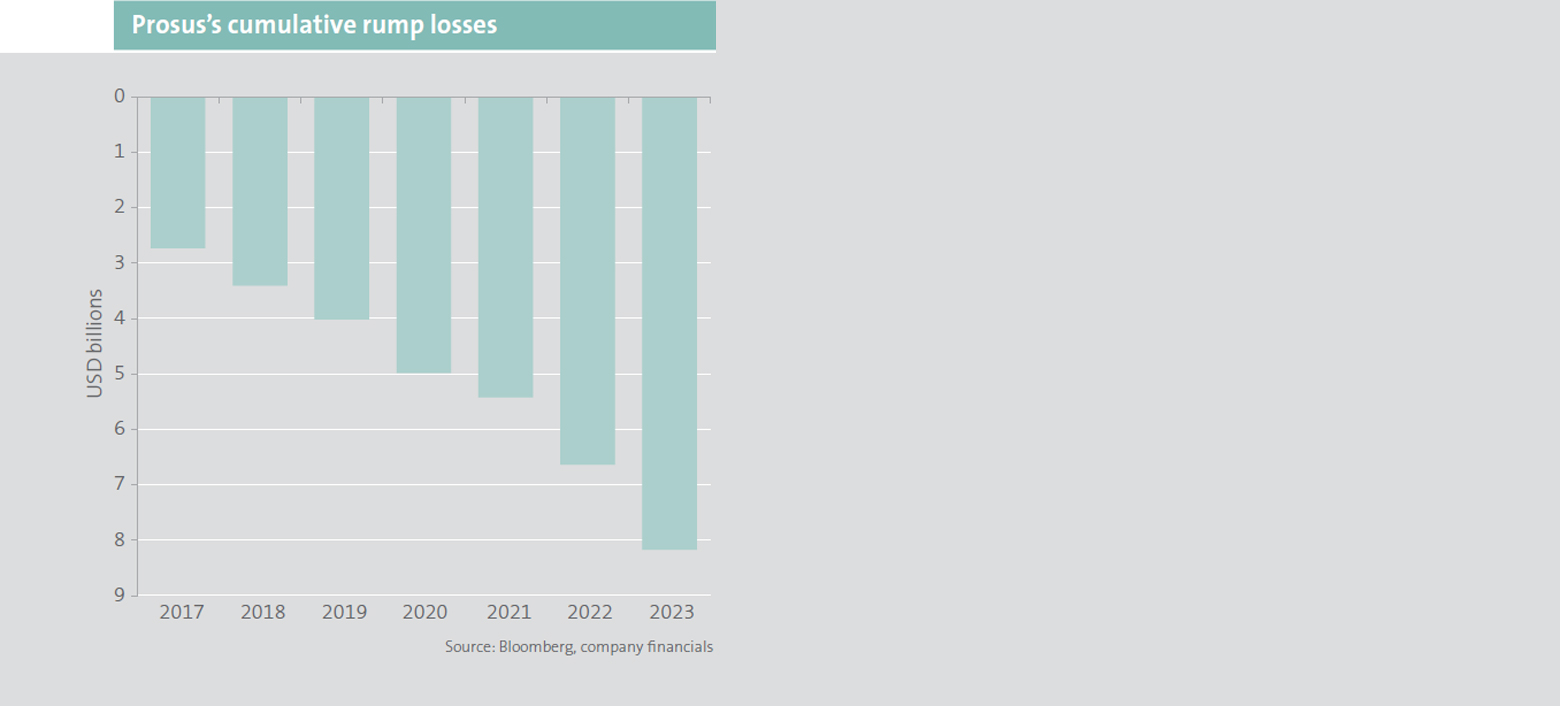

Despite achieving profitability in a few early investments, Prosus’s strategy of frequently entering new markets has resulted in mounting aggregate losses over time. Our estimates indicate that the portfolio has incurred cumulative losses exceeding $8 billion since 2017 (shown below). Furthermore, the estimated return on capital since 2008 for its portfolio – a critical measure of capital allocation effectiveness – has been a disappointing 4-6% per annum. This falls well below the returns attainable from other, less risky equity asset classes during the same period. This subpar performance is extremely disappointing, particularly considering the roughly $1.5 billion in additional cumulative corporate costs incurred to deliver these lacklustre results.

Investing has been poor

The global private equity market has witnessed explosive growth during this time, expanding from approximately $3 trillion in 2012 to over $7 trillion in 20221. Investors have sought to replicate the incredible success of the prior generation of venture capital investors that invested early in today’s tech giants. This has ushered in heightened competition, with the number of private equity managers more than tripling over the past decade.

A cash flush private equity market and abnormally low interest rates in the decade prior to 2022 have led to increasing private market valuations and seen the extensive funding of business models with questionable long-term economics. Against this backdrop, we’ve witnessed a widening gap between the best and the least successful private equity investors. Prosus’s performance unfortunately ranks very poorly against the competition, with its estimated return since 2008 well below the median return for private equity managers of around 15%2. Despite making well over 60 investments since 2008, we estimate that fewer than five have delivered an internal rate of return above the company’s cost of capital.

1Source: BlackRock

2Source: JP Morgan Asset Management (2008 to 2022)

Changing focus

Prosus recently unveiled a shift in its investment strategy, announcing a clearer path to profitability for its larger businesses. Management has committed to shorter investment cycles and is prioritising value realisation for shareholders through the divesting of assets.

Prosus is also now pursuing a multi-year share buyback program while it trades at a discount to the value of its underlying assets. This will generate significant shareholder value as Prosus sells Tencent and repurchases its own shares – securing substantial profit with each trade due to the currently large discount to underlying assets. We estimate that the buyback alone holds the potential to grow Prosus’s value per share by approximately 5-7% annually. Naspers is pursuing a similar program, selling Prosus shares and repurchasing its own.

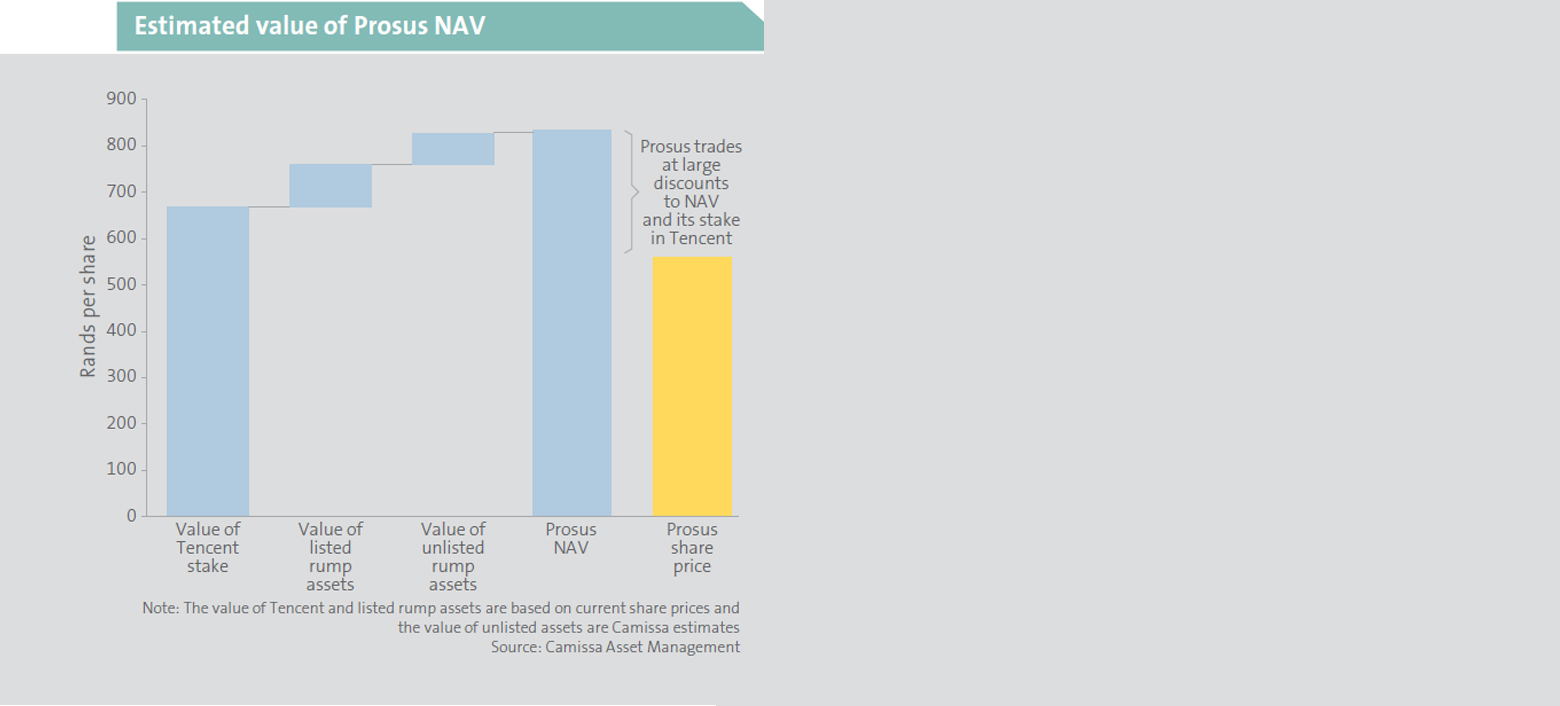

Prosus currently trades at a 35% discount to its net asset value and a 20% discount to the value of its Tencent stake alone (shown below), indicative of the market attributing a negative value to the rump. In our view, this is unjustified based on the prospects of these businesses and considering that over half of the rump assets are listed with readily observable market values.

Tencent is also independently pursuing a share buyback program, given that its share price is substantially too low.

Promising prospects

The Prosus strategy of the last 10 years – to invest in a broad range of high growth online businesses and replicate its early success – has failed. Profitability across its investments remains elusive, with estimated returns considerably below its cost of capital. Despite this, Prosus is a very compelling long-term investment.

Its largest asset, Tencent, has a promising long-term future through its exposure to online Chinese economic activity and rapidly expanding incomes in the Chinese middle class. Nascent businesses including cloud services, mobile payments and video advertising are scaling rapidly, thereby diversifying revenue beyond the core domestic gaming and social network segments. Additionally, its international gaming business is now substantial and growing very rapidly. Tencent currently trades at a substantial discount to our estimate of its intrinsic value.

The shift in strategic focus toward rump profitability coupled with improved capital allocation and recent management changes are all positive developments. The combination of growth at Tencent, NAV accretion from buybacks and potential recognition of value across its e-commerce assets as the new strategy unfolds, positions Prosus for material outperformance.