Aslam Dalvi – Portfolio Manager

“Mobile money” encompasses a set of financial services (and to a lesser extent other commercial services) provided to consumers through their mobile telephones. At the core of the service is usually a mobile wallet that is either directly linked to a bank account or to a customer identity, with funds held in trust at a bank on behalf of the customer. We set out the backdrop to where mobile money services stand today and the opportunity for MTN.

Mobile money moves in

Mobile money adoption has grown meaningfully over the last decade, particularly within developing economies where financial inclusion, with regards to formal banking, is low. Supported by rising mobile telephone penetration and an undeveloped banking industry context, the demand for mobile money services continues to grow. Accessible, affordable mobile money financial services benefit consumers through lower transaction costs, the smoothing of expenditure via credit and by encouraging saving. Mobile money has also aided the growth of small businesses that can now access credit and working capital financing more easily.

With their existing infrastructure, large customer footprint and regular billing relationship with customers, telecommunication companies have emerged as key competitors to traditional banks and have been successful in servicing the previously unbanked consumer.

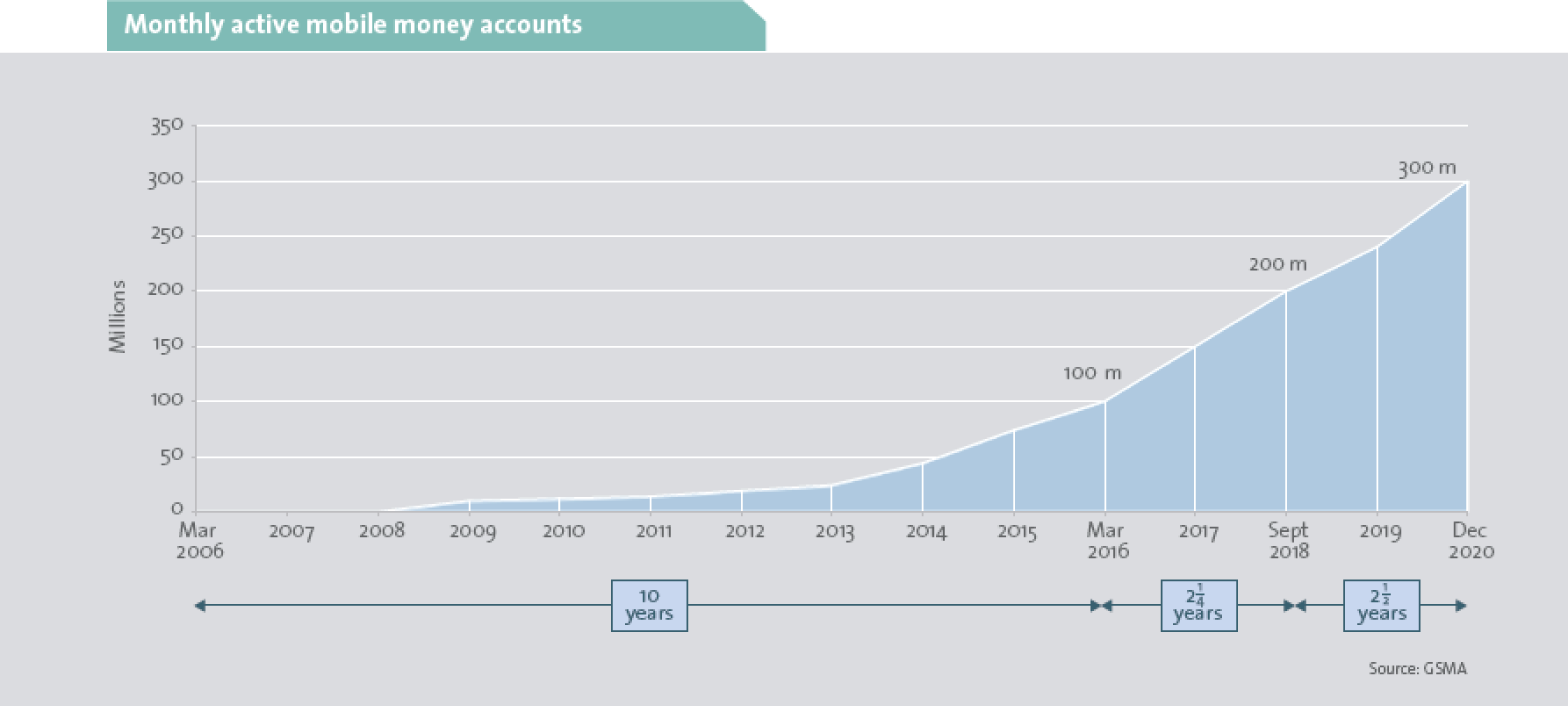

Global mobile money transaction value and subscribers has grown at over 50% per annum since 2015 and the outlook is still strong (charted below). In 2020, there were 310 live mobile money services across 96 countries, with an annual transaction value of more than $767 billion. Sub-Saharan Africa is the largest mobile money region accounting for over half of the 300 million active users globally. East and South Asia are the second and third largest markets, with 49 million and 37 million subscribers respectively.

Mobile money models

There are two distinct mobile money models:

• the bank-led model, whereby the bank is licensed or permitted by the regulator to provide mobile money services that may be executed in partnership with other non-bank or mobile service providers; and

• the telecom-led model, whereby mobile operators or non-banks can launch their services as a stand-alone business without a bank partnership.

The latter has proven most successful as telecommunication companies are able to leverage their large mobile subscriber base and established network infrastructure. Bank-led models have been less successful as traditional banks are often reluctant to support the growth of competing financial services that will erode their existing profit pools.

We find that mobile money markets are generally competitive in the early stages of development, with many participating players. As a platform scales, competitive moats are created through a virtuous cycle of user growth, increasing transaction value, improving economics for agents and further agent growth. This enables additional network expansion, ultimately attracting new users. At maturity, we would expect only two to three profitable players with the requisite scale to remain in any market – given this powerful network effect.

Mobile money economics

Revenues are derived primarily from transaction fees charged for person-to-person or person-to-bank transfers, for the purchase of goods or services and for moving cash into and out of the mobile money ecosystem.

The fee structure changes over time and is linked to the maturity of the platform. Deposit fees are low in the early stages, while operators often limit transfer and payment fees to encourage the use of these services and to ensure a growing deposit base. Fees for outgoing transactions are typically high to discourage payments to parties outside of the system and to incentivise subscription by all parties in a transaction.

Initially, mobile money businesses make significant losses (as administrative and technology expenses are borne upfront), but profitability grows rapidly as scale is achieved and fixed costs are spread, with mature businesses delivering profit margins of 30%-35%.

A high-return business model

Unlike traditional mobile telecommunication services that require heavy investment into cellular infrastructure, mobile money is an over-the-top service requiring internet access only. Returns for mobile money businesses are robust because incremental capital requirements are low and the scale of revenues generated can be very high. These platforms benefit from interest earned on a growing deposit base and from a positive working capital cycle as payments to agents and other creditors usually happen at month end, while customers are charged immediately for services rendered.

At scale, a successful mobile money business also delivers several indirect advantages that can materially improve the return profile of the mobile voice and data business. These include (i) lower acquisition costs as customers are more sticky, (ii) lower distribution fees as airtime purchases are made on the network rather than through agents, and (iii) a moderate rise of voice and data spend, typically after a customer becomes an active mobile money user.

The success of mobile money

While the demand for mobile money services continues to grow, the rate of mobile money adoption has varied substantially across markets. The following factors are common in markets where the service has grown rapidly and are important for success:

• Low access to formal financial services and a high unbanked population. The financial inclusion rate across Africa (ex South Africa) is low at around 35%-40% and explains the relatively strong demand for mobile money services across the region.

• A light touch and supportive regulatory framework that allows mobile operators to efficiently roll out the service with limited cost and administrative overheads. Low initial capital requirements are also important to support growth as upfront losses are high.

• A large starting market share improves the chance of success. Dominant telecommunications service providers have a strong brand and a well-established airtime agent network that enables them to leverage their existing telecommunications user base and infrastructure.

• The first player to establish a deep and trusted agent network is likely to be the winner. Mobile money agents range from large retail outlets to corner shops or kiosks in informal areas. This creates a decentralised, low-cost agent network that cannot be matched by traditional banks.

Key players in Africa

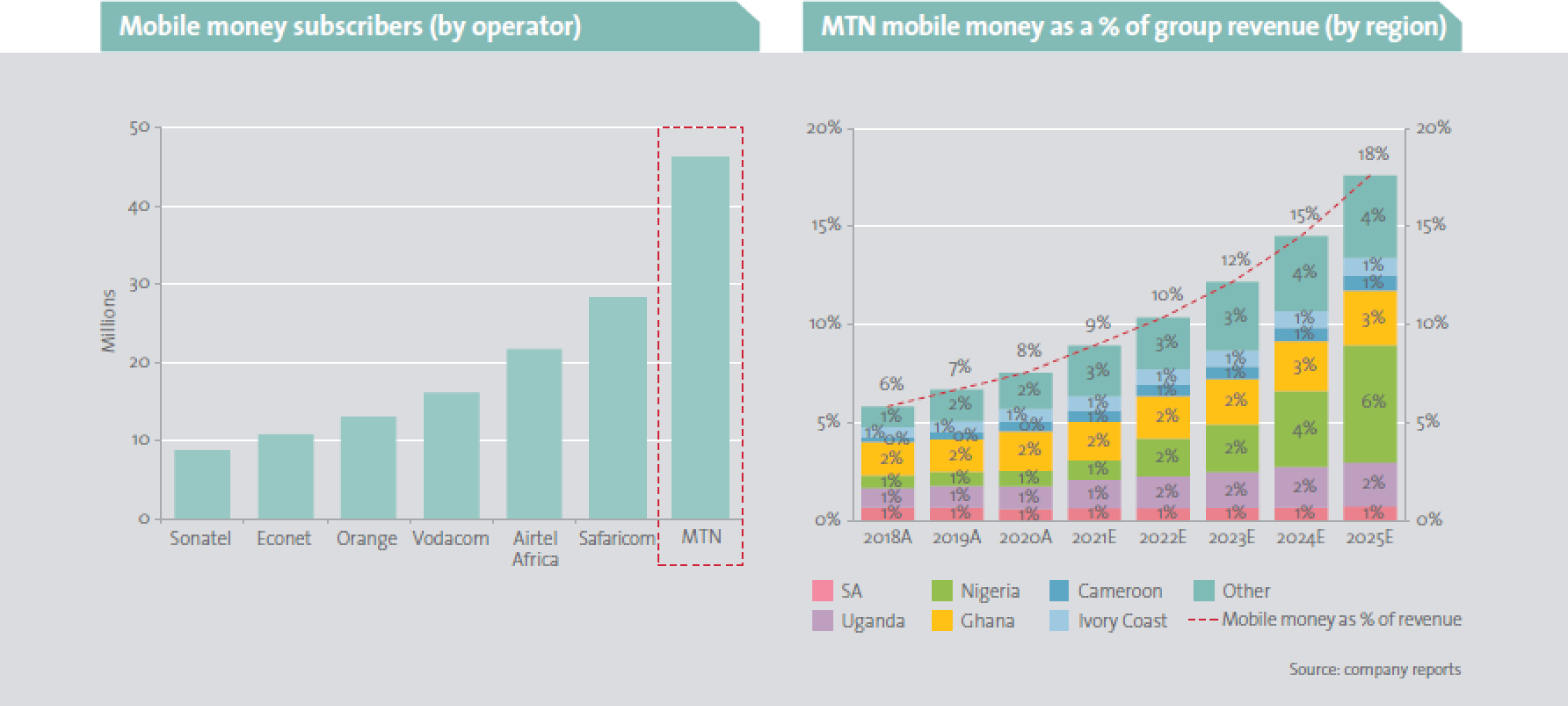

Being the largest mobile money region globally, sub-Saharan Africa’s 145 million subscribers currently generate more than $3.2 billion in revenue. As charted below left, MTN is the largest mobile money service provider on the continent followed by Safaricom, who pioneered the service in Kenya in 2005. The Orange Group is the third largest player followed by Vodacom (excluding Safaricom) and Airtel Africa.

MTN is particularly well positioned

MTN’s mobile money operations have grown by more than 30% per annum since 2015, yet are still considered nascent, with a sizeable runway for growth. We estimate that the addressable market for mobile money services across MTN’s territories is over $23 billion per annum. This is far larger than their current revenue base of around $1.5 billion per annum.

MTN has a much more diverse revenue base than other operators, with no single country contributing more than 25% of mobile money revenue. Their mobile money penetration, measuring the extent to which their existing customers have converted to using mobile money services, is only around 8% – indicating a large growth opportunity ahead (below right).

MTN recently received approval for a mobile money banking license in Nigeria, its largest market in terms of mobile subscribers. This license provides the opportunity to launch new services without relying on banks (who have historically been reluctant to support the growth of these services). This is a hugely positive development and will materially accelerate growth in this market. We expect MTN to more than double its mobile money subscribers over the next few years, with the service growing from 8% of group revenue to just under 20% by 2025.

A growing contribution to value

The mobile money business model is powerful and lucrative, with the potential to be a material contributor to the value of mobile telecommunication companies in the long run. These businesses should command higher valuation ratings relative to traditional telecommunications businesses, given the attractive growth outlook and far superior business model. This has been confirmed by recent transactions on the African continent, with Airtel having sold a minority stake in its mobile operation at a rating twice its own. Of the South African mobile service providers, MTN is best positioned to capitalise on the opportunity and we expect its mobile money businesses to be material value contributors over the medium term. The recognition of this future value has resulted in MTN being one of the best performers in our market over the last two years and our clients have benefitted materially.